Earnings Season – Expectations vs. Reality

August 18, 2022

As we approached the end of June 2022, markets seemed to be in a free fall. There was no shortage of things to worry about as an investor – inflation, rate increases, global unrest, midterm elections, covid variants, and perhaps front and center: Recession fears.

With reports of a slowing economy and the persistent belief we were headed for (if not already in) a recession, the general consensus was that Q2 2022 earnings (results for April 1- June 30, reported in July and August), would be rather weak and would show a marked decline in earnings. Wall Street was bracing itself for the worst.

That was the expectation in June. With most of earnings season now behind us, let’s take a look at the reality.

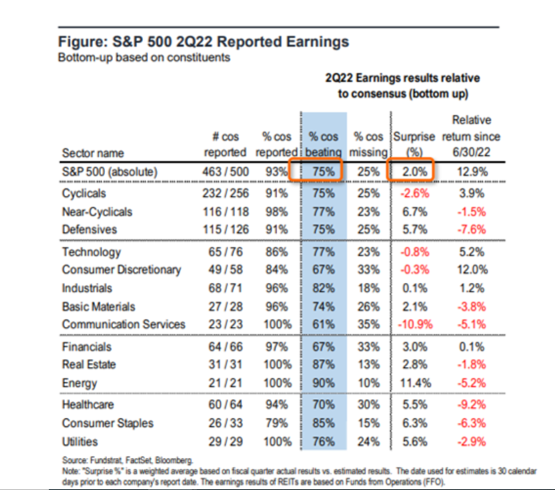

- Of the 463 companies that have reported so far (93% of the S&P 500), overall earnings results are beating estimates by a median of 7%

- 75% of those reporting have individually beaten earnings estimates

- On the top line (ie: revenue), overall results are beating estimates by a median of 5%

- 70% of those reporting have individually beaten revenue estimates

- Consensus earnings estimate for the S&P 500 as of June 30th was $54.80. As of today, the actual is $55.82, ahead of estimates by 1.9%

As the below chart shows, the earnings picture was far different for each of the eleven sectors. Energy had an exceptional quarter while communication services struggled as ad demand slowed

All in all, the reality of earnings season was far better than the expectations. This may be part of the reason for the sharp rally in markets since late June – in addition to other “positive” factors including lower inflation readings as we discussed last week.

There remains some material concerns lurking beneath the earnings surface – including negative earnings revisions for Q3 and the lingering uncertainty surrounding the future impacts of the lingering variables in the system (inflation, interest rates, supply chains, etc). But for now, Q2 2022 proved to be better than expected and markets have been celebrating that small victory.

Onward we go,

Note: All commentary above is as of the date of this post and is for education and informational purposes only. Windermere and its principals do not intend for this to serve as investment advice and are not responsible for any actions taken based on this article. Consult your financial advisor before taking any actions as it relates to your own investment portfolio

Leave a Reply

You must be logged in to post a comment.

Leave a note