Now What?

April 3, 2025

Before diving into today’s post, let’s all take a collective breath together. This week (well, let’s be honest – this year) has been a lot to navigate for investors. But let’s not lose sight of the fact that we’re all still here, much of what’s good remains, and we have no better option but to move forward one day at a time. Let’s exhale – and dive in.

If you’re like me, here is what you’re probably wondering:

- What is happening?

- Why is this important?

- What happens next?

- What can (or should) I do now?

Let’s take each of these in turn

What is Happening?

This week brought the end of Q1 2025, which was a challenging quarter for equity markets. As the administration took office in late January, it became clear that trade policy was top of the agenda but it remained rather unclear what that policy would look like (as tariffs were put on and delayed a few times in a matter of weeks).

On Tuesday (ie: “Liberation Day”), President Trump held an event in the Rose Garden where he unveiled an executive order placing tariffs on virtually all trading partners with the US (many of which have large trade deficits (ie: US imports more than it exports to them)).

These tariffs were dubbed “reciprocal” (although a closer look at the “math” reveals some questions regarding whether that term is appropriate). Certain products, such as semiconductors, were exempt. And certain countries (such as Canada and Mexico) were exempt for most goods (for now).

These tariffs were shockingly higher than markets had been anticipating. Equity markets sold off around the globe and interest rates fell as investors fled to safety and anticipated lower growth ahead.

Why is this important?

Based on market’s reactions around the world, these policy moves are clearly consequential. Why is that? Probably due to a few beliefs – tariffs are likely to lead to higher prices, rising inflation, slower growth, falling corporate profits, dour consumer confidence, or some combination of the above. Let’s look at how these may each come to bear.

Higher prices/inflation – these two worries seem to go hand in hand. To understand this concern, we should first review how a tariff is actually charged/paid. The tariff is paid by the US companies that import the goods from other countries. These costs are then commonly passed on to the end consumer by way of higher prices. As an example, let’s assume Apple purchases a $10 part from India. The new tariff rate on India is 26% so upon purchasing that product, Apple now pays $12.60. Apple can either absorb that added cost or increase prices charged to consumers for its end products. In the end, tariffs are a tax on imported goods. They are not a fee charged directly to a foreign country.

If this dynamic plays out across a whole host of goods (think food, clothing, cars, electronic components, etc), it’s logical to think that consumers will end up paying higher prices for many goods in the future. It may also limit supply as companies seek to find lower-cost solutions to produce products which can take time and slow production. As we know from the post COVID era, many dollars chasing too few goods is inflationary.

Slower growth – perhaps the loudest drumbeat today is that of slowing growth (which links up with recession fears, commonly defined as two quarters of negative GDP growth). As we wrote about a few weeks ago, GDP equals:

*Personal Consumption Expenditures – also called consumer spending, this is the goods and services people buy, such as clothing, groceries, health care, cellphone services, etc.

*Investment – This is business spending on capital expenditures/fixed assets, such as land, buildings, and equipment as well as investment in unsold inventory. This category also picks up the purchase of homes by consumers

*Government Spending – As the name implies, this represents spending by federal, state, and local governments

*Net Exports – US exports minus US imports

It’s easy to see how some, if not all, of the components of GDP would fall given this chaotic backdrop. Businesses are highly likely to hold off on any investment spending in this environment until it becomes clear tariffs will remain and onshoring and/or moving operations will truly be beneficial. Consumers could pull back from spending (due to the “wealth effect” where consumers feel less wealthy when their portfolios decline, even if they are not actually spending those funds, since they feel less wealthy). Government spending is already coming down from efficiency efforts and net exports had already been falling due to front-running of imports ahead of tariff plans.

All of these “wait and see” attitudes and the rapid shift in consumer and business behavior have the real potential to put the brakes on US economic growth. When growth expectations fall, equity prices fall and bond yields fall – which is what we’re seeing in markets today.

Falling Corporate Profits

As we wrote about recently, the prices of individual stocks (as well as the broader equity indexes) are based upon anticipated earnings times a given multiple. As of late, the decline in indexes (and many individual stock prices) has been due to the multiples compressing. However, there is now a fear that the “e” part of the equation may be at risk. Why? See example above using Apple. If US companies are now paying these tariffs for parts or inventory, in order to keep earnings constant, they must raise prices. However, raising prices can oftentimes lead to declines in volume (as the US consumer is conditioned to low prices and sales and very adept at seeking out alternatives when they reach their price limit)

If earnings are set to come down, equity prices need to rerate lower, which is what we are seeing today.

Dour Consumer Confidence

As Ian Bremmer, a global political strategist, wrote last night – “Americans are the shortest term folks imaginable” His point – it’s hard to see the country accepting prolonged short-term pain based solely on the promise that it may get better in the future. In his words, that “flies in the face of our national experience.” How long will Americans, republicans and democrats alike, stand for falling investment portfolios, weakening job markets, falling dollar, and higher prices for virtually everything they buy?

Americans react in the short term and it’s very possible that they will rapidly adjust their spending and behaviors, lending further support to the recession and falling corporate earnings arguments noted above.

What happens next?

