Churchill and the Federal Reserve

November 3, 2022

As we turned the calendar to November this week, there were a lot of things to look forward to – final two months of 2022, Thanksgiving around the corner, the few remaining nice days of fall weather (at least for us Midwesterners), and of course – the second to last meeting of 2022 for the US Federal Reserve!

The meeting, held on November 2, was hotly anticipated by markets. After their swoon post the September meeting, markets staged quite the rally in October and had many market pundits anticipating a friendlier Federal Reserve appearance in November.

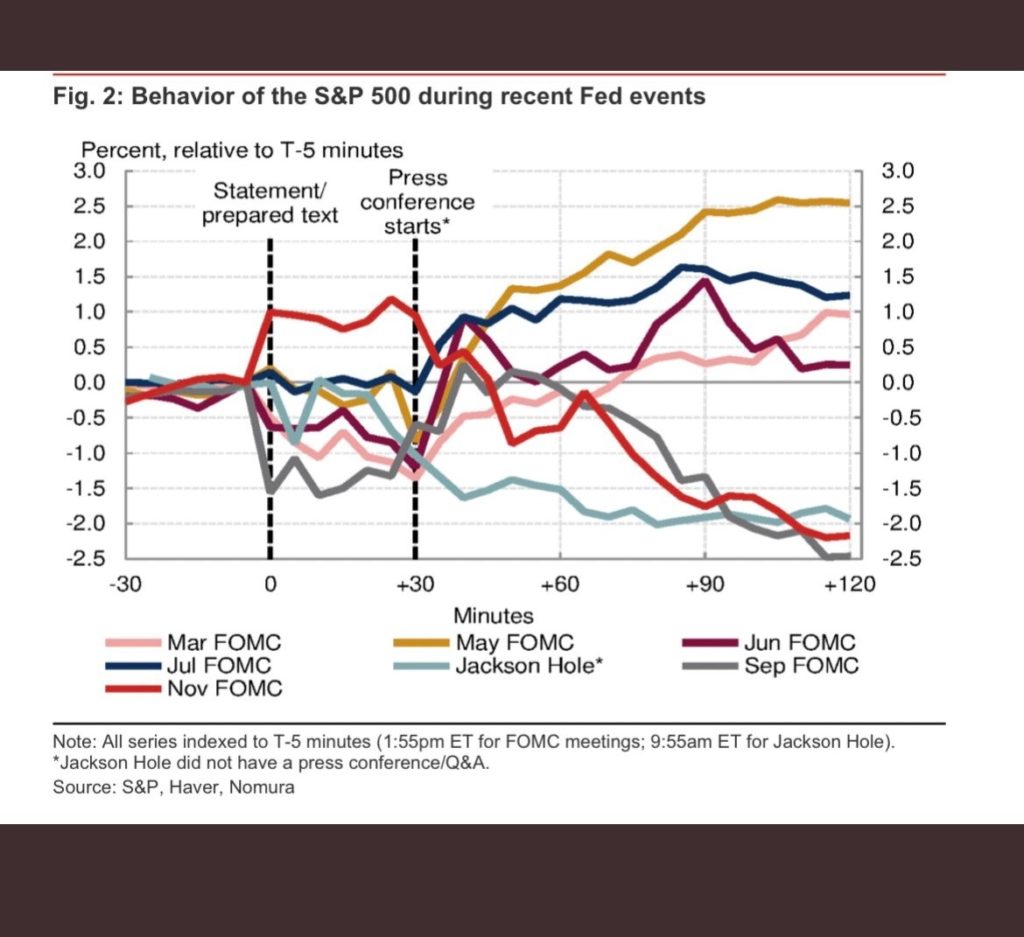

Not so fast. The Fed Funds rate was once again raised by 75 basis points (bringing the range to 3.75-4%). The minute Fed Chair Jerome Powell started his press conference, it was clear that the tone was not going to be victorious. This chart shows the market reaction to not only this meeting – but for the recent fed meetings. You can see the sharp drop post press conference for November.

As the press conference wore on, I was reminded of this famous quote by Winston Churchill

Now this is not the end. It is not even the beginning of the end.

But it is, perhaps, the end of the beginning

With inflation remaining elevated and the job market remaining strong, it is too soon to think about moderating rate increases. Powell himself said as much – “It is very premature to be thinking about pausing. We think we have a ways to go.” Now is not the end. It is not even the beginning of the end

However, in reading the Federal Open Market Committee statement that accompanied the rate increase, there was one new sentence that gives us hope that perhaps, this is the end of the beginning

“In determining the pace of future increases in the target rate, the Committee will take into account the cumulative tightening of monetary policy, the lags with which the monetary policy affects economic activity and inflation, and economic and financial developments”

Without a doubt, the Federal Reserve is in a very challenging position. Stop too soon and they risk losing the narrative on inflation permanently. Go too far and they could tip the economy into a recession (parts are already showing strain for sure). Chair Powell noted yesterday that if they go too far they have tools (ie: lowering rates) to course correct quickly – but lack options if they don’t do enough.

We’ll see what the next month brings in terms of inflation and job readings, as well as further rate hikes. In the meantime, exhale, try to take this in stride, and focus on what you can control. This too shall pass. It always has and it always will.

Leave a note

Leave a Reply

You must be logged in to post a comment.

Powell was a nickel short and five minutes late and influenced by the administration when conveying inflation was transitory. It wasn’t. Now, he insists on continuing to look in the rear view mirror to obtain his data for decision-making. Home sales and prices are dealing rapidly. Layoffs and reductions are happening everywhere by companies who are reporting improved earnings but expecting reduced volumes and are laying off now. A self fulfilling philosophy.