Economic News Hot Off the Presses

April 12, 2023

Two major economic reports have been released in the past week for March – labor report and inflation report (as measured by the Consumer Price Index (CPI)). Let’s review the headlines of these economic news releases and explore what these reports may mean for markets moving forward.

Labor Market Report

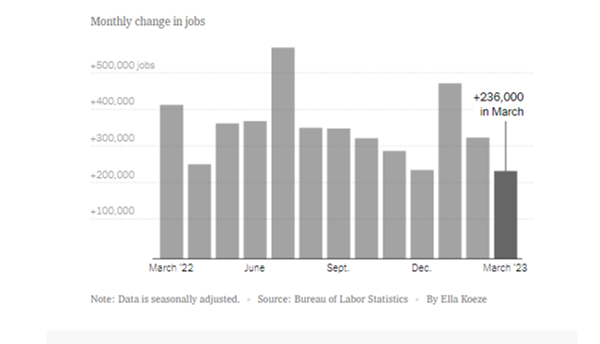

Markets may have been closed on Good Friday, but the Bureau of Labor Statistics was hard at work releasing the latest jobs report for month ended March 31, 2023. That report was in line with expectations, showing another month of steady job growth (236,000 jobs created). That increase was below that of prior months however, as shown in the graph below from the New York Times.

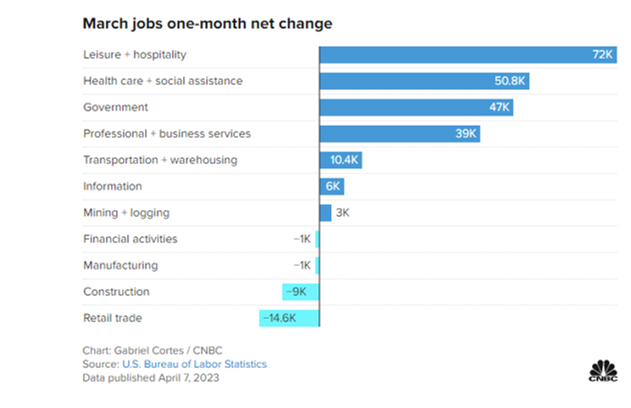

The unemployment rate fell to 3.5% (down from 3.6% in the prior month). The range of industries beginning to fade has widened, as warehousing, retail, manufacturing, construction and financial activities — those more sensitive to borrowing costs — either lost jobs or stayed flat over the month.

A few other highlights from the report:

*Year over year growth in average hourly earnings slowed slightly in March, to 4.2% (lowest since mid-2021)

*US Labor Force added nearly half a million workers in March

Overall, this report showed that we may be in the early stages of a slowdown but that for the moment, the job market as a whole remains resilient and well positioned for growth.

Inflation Report

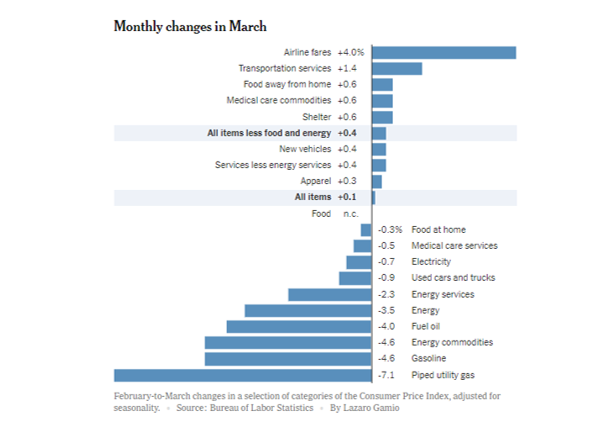

Earlier this week, the CPI data for March 2023 was released. Inflation moderated during the month, rising 0.1% (as compared to 0.4% last month and 0.2% expected). Year over year, the increase was 5%, compared to 5.1% estimate and down from a 6% year over year change in February.

The below chart illustrates the changes by category. Energy abated and food prices were finally flat (a 28 month low) but that was offset by ongoing increases in other categories such as travel and transportation.

What do these reports mean?

Neither of these reports added definitive evidence to the central issue facing markets – is Is the Federal Reserve done raising rates? Both reports contain elements that can be used by both sides of that discussion to formulate their arguments.

On one side (the side of no more hikes), you have a relatively stable (even though it’s slowing just a bit) job market that gives the Federal Reserve some cover to slow down rate increases. And that same camp can argue that rate hikes have started to dampen inflation to the lowest YOY change since 2021. They can also highlight that the trend line will continue, especially once rent and housing data catches up from its well-known lag in CPI data.

However, on the other side (the side of further rate hikes), there is the case that job markets remain tight and unemployment stubbornly low, which will result in renewed wage pressure. Further, inflation, while dropping, is still well above the Fed’s stated 2% level.

Who’s right? Only time will tell – and the arguments on both sides are further complicated by the fact that each of these reports largely contain data that pre-dates the banking collapse and resulting fallout.

However, in the meantime, it can be instructive to look at what another key player in this debate has to say – the almighty bond market. The US 2-year has exhibited shocking volatility and has fallen considerably in the past month (in the wake of the banking crisis), from over 5% to near 4% today. That current level remains 0.83% lower that the current Fed Funds midpoint and indicates that the bond market believes the Fed is done hiking (and will actually lower rates by year’s end).

These economic reports are interesting to follow and provide for some engaging conversations and debate. However, as always, it’s far more beneficial to direct your attention to things you can control. Focus on your cash flow, your ongoing savings & investment, your risk profile and related allocation, and your long-term financial goals. In time, the economic reports, trend lines, and resulting market gyrations will fade into the background – right where they arguably belong

Onward we go,

Leave a Reply

You must be logged in to post a comment.

Leave a note