Progress on Inflation

July 13, 2023

After a slow holiday week, markets have resumed normal operating speed this week and thankfully, the momentum has been positive. The upward moves are largely due to signs of disinflation. The two inflation reports for June released this week did their part to reassure investors that it remains possible the US can attain a soft landing.

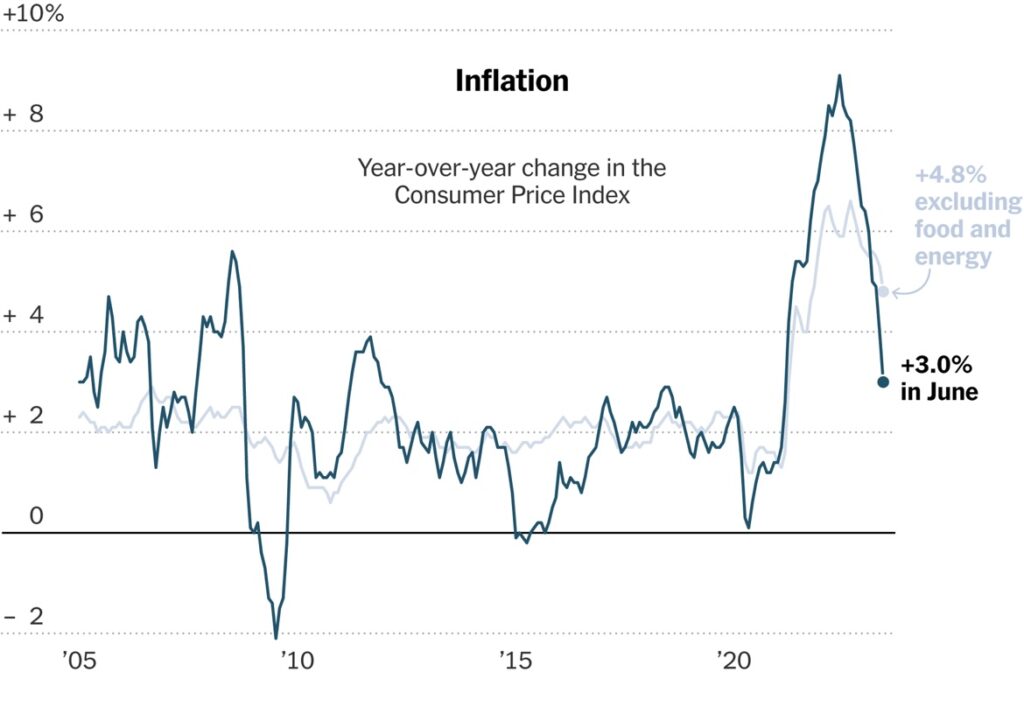

The Consumer Price Index (CPI) rose 0.2% in June, with the year over year increase falling to 3% (compared to 4% in May and 9.1% in June 2022). This is the slowest annual increase in over two years.

Energy prices were a major driver of the decline, falling 17% from a year earlier, along with prices of used cars, appliances, and airfare. Over 45% of the components of CPI are in outright deflation. On the other hand, shelter and food prices remained elevated, as did the cost of certain services (like auto repairs and auto insurance).

The meaningful decline this month has a lot to do with the “math” – the CPI had a considerable increase in June of 2022 (1.2%) and that figure rolled off this month, replaced by June 2023’s 0.2% increase. But despite that math element, the fact remains the majority of prices are cooling.

The Federal Reserve’s preferred measure of inflation – Core CPI, which excludes food and energy, came in at 0.16%, a beat of the consensus 0.30%. This is the lowest month-over-month change since February 2021 and may be indicative that the “sticky” inflation narrative is faltering.

Another measure of inflation – the Producer Price Index (PPI) – also was released this week. And again, it was encouraging. The PPI rose .01% in June, lower than the .02% that was anticipated.

What does this all mean? Investors may see the actual impact of these inflation trends later this month, when the Federal Reserve meets. It’s widely believed that they will proceed with another interest rate increase in an effort to not “stop too soon” and slow inflation ever further. This will be good news for savers and once again challenging news for borrowers. However, even if the Federal Reserve does increase rates, there may now be a case to be made that rates don’t need to stay elevated for an extended period of time (why does Fed Funds need to be at 5.5% if inflation is tracking sub 3% over the coming months?)

We could also get some further validation of the soft landing narrative this month as companies report quarterly earnings. If earnings remain strong, it would serve as further evidence that a recession may be avoided (despite the high level of interest rates) and that the Federal Reserve did not break the economy after all.

It is far too soon to declare victory of any kind, but these trend lines in inflation are very encouraging. Slower inflation is helpful for investors but it’s also helpful for every American as more and more prices start to decline. After a few longs years of battling this market dynamic, this is very encouraging news.

Onward we go,

Leave a note