Ray of Light?

January 12, 2023

I’m writing this on another grey and gloomy January day in Wisconsin. Perhaps that is why I chose this title. Or perhaps it is because today’s inflation report may finally be giving markets, investors, and this ever-optimistic financial advisor a glimmer of hope that we are approaching lighter and brighter investing days ahead.

December CPI Report

Another widely anticipated inflation report was published on January 12, 2023. It came in as expected, with inflation falling 0.1% for the month (largest decline since April 2020) and up 6.5% year over year. As annualized numbers pull in the worst levels from mid-2022, many look at 3-month annualized which is now 3.1% (on par with September 2021 levels).

It seems that at the exact moment the consensus had become “inflation is here forever,” inflation broke to the downside yet again and is proving to be transitory as the Federal Reserve first believed. It was simply an issue of the transition period being far longer than anticipated. Perhaps transitory never meant brief – it just meant temporary.

The main drivers of inflation in mid 2022 (housing, cars, and energy) all faced the same inflationary fact pattern – unrelenting demand and very limited supply. The price movements were almost parabolic but those changes were not sustainable and had to reverse, which is what we are seeing now. Example – 3-month annualized change in used car prices is -27.5%, the largest decline since the 1960s. And as Greg Ip points out in today’s Wall Street Journal, prices don’t have to return to their prior levels for inflation to fall. They just have to stop rising (or start declining). And we are definitely seeing that play out in goods pricing. Transitory…finally.

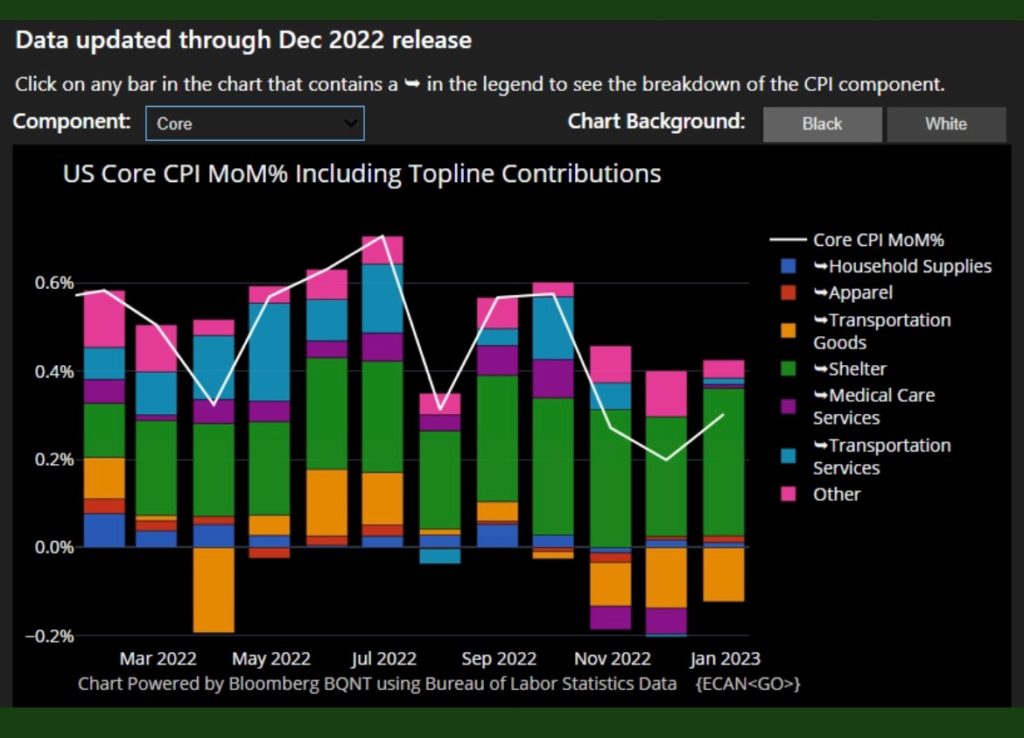

This picture graph, shared by Schwab’s Chief Fixed Income Strategist Kathy Jones, shows the components of CPI over time. Goods have clearly fallen.

Shelter has a known lag (one the Fed has acknowledged) so many have taken to pulling shelter out of these figures. That metric (core CPI less shelter) posted its their negative month and is now up only 4.4% year over year – a very strong sign that inflation is abating.

Focus on Jobs

With inflation showing improvement, market watchers are now shifting their attention to jobs data. Wage growth can flow thru to inflation via the price of various services and with its dual mandate (of controlling inflation and employment levels), the Federal Reserve closely monitors wages as well. With historically low unemployment (ie: low supply of workers), one would think wage growth would be accelerating rapidly. That has not been the case, with wages growing at 4.1% annualized in the last jobs data – a rate that is not too far off the Fed’s target. If wages can be kept at a reasonable growth rate, along with falling inflation, we may just get the soft landing the Fed and investors are hoping for.

Reason for Optimism

Markets traded rather well in response to the inflation news today, with equity markets rising modestly and bond yields falling. Even after Federal Reserve members cautioned that there was still work to do, markets marched higher. Clearly, market participants believe inflation is abating, wage growth is under control, we are transitioning back to better financial conditions, and as a result of all those factors, interest rates will moderate.

Market moves in the first two weeks have been positive and today’s CPI data reinforced those trends. As always, we can never be sure what lies ahead and one data point (and 10 trading days) do not solve all the challenges we are facing in 2023. But for today, I personally appreciate the glimmer of hope and positive trend lines for what they are – a shining ray of light encouraging us to invest on.

Note: All commentary above is as of the date of this post and is for education and informational purposes only. Windermere and its principals do not intend for this to serve as investment advice and are not responsible for any actions taken based on this article. Consult your financial advisor before taking any actions as it relates to your own investment portfolio

Leave a Reply

You must be logged in to post a comment.

Leave a note