Jobs in Focus

April 6, 2023

The health of employment in the country has always been a topic of interest. However, ever since COVID, the release of the monthly payroll report by the Bureau of Labor Statistics has become “must see TV,” second only to the release of CPI!

Early on in the pandemic, it was shocking to see how quickly unemployment spiked. And ever since, it has been just as shocking to witness the seemingly impenetrable strength of the labor market.

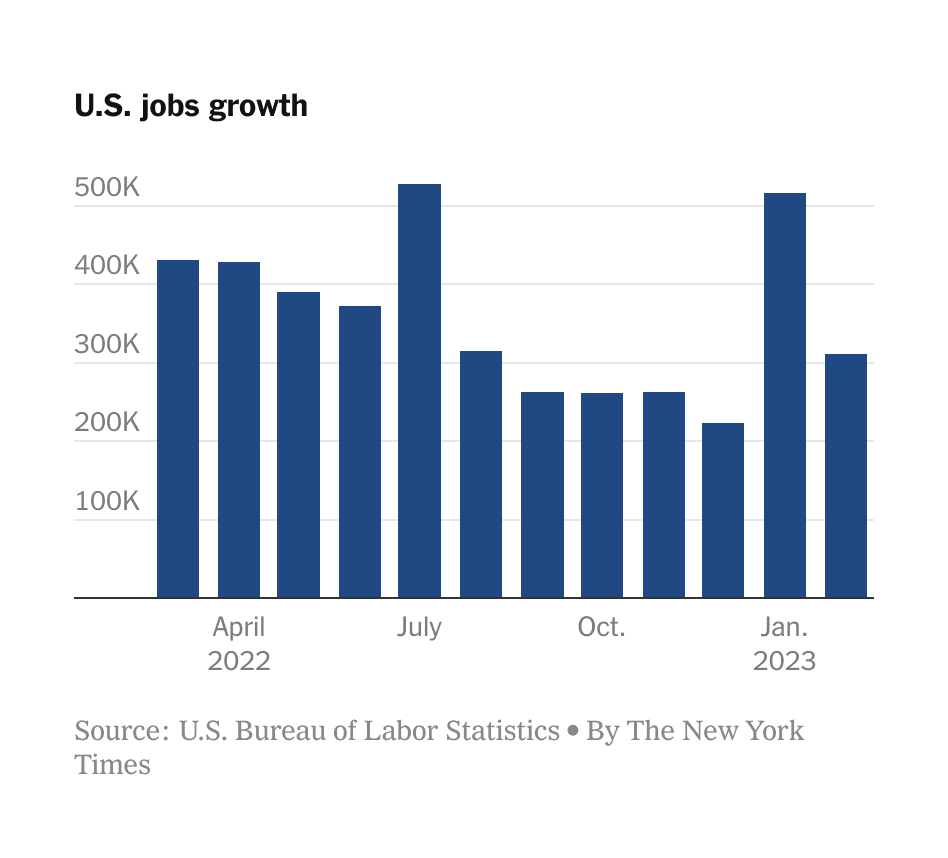

The labor market has been very resilient post-COVID – with the unemployment rate at a 53-year low as of February 2023 and the last eleven jobs reports coming in ahead of expectations.

Can the labor market retain its march forward? Earlier this week, there was a first sign that perhaps the job market’s ascent is running out of steam. JOLTS data (Job Opening and Labor Turnover Survey) reported 9.9 million open jobs, which marked the first time the number was below 10 million since May 2021 and was below expectations. Many saw that report as the first sign of weakness in the labor market.

The “main event” for labor markets is tomorrow (as of the day I write this), with the release of March payroll report Tomorrow (On Friday April 7, 2023), the March payroll report will be issued. Markets will be closed for Good Friday but no doubt many will be tuning it to see the release.

Why is this getting so much attention? It all ties back to interest rates and their likely path from here.

The US Federal Reserve has a dual mandate – price stability (ie: inflation control) and maximum sustainable employment. Over the course of the past year, the Fed has been rapidly raising interest rates in an effort to deliver on the first part of that mandate (as the belief/hope is that higher rates slow spending, which in turn slows inflation). And up until now, that breakneck pace of rate increases has not caused employment to waiver. Quite the opposite actually, as hiring and wages have stayed strong. This dynamic has allowed the Fed to “keep its promises” on the second part of the mandate while actively fighting for the first.

However, if and when the employment market shows cracks in its armor, the belief is that the Fed may be driven to respond (by perhaps stopping rate hikes – and eventually easing). This is far from a certainty as again, the Fed has to focus on inflation as well as employment. This tug of war between “will they won’t they” is exhausting markets (and its participants) and is leading to meaningful volatility.

There is another debate that centers around jobs data and its trend line – recession. The concern is that a slowdown in hiring, a plateau in wages, an increase in unemployment – or a combination of the three – would indicate that the growth in the US economy is also on the decline which could portend a recession.

At a high-level, there are likely four possible outcomes for tomorrow’s report –

*Weak jobs report “bad news” for employment = good news for markets (means no more rate hikes coming)

*Weak jobs report “bad news” for employment = bad news for markets (means recession is on horizon)

*Strong jobs report “good news” for employment = bad news for markets (means more rate hikes may be coming)

*Strong jobs report “good news” for employment = good news for markets (means recession fears appear overdone)

Which one will we get? We will have to see what the jobs report shows and then wait for Monday’s trading action to find out what markets think it all means. Keep in mind – one report and one day does not an investing journey make. Stay invested for the long haul and view these events for what they are – interesting sights to see along the journey.

Onward we go,

Leave a Reply

You must be logged in to post a comment.

Leave a note