Decisions, Decisions

February 9, 2023

A research service I subscribe to recently shared an article about decision making. If you are an investor like me than you know all too well the level of decisions you are required to make to stay sane (and invested!). A fresh perspective on decision making is always welcomed.

The article discussed a recent book by Annie Duke, a former professional poker player turned cognitive-behavior writer.

Decision quality and outcomes

A main point she makes in her book is that we often evaluate the quality of our decisions after the fact using only the related outcomes – and use that analysis to guide future decisions.

Think about it – if I were to ask you about your best investment decision, you will probably give me one that led to a good outcome right? You may tell me about a stock you bought before it doubled in value. Or you may tell me about how you stayed in the market during the COVID market panic of 2022.

And on the flip side, if I ask about your worst investment decision, you will reluctantly share one that didn’t turn out so well (ie: bad decision, bad outcome). Perhaps you went to cash in 2008 and never got back in. Or maybe you bought a crypto currency last year at the height of the hype.

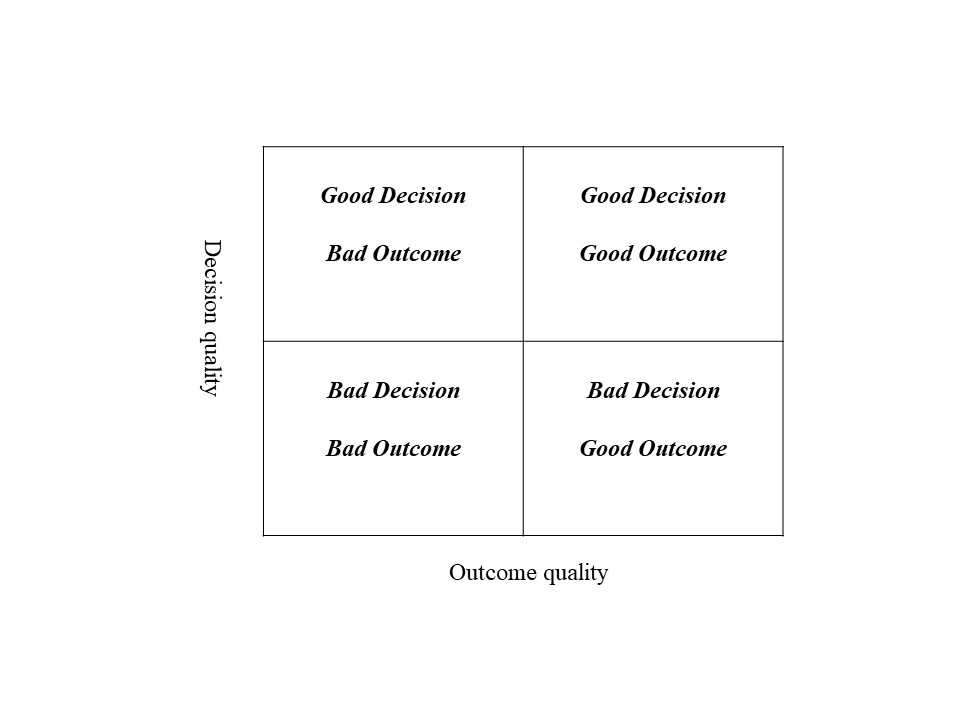

However, these are only two possible combinations (good decision/good outcome, bad decision/bad outcome). It is also possible that a bad decision led to a good outcome – and that a good decision led to a bad outcome. It can be helpful to think of it in this quadrant – there are four possible combinations – and no guaranteed correlation between decision quality and outcome.

Again, there is not necessarily a correlation between decision quality and outcomes. And yet – many of rely on the past outcomes of our decisions to guide us the next time we have to make one. Duke argues that we should resist this temptation and instead take the time to carefully study our decisions in advance in a structured framework.

Probability Weighted Outcomes

Instead of only using past outcomes, consider instead this framework listing out:

a) the potential decisions you can make

b) the possible outcomes of each of those decisions

c) the likelihood/probabilities each of the possible outcomes will occur

Let’s take each in turn:

Potential decisions- here is where you list the decision (or decisions) you can have to make. This is your starting point

Potential outcomes – for each decision, list the potential outcomes. Be sure to include those you prefer, as well as those you don’t want to see come true (the good, the bad, and the ugly)

Probabilities – this may be the most important step. To become a better decision maker, you need to not only get better at seeing the scope of potential outcomes but also improve your ability to accurately and realistically assess how likely each outcome is

Application to investing

This framework would prove very useful in investing. By applying it, you are thoughtfully evaluating decisions (in advance) based on the probability-weighted outcomes you compile for each decision. This is in contrast to a quick “well, last time that decision gave me a good outcome so it’ll work again.” As we saw above, a good outcome is not necessarily caused by a good decision.

Further, the investing world and markets are not static, so a snap decision that worked in the past is not likely to automatically work in the present. As Duke says “identifying the set of reasonable outcomes is a huge improvement over having particular outcomes (ones from the past or one you really want now) distort your view.”

Further, by laying out possible outcomes, you are forced to confront your biases and determine what you actually know (ie: what is factual) and what might instead be your beliefs, or opinions coming thru. You will also be forced to look at all sides (remember – you should consider both positive and negative outcomes) You will be able to see clearly what you know – and what information you may need to seek out before making any decisions. And perhaps most importantly, you will be evaluating how likely it is these outcomes will occur, which may highlight an overly cautious or overly aggressive approach to your decision making.

Next time you are faced with an investing decision, give this framework a try! Hopefully it will lead to a great outcome for you and your financial journey.

Invest on,

Leave a Reply

You must be logged in to post a comment.

Leave a note