WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

To those of you that live in a four-season area, congratulations! We have once again made it thru winter and once again find ourselves (almost) immersed in the glorious days of summer. I fully appreciate that any free summer days are mostly spent taking road trips, working on yards & gardens, relaxing by the pool, […]

May 23, 2024

read more

Santa isn’t the only one who should be reviewing a list this time of year! I’ve been working thru a year-end financial checklist for myself and my clients the past several weeks and thought it may be helpful to share some of the key items. (Note: as always, be sure to consult your advisors to […]

December 8, 2022

read more

At some time in your life (and perhaps during the holiday season), you may be positioned to gift (or receive) a meaningfully sized gift of money or another asset. A client is on the receiving end of that equation and reached out for a discussion about gifting and the potential tax implications. Very timely topic […]

November 17, 2022

read more

Congratulations, you’ve survived another week as an investor in 2022! A week where we have seen positive and minus +2% moves in equity markets within the same day. Is anyone else just a bit tired of this?! Much of this week’s excitement centered around – you guessed it – inflation. You can read more on […]

October 13, 2022

read more

We took a lot of road trips when I was a child. Much to my parent’s chagrin, I would usually ask (at least a few times per trip) the age old question – “are we there yet?” I wasn’t trying to be annoying, I promise! I was simply tired of sitting still, tired of waiting […]

September 29, 2022

read more

As I watched the recent inflation release on Tuesday (and the subsequent jarring market decline), a common phrase kept coming into my mind over and over – “change is hard.” How many times have I said or heard that saying in my lifetime? At least a few hundred – maybe more. Why do I always […]

September 14, 2022

read more

When discussing the upcoming annual enrollment season (the time of year when employees need to elect various health care and employee benefit elections), a client recently asked for a refresher on Health Savings Accounts (commonly known as HSAs). These are very powerful tools – both for health care costs as well as for long-term investing […]

September 8, 2022

read more

There is no shortage of acronyms when it comes to finances. One you may be hearing in the news lately is RMD, or Required Minimum Distribution. A client recently asked me to explain this concept in more detail. So, let’s take a look at what an RMD is, how it may apply to you (now […]

July 7, 2022

read more

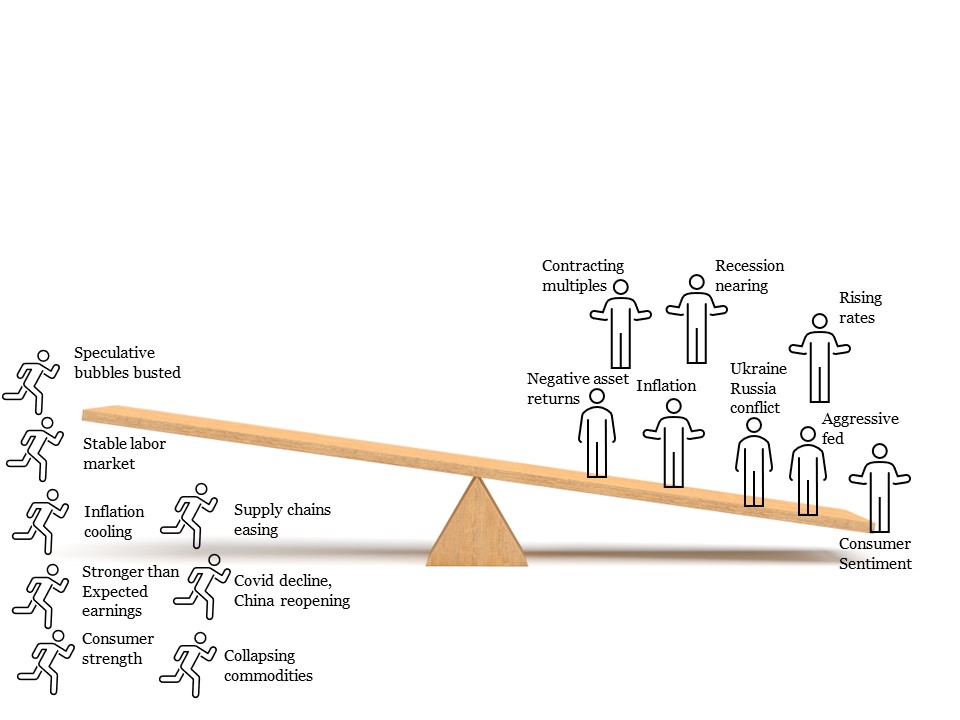

When my nephews visited last November, we visited a local playground. They are two very curious and active boys (ages 6 and 3 at the time) so naturally, we had to explore and try out every piece of equipment and toy in the park. They eagerly climbed on one side of the teeter totter together […]

July 6, 2022

read more

I’m writing this post on June 30, 2022 as stocks are set to end the first half of 2022 with the worst first-half performance since 1970. Think about that – the worst six month start to an investing year in 52 years. Geez, that’s longer than I’ve been alive! Add in high prices in many […]

June 30, 2022