Client Question: Impact of Politics on Returns

April 18, 2024

It’s no surprise that the upcoming election is at the top of client’s minds in recent meetings. This week, a client asked what impact various parties being in control has had on market returns over the years. Let’s take a closer look.

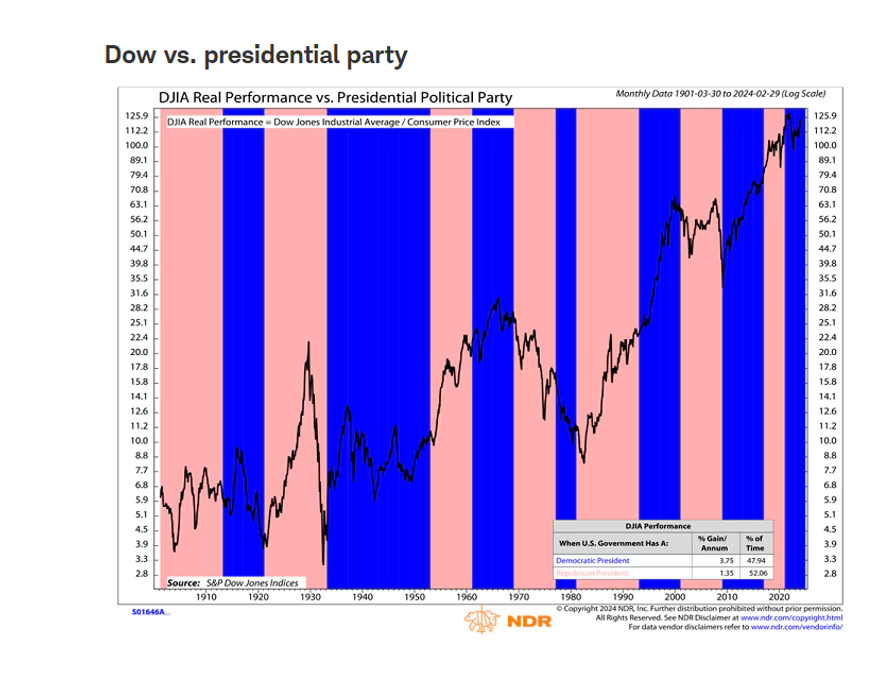

The following chart (from Ned Davis Research) shows the performance of the Dow Jones Industrial Average (which as a longer historical tracking period than the S&P 500) under democratic and republican presidents. The returns under a democratic president (average annual return) were higher: 3.75% vs 1.35%

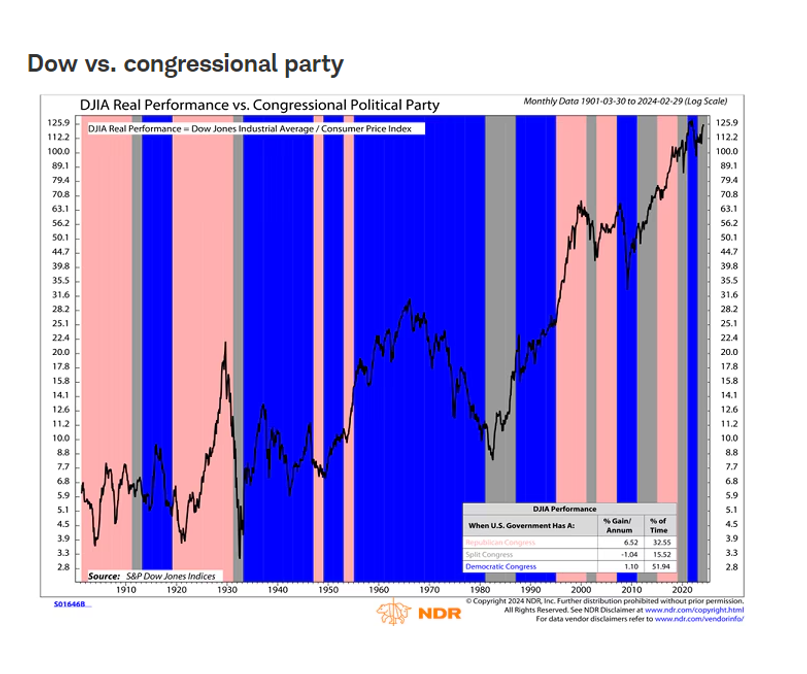

Of course, we all know that the presidential party doesn’t have full control of the government – there is also Congress to analyze when it comes to political party and market performance. As shown in the chart below, the best performance has come with Republican control of Congress (6.52%), with the worst coming when Congress was split between the two parties (-1.04%), with Democratic Congress in the middle (1.1%).