While markets had hoped for more clarity on April 3 than April 1, it seems the opposite may be true. Unfortunately, at this time, it’s a bit of waiting game. We are waiting on a few things:

*Foreign country response – this is a major wild card. Will the hardest hit countries attempt to retaliate against the US (which could lead to further “punishment” by the US)? Or will they seek some level of negotiation? Keep in mind – the US is a major consumer of the world’s goods. Some foreign countries would suffer real damage if the US stops importing their goods. This seems to be at least part of the administration’s plan since the Executive Order gives Trump the ability to reduce tariffs if a country negotiates

*Trump’s response- there has been a belief that there is a “Trump Put” in the market, meaning if the stock market reaches a certain level, Trump will step in. So far, he does not seem as concerned with stock market corrections as he has in the past. This is a big unknown

*Fiscal policy – This administration has promised fiscal stimulus by way of tax cuts, lowered regulation, increased business combinations, and several other methods. Some clarity on those actions would be helpful to offset the slower growth expectations

*Monetary policy – Fed Chairman Powell speaks tomorrow and market participants will be anxiously listening for clues regarding the rate path from here. Rates fell with the tariff news and the 2 year bond yield now sits below Fed Funds. The Fed has its hands full (again) with a likely slowdown in growth coupled with a potential for rising inflation making it’s path for rate cuts unpredictable

*Hard data deterioration – Up until now, the place where weakness has been observed has been in “soft data” namely confidence measures and sentiment surveys. When will we start to see changes in the “hard data”? Tomorrow’s March jobs report will be a first look

*Congressional action – President Trump issued these tariffs under Executive Order, which requires there to be an emergency situation. Otherwise, in normal times, tariffs need to be issued by Congress. With republican control of both the house and senate, it’s very unlikely the “emergency” provision could rolled back and also unlikely Congress would seek to question the issuance of these tariffs

What can (or should) I do now?

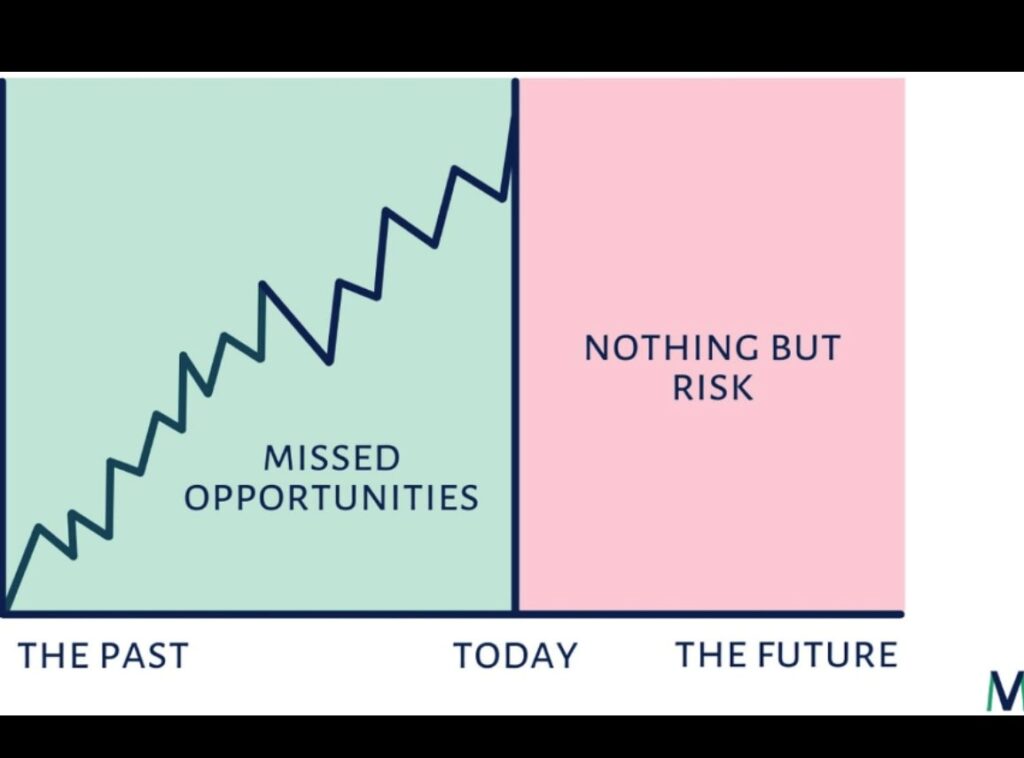

It’s very easy to play the “should have” game right now but let’s be clear – very few market participants saw this coming. Just like past jarring market events – whether it be the Great Financial Crisis or COVID – they seem much clearer in hindsight but were nearly impossible to fully predict and price-in in advance.

As I always say, you want to build the ark before it starts raining. Steps should be taken in “good times” to prepare for these market storms. These steps may include: building cash reserves (to cover unexpected spending or unforeseen job losses), allocating near-term cash needs to stable value investments (such as cash equivalents or short-duration fixed income securities), keeping your spending in line with your earnings and/or planned portfolio withdrawals, and keeping equity allocations at a level you can (and more importantly, will) tolerate the volatility when it arrives.

If you’ve taken all those steps (which I believe you have if you have read this far in this article!), you’ve done the pre-work. You are prepared. Now comes the hard part. You have to wait it out. You have to keep in mind that you have overcome all past market challenges you’ve been faced with. You have to resist the urge to act out of emotion. You have to remember that every other event such as this was an opportunity in the long run (but represented nothing but future risk at the time)

It’s not easy – in many cases (and this is no exception) investing is about managing your emotions and your behavior. Don’t let this chaos distract you from your long-term approach.

Onward we go,

Leave a note