In Defense of Optimism

March 30, 2023

Here we are, nearing the end of Q1 2023. If you simply looked at market returns, you would think it was a pretty decent quarter. During the first three months of the year (with one trading day to go), equity markets have risen around 5%, interest rates have fallen slightly (giving a boost to bond prices), earnings have held up pretty well, consumer confidence remains high, and inflation (albeit still elevated) has come down from its peak. All is well, right?

Not so fast. My guess is that if you take stock of how you are feeling as an investor, you may have some negative emotions to express. And the “crowd” is certainly leaning towards the pessimistic end of the spectrum.

There has been a bearish sentiment firestorm brewing since last year – and a match has been set to those burning embers of negativity over the past three weeks as a material banking crisis unfolded.

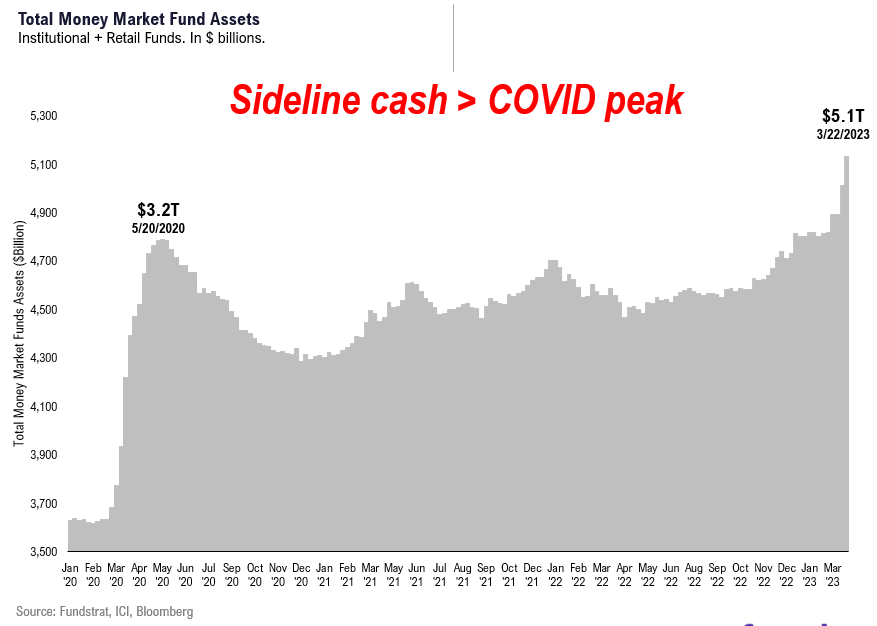

The prevailing narrative is pretty negative – focused on an impending recession, a looming banking crisis akin to 2008, ongoing inflation, impending cliff for corporate earnings, and generally challenging prospects for investing. There is perhaps no clearer sign of these thoughts than the explosion in cash on the sidelines shown in this chart, which now exceeds cash on the sidelines during initial days of COVID

What’s one to do in this environment? Personally, I keep coming back to this quote my dad sent me last week. It was included in an email written by Harvard Professor Youngme Moon. In it she shared a few excerpts from her twitter thread “20 personal lessons from 2022” and one jumped off the page as a strategy I’m choosing to act upon during this time:

“The harder it is to be optimistic, the more important it is to be optimistic”

No, I’m not advocating that you turn a blind eye to all of the risks and be naïve about where we could go from here. And no, I’m not saying that things are 100% favorable and ideal.

Rather, I’m simply reminding myself (and you) that this may be a time when it’s the hardest – and perhaps the most important – to stay positive and trust in the process.

What if you were just a bit more optimistic than you are inclined to be at this moment? What could you do?

Perhaps you stay invested versus cashing out?

Maybe you consider upping your 401k contribution rate ever so slightly?

Maybe you turn off the downbeat business news and instead read a few updates on the businesses you own penned by management themselves?

Perhaps you review the details of the insurance in place at your bank and brokerage firm and rest easy knowing that you are protected instead of letting the newscasts worry you sick?

Maybe you accept this reality, acknowledge that it is hard (most things worth having are), turn your dial to a positive lens, and keep executing on the plan you put in place for your financial journey?

“The harder it is to be optimistic, the more important it is to be optimistic” – well said Youngme.

Onward we go,

PS – I suggest reading her whole thread if you have time. My other two favorites:

- The older you get, the easier it is to greet new things with skepticism. An easy way to stay young is to simply replace skepticism with curiosity and openness

- Bad news comes at you fast, but the good stuff tends to happen slowly

Leave a Reply

You must be logged in to post a comment.

Leave a note