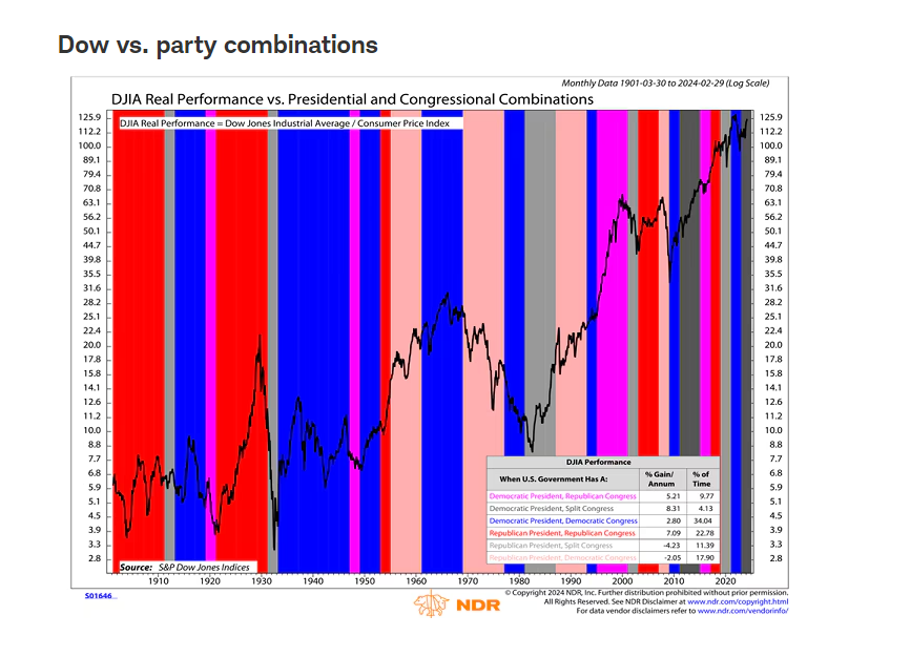

Combining the two – there are six possible combinations in terms of the presidential and congressional party split. The best performance has occurred when there was a Democrat in the White House and a split Congress (the current configuration – average return of 8.3%), but full Republican control a close second (7.09%). The two worst (both with negative annualized returns) outcomes historically were under Republican presidents and either a split Congress (-4.23%) or a Democratically controlled Congress (-2.05%).

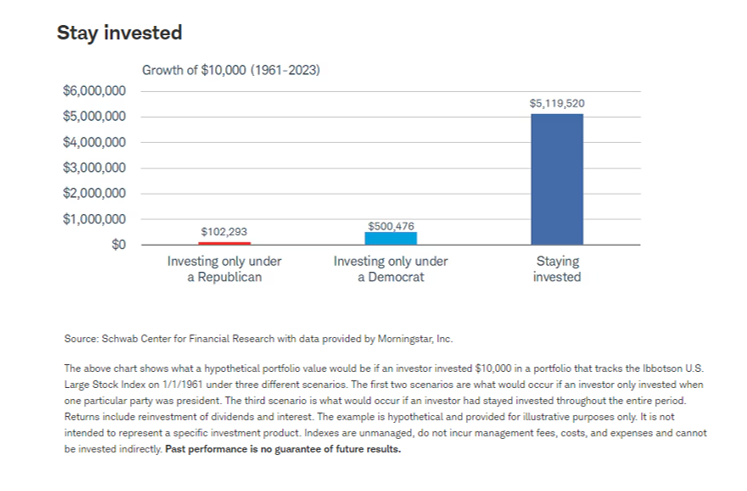

All of the above data is interesting to consider – but what is an investor to do a little more than 6 months before 2024 election day? Based on the one final chart I’ll show you below my advice is: stay the course. As you will see, investing under a democrat only did outperform investing under a republican only. But what strategy trounced them both? Investing in all political party combinations (ie: staying the course).

Politics will undoubtedly move markets and your portfolio in the short-term but in the long-term, it’s clear that many other factors drive market returns.

Leave a note