Teeter Totter Market

July 6, 2022

When my nephews visited last November, we visited a local playground. They are two very curious and active boys (ages 6 and 3 at the time) so naturally, we had to explore and try out every piece of equipment and toy in the park.

They eagerly climbed on one side of the teeter totter together and asked me to get on the other side. You can guess how this played out – my side instantly sank down into the sand and they flew up to the sky. I spent the next five minutes getting quite the leg workout as I tried to offset my weight to bring them up and down.

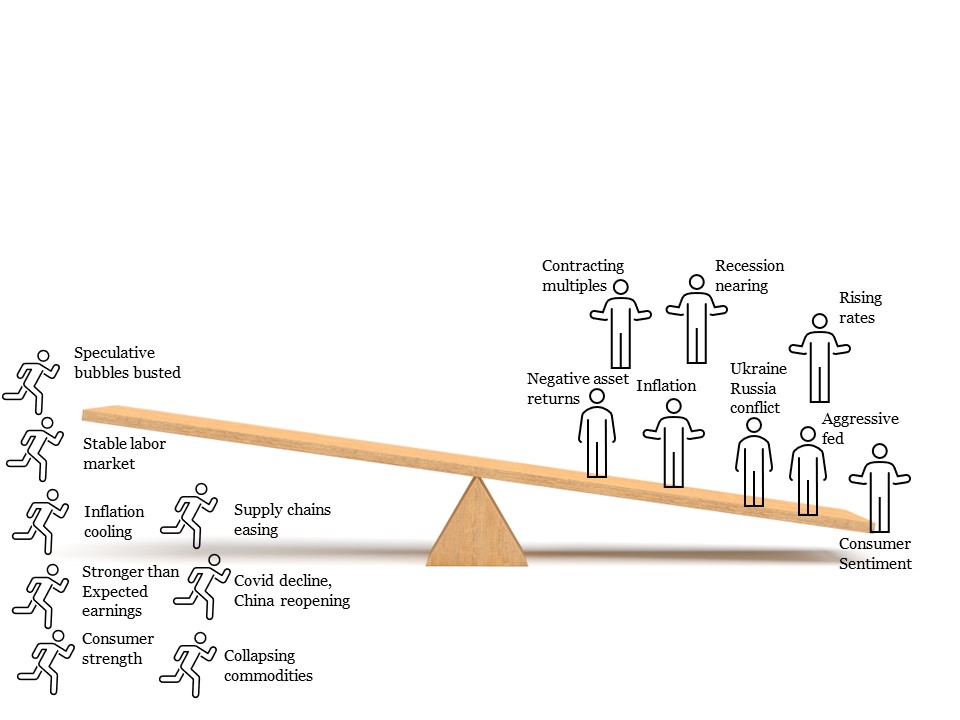

As I think of where markets stand today, I can’t help but think of this playground structure and the lopsided nature of the ride with my nephews. That is what markets remind me of today – everyone is piled onto one side of the ride, thereby driving markets (and investor attitudes) right into the sand. We all know what has gone wrong – and what could continue to go wrong from here. And that “team” is clearly winning and dominating the narrative.

However, there are still things that could start to go right (and a few that are already moving in that direction). Could their emergence start to level out this ride during the second half of the year?

What could (and is) going wrong

We are all very familiar with these items by now, but let’s review them quickly so we’re all on the same page

Inflation appeared at historically high levels in late 2020/2021 as we had two highly unusual factors take hold – supply falling due to a once in a lifetime pandemic and demand exploding due to pandemic-related shifts in spending and astounding levels of fiscal stimulus. The Federal Reserve believed inflation would be transitory and signaled that modest rate increases would be sufficient to slow the economy and bring inflation down. (in December 2021, they signaled three rate hikes resulting in fed funds of 0.75-1% at end of 2022)

This fact pattern may have actually played out but as we entered 2022, two other macro situations took hold. Russia invaded Ukraine, further exacerbating inflation in two key areas (energy and food). And COVID reappeared in force in China, putting renewed pressure on supply. Markets started to behave as if inflation would become structural

As those two events pushed inflation even higher, the Federal Reserve took aggressive action and drove rates higher (fed funds is already at 1.5-1.75% and is expected to end the year at 3.25-3.5% – more than double the expected pace only a few months prior).

