Serenity Now

June 24, 2022

Just as I was putting the finishing touches on a different Pam to Paper column (I’ll come back to that one another week), I received an email from a Mutual Fund Company we work with, Calamos Investments. In addition to having a proven track record as a money manager, they also produce some very informative and non-nonsense content.

The email was entitled “Give your Clients Serenity Now.” If the goal of that headline was to get my attention, in the sea of my email inbox, mission accomplished! It (intentionally) harkens back to the famous Seinfeld Episode featuring this line, as the chronic worrier George Costanza attempts to put self-help advice into action. With markets behaving as they have lately, I think we could all use some calming inputs and hopefully find some of that serenity George was looking for.

I plan to share this content in more detail with clients during our upcoming quarterly meetings as it provides some very powerful and instructive graphics and information. In the meantime, here are three highlights to tide you over and hopefully provide you with a bit of serenity.

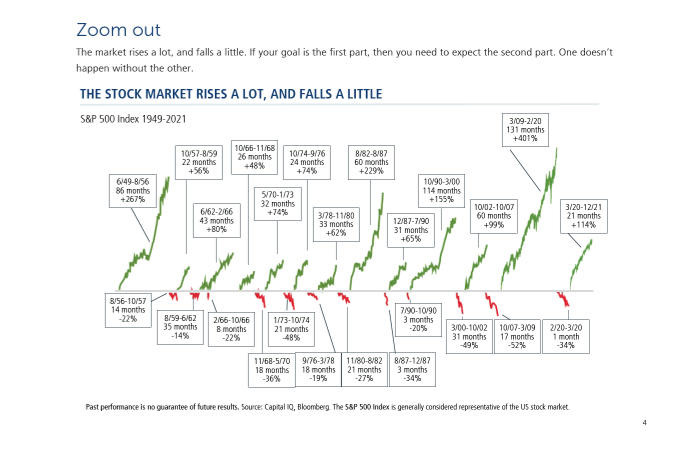

Zoom Out – if this advice sounds familiar, it could be that you are a Friday Five super fan and remember the article I recently wrote (Breathe In, Zoom Out). I had shared a long-term graph of the S&P 500 during the time I’ve been investing. Calamos shared a different chart getting at the same concept – the market rises more than it falls over the long term

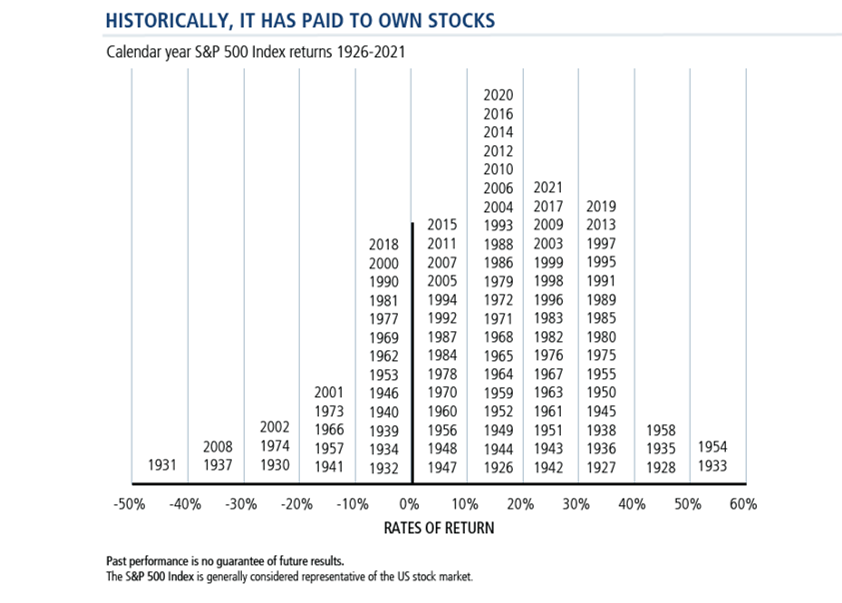

Odds in our Favor – I’ve never seen this data presented in this manner and I found it very striking. Historically, stocks rise in most (but certainly not all) years. Could we end 2022 on the left side of the chart? Perhaps. But based on this graphic, it is nice to know the odds are in our favor

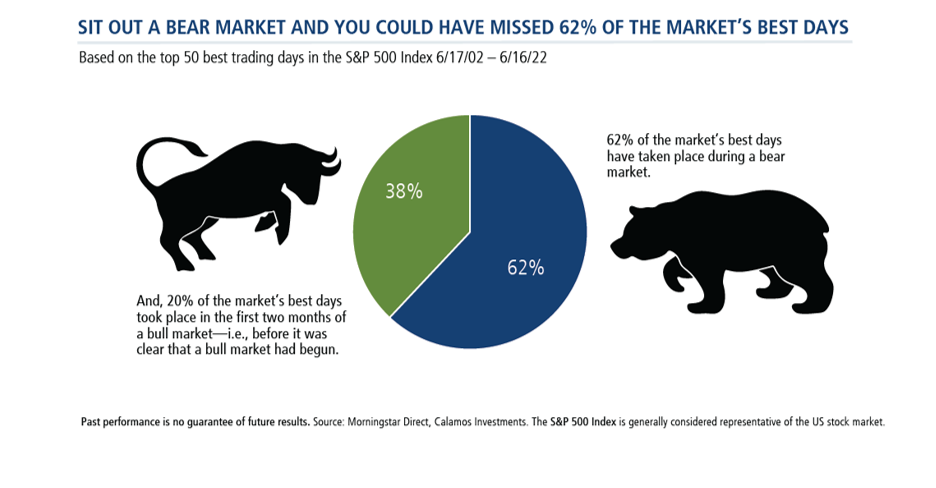

Animals are unpredictable – Two animals are commonly used to describe the current direction of markets. A Bull market is a rising market. A Bear market is a falling market (defined as a 20% or more decline from recent high).

The terms are thought to originate from how each animals fights/attacks – a bull moves upward with it’s horns, whereas a bear swipes downward with its paws/claws.

As with all animals, these figurative representations used to define markets are unpredictable. As pointed out by Calamos, a majority of the markets’ best days have come during bear markets – at exactly the time we come to believe that things can & will get worse. Getting out is too high a price to pay – you never know when the bear may relent

I don’t know about you, but just seeing these few graphics has made me feel a bit better about things. George Costanza would be proud.

To clients – I can’t wait to share more and hear how you’re feeling during our upcoming quarterly meetings.

To non-client friends – if you feel you need a bit more serenity, please reach out and I’m happy to share the presentation.

Your serene friend,

Note: All commentary above is as of the date of this post and is for education and informational purposes only. Windermere and its principals do not intend for this to serve as investment advice and are not responsible for any actions taken based on this article. Consult your financial advisor before taking any actions as it relates to your own investment portfolio

Leave a note

Leave a Reply

You must be logged in to post a comment.

I get serenity from our dog.