Wall of Worry

October 26, 2023

As I’ve mentioned in the past, we subscribe to a few research services to help provide timely information and analysis of markets. One of these firms (FS Insight) published a video this week discussing the “wall of worry” markets have been attempting to climb (unsuccessfully) ever since late July.

I thought it would be worthwhile to share this analysis with you (as summarized in my own words) so you can better understand what may be driving recent market action – as well as appreciate how markets are likely to eventually clear this latest set of obstacles.

“Wall of Worry“

This is a phrase used by traders and market participants to describe a confluence of concerns and challenges for markets. The phrase was coined in the 1950s and is often used during a time of economic uncertainty and instability.

Reasons for the Recent Worrying

If you’ve been an investor for any length of time, you will know there is always something to worry about. In recent weeks, it seems like there are a quite few things to choose from, which is contributing to the market weakness. Let’s look at them in turn below:

1.) Rising Interest Rates

Since the end of July 2023, rates have moved meaningfully higher. We’ve written about this over the past several weeks but the bottom line is a move in the US 10 year from 4.2% to 4.9% at present time. This is a challenging headwind to asset valuations as well as a sign of potentially tighter financial conditions moving forward

2.) Rising Oil Prices

Oil prices are also on the move once again, rising from $81 in late July to $85. While this is not a large percentage move, there are concerns that conflict in the Middle East may push prices even higher and reignite a major source of inflationary pressure

3.) Global conflicts

Any type on conflict raises concerns for investors and the recent violence in Israel has added to the concern. Google searches for “WW III” have spiked to near record levels showing that the conflicts are top of mind for many

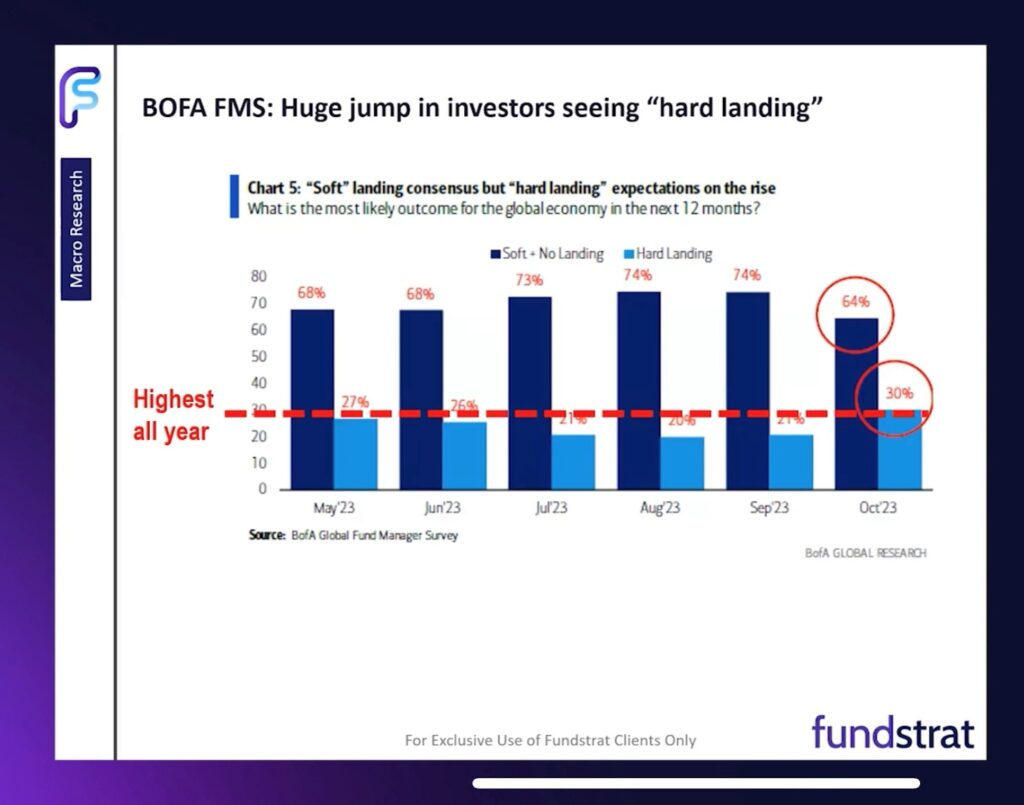

4.) Hard Landing Concerns Rising

For almost two years, there has been debate of whether the Federal Reserve can execute a “soft landing” – meaning they can bring down inflation, maintain strong employment, and avoid causing a recession along the way. Belief in their ability to do so has declined as of late, with more fund managers now seeing a hard landing ahead

