WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

This week, the Consumer Price Index (CPI) for January 2024 was released. The popular inflation report came in ahead of expectations, showing an increase in inflation during the month. CPI rose 0.39% in January, 0.09% more than expected. On a year-over-year basis, the index was up 3.1% (lower than December’s 3.4% but higher than 2.9% […]

February 15, 2024

read more

I’ve been hearing from a few clients this week asking when they will receive their 1099s from Schwab (the custodian we work with at Windermere). With tax season in full swing, I thought these reminders may be helpful for a wider audience What is a 1099? A 1099 is a tax form that reports non-employment […]

February 15, 2024

read more

A few weeks ago, a client told me that the movie “Dumb Money” was now available on Netflix. I watched the movie this past weekend, which portrays the still shocking events surrounding the surge of Game Stop stock in early 2021. The movie (while a bit crass and dramatic – it is a movie after […]

February 8, 2024

read more

I talked with two clients last week about their home equity lines of credit (HELOCs). These can be very helpful forms for available debt to have in place so I thought it was worth discussing in more detail What is a home equity line? A home equity line of credit (or a HELOC as it […]

February 8, 2024

read more

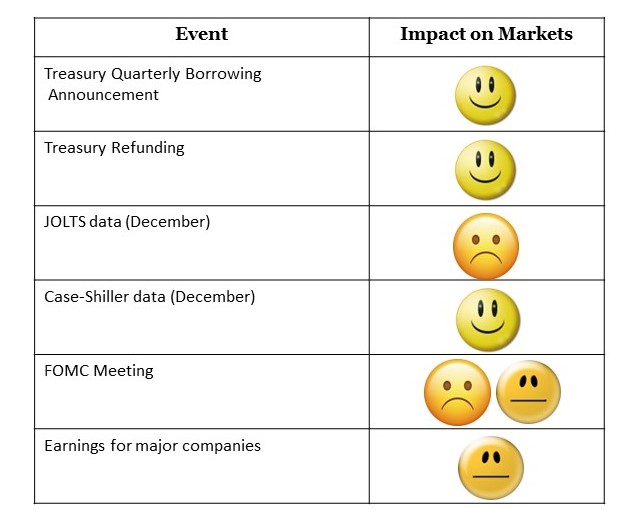

If you are a loyal reader of this weekly column, you are keenly aware of just how much there is to know and remember when it comes to your financial journey. The minute you think you’re caught up, you learn of another task you need to address! On this week’s list of things you need […]

February 1, 2024

read more

Ahh January. This month always feels like it lasts forever doesn’t it? The post holiday season let-down, the cold weather, winter storms, 31 days long.. you get the idea! Yet it is a very important month as it can the set the tone for the following eleven months. It turns out this is very much […]

February 1, 2024

read more

If you live in Wisconsin, odds are you too endured a wicked winter storm as well earlier this month. I went thru quite the adventure (which included lost power, downed trees, and manual bailing of two sump pumps)! After that experience, I took some time to sketch out action items I need to take care […]

January 25, 2024

read more

During a year-end planning meeting, my tax advisor brought up the idea of adding a PIN to my IRS record to protect myself against the increasing risk of tax return fraud. This PIN prevents unauthorized individuals from filing a tax return under your social security number (which would allow them to possibly access any amounts […]

January 24, 2024

read more

Pension plans, a type of employer-sponsored retirement plan that provides ongoing income after retirement, used to be very common. However today, about 15% of private sector employees and 75% of government employees have pensions, with the remainder of workers having 401k/403b plans instead. Pensions are defined benefit plans, meaning that as a participant, you are […]

January 18, 2024

read more

There are a lot of adages in investing and one that has gotten a lot of air time in recent years is “don’t bet against the American consumer,” cited by those advocating for ongoing strength in the US economy backed by Americans’ desire (and ability) to spend. This adage was once again proven true this […]

January 18, 2024