Can We Leave Inflation Worries in 2024?

December 12, 2024

With 19 days left in the year as I write this, it’s safe to say that we will be saying goodbye to 2024 in no time at all. As we start to look ahead, it’s fair to wonder what the new year will bring. Will we be concerned with the same things that held our attention as investors during 2024? Or will we finally able to close the book on some of those worries and direct our attention elsewhere? I have to admit, one such items it would be nice to leave behind is inflation.

For almost four years, inflation (merely an afterthought for decades prior) has taken center stage. Investors watched as it rose to over 9% annualized at the peak in 2022, with staggering increases across many categories, including items we never gave much thought to before like car insurance and egg prices. However, as supply chains eased and interest rates rose, the rate of increase in inflation has moderated. So much so in fact that for the last few months of 2024, the Federal Reserve has indicated it is more focused on the labor market portion of the dual mandate than the second part (inflation). It is approaching (but not yet at) the Fed’s targeted 2% level.

Earlier this week, we received November’s inflation prints. First the read on consumer prices (Consumer Price Index, or CPI) and then the Producer Price Index (PPI), a read on wholesale prices.

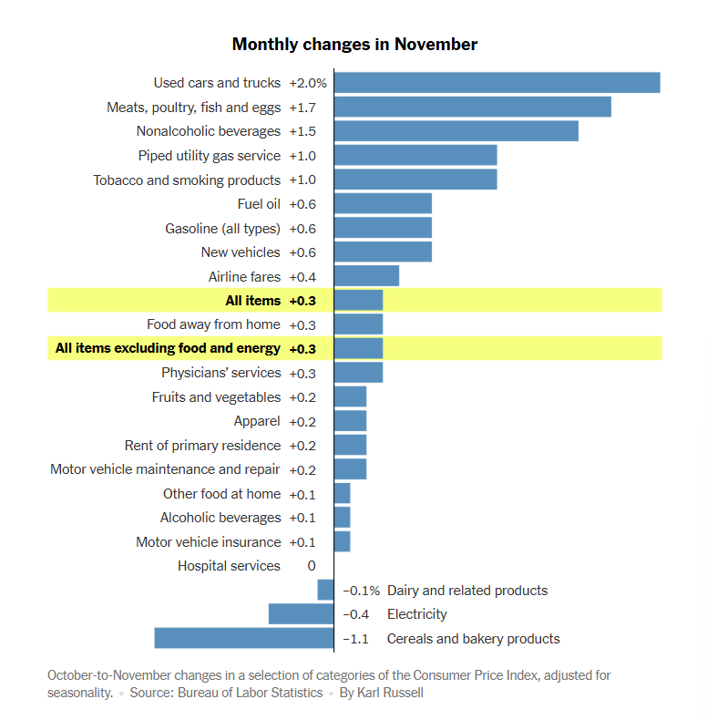

CPI rose 0.3% in November, 0.1% more than had been expected, with the annualized increase rising to 2.7%. The core CPI index (the Fed’s preferred measure that strips out volatile metrics for food and energy prices) rose 0.3% in the month. However, the make-up of this increase was seemingly positive as a slowdown in housing costs was finally observed.

It’s always interesting to look at where the price increases (and decrease came from) – here’s the chart for November CPI from the New York Times. Used cars once again proves very sticky and food prices continue to rise. Keep in mind there is some likely “noise” in these numbers due to the impacts of the two major hurricanes but no matter what, inflation remains (somewhat) of an issue.

The PPI report released on Thursday led to further discussion of inflation being stickier than anticipated. PPI increased 0.4% in November, above estimates of 0.2%. On an annual basis, it was up 3%, the biggest annualized advance since 2023. Core PPI (excluding food and energy) rose 0.2%, in line with expectations. Underneath the surface, much of the increase in this metric is coming from food prices.

Despite the inflation prints being somewhat higher than anticipated, the market odds of the Federal Reserve cutting rates next week (in their final rate decision of 2024) ticked higher and are sitting near 100%. Clearly market participants believe the data was good enough to allow the Fed to once again ease monetary policy to some degree.

We will see what happens next week with rates – and what happens next year with prices as talk of tariffs and US isolationist policies are getting more airtime. All that to say, I don’t think we can close the book on inflation quite yet.

Onward we go,

Leave a note