This sharp rise in rates (far above what was expected) and fears of structural inflation put pressure on almost all asset prices, with equity multiples contracting, yields rising and bond prices falling, and the most speculative bubbles (ex: unprofitable SPACs, certain crypto currencies, etc) being washed out.

The rise in rates made US debt relatively more attractive, which drove investors into the US debt market, causing the US dollar to spike higher and impacting earnings of multinational companies

Consumer spending pivoted on a dime – and this shift from goods to services left many retailers (such as Walmart and Target) with excessive inventory levels. Earnings charges and anticipated deep discounting rattled investors

High inflation and high prices on every day goods (like gas) coupled with disruptions in every day life (such as air travel and staffing issues in hospitality industry) and falling asset prices caused consumer sentiment to hit historic lows.

Recession fears have mounted, as growth is slowing and long term rates are falling (leading to yield curve inversions across the curve). Concerns over upcoming earnings are now front and center

What may start to go right?

I get it. It’s easier to join the “winning team” and adopt the prevailing narrative that things are going wrong and will never get better. Maybe. But maybe not. There are some signs emerging that things may just start to improve. On that “team”, we have:

Stable labor market – employment remains very strong. There are more job openings that those seeking work. The bursting of speculative bubbles has hurt certain sectors of the job market (higher-earning tech employees at crypto and newly public companies that suddenly have cash flow concerns). But in general, labor is strong and we’ve never had a prolonged recession with labor at these levels

Inflation cooling/commodities collapsing – You wouldn’t know it from listening to the financial news, but prices are falling in a lot of key areas. Precious metals, lumber, cotton, fuel, natural gas, food, fertilizer, and home prices to name a few are all falling – and falling fast. Oil prices recently returned to levels prior to Russia’s invasion. Retailer discounts (see above) will also bring down end consumer costs and gas prices are also expected to tick down. Wages are even softening in some sectors. Five year inflation break evens are below 2% for first time since start of 2022

Supply chains easing – Shipping times are improving. A shift in spending from goods to services is lowering demand for goods. Shipping costs and container congestion is plumeting

Speculation washed out – As noted above, considerable excess has been washed out of markets and the unwinds required due to underlying leverage are largely played out. Valuations are more in line with historical prices in both equity and fixed income markets

COVID declining – China has reopened and COVID seems to be retreating (and resulting in less death, less severe illness). Proposed vaccines for the fall should hopefully maintain this trend

Consumer strength – Consumers entered 2022 with record savings, low levels of debt, and favorable debt service (thanks to refinancings during 2020-2021). Wages remain strong. The consumer is in a better place than they have been in almost all prior recessions

Fed could back off – The Federal Reserve was rising interest rates in order to cool the economy, slow spending, and ease inflation. It’s possible that much of the result they were seeking has already been achieved given the carry-on effects of their initial rate rises and other changes since they began

Recession avoided (or minor) – If inflation cools, growth slows (but stays positive), labor cools (but stays healthy) and rates stabilize (but remain healthy), a recession could in fact be avoided or be shallow/short if it occurs. Another interesting note: in all prior recessions, one of four cyclical sectors (Residential investment (housing), Business fixed investment, Vehicle Sales, and Business Inventory/Sales) has gone from boom to bust. At the present moment, all of these areas are near or below their trend line and show no signs of “boom.” As JP Morgan’s David Kelly says, “you just can’t hurt yourself from falling out of a basement window”

When will the teeter totter level out – or better yet, turn to the side of “what can go right?” Sadly, I don’t have an answer to that question. What I do know is markets have a way of working thru challenges, correcting excesses, leveling out, and then ultimately moving higher. The bad news if this takes time. But the good news is, you have that time.

Let markets do their work. And in the meantime, turn the news off, count your blessings, soak up the magic of summer, and stay the course,

Note: All commentary above is as of the date of this post and is for education and informational purposes only. Windermere and its principals do not intend for this to serve as investment advice and are not responsible for any actions taken based on this article. Consult your financial advisor before taking any actions as it relates to your own investment portfolio

Leave a Reply

You must be logged in to post a comment.

Leave a note