Client Question: Should I Buy Gold

April 24, 2025

If you’ve been reading any financial news as of late, you may have had the same question a client did this week – “should I be buying gold?”

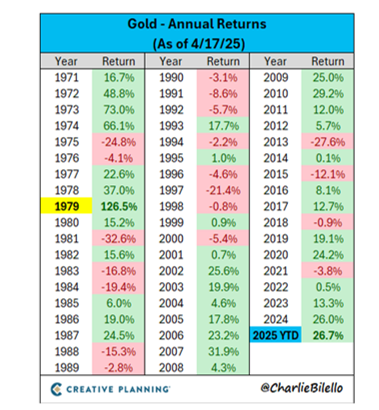

The question is justified as the precious metal regained all-time high prices, last seen in 1980 (adjusting for inflation) and is on pace for its best annual return since 1979. Even Costco sells gold bars now and has had trouble keeping them in stock!

I’ll be honest. I personally have never invested in gold. That is not meant to be investment advice one way or the other – it’s merely a statement regarding my past behavior.

Why have I never invested in the metal? The challenge I have found with investing in gold (the same challenge that keeps me from telling this client (and anyone else) whether to buy, sell, or hold gold today), is that I am not sure how to value it. It reminds me of investing in a collectible or a crypto currency. You are making a sentiment trade and your return will be based on someone else’s willingness to pay you more (ie: want it more) than you did.

Sure, equity and fixed income prices can be swayed by sentiment as well and their prices can move for externally related forces (see the past month of market action). However, those securities have other characteristics that can be used to validate an investment thesis and level set a stated valuation. With equities, you have underlying cash flows, products, innovation, earnings, earnings forecasts, employees, management teams, product cycles, balance sheet status, and many other items to assess. With fixed income, you have the contractual cash flows, stated interest rates, implied yields, and health of the underlying issuer.

With gold, you have none of these other items to assess or use in a valuation calculation. Rather, you are making a call on whether the next person will pay you more or less for the metal. This can be based on a belief of what may come next. For instance, gold tends to do very well in times of high uncertainty and fear (like today’s environment) and that drives up demand and prices. It also does well in times when there are concerns about government deficits (as evidenced by its strength post COVID) based on a belief that gold can be used as a means of exchange/currency (and has been for centuries).

Gold can certainly play a role in a diversified portfolio (it tends to have low correlations to traditional assets) and gives investors comfort due to its tangible nature and ability to serve as a means of exchange. With its recent strength, it has outpaced the return on the S&P 500 over the prior 20 year period so it clearly is an asset class that deserve attention.

It’s just a very real challenge to value the asset as it lacks many attributes that other investable assets possess, making it difficult to know if now is a good entry price. This has kept me on the sidelines but if you are able to form a reasonable thesis on the path forward from here, it may be worth a closer look. Here’s a good article from Schwab on the various ways one may invest in gold if its right for them and their portfolio

Leave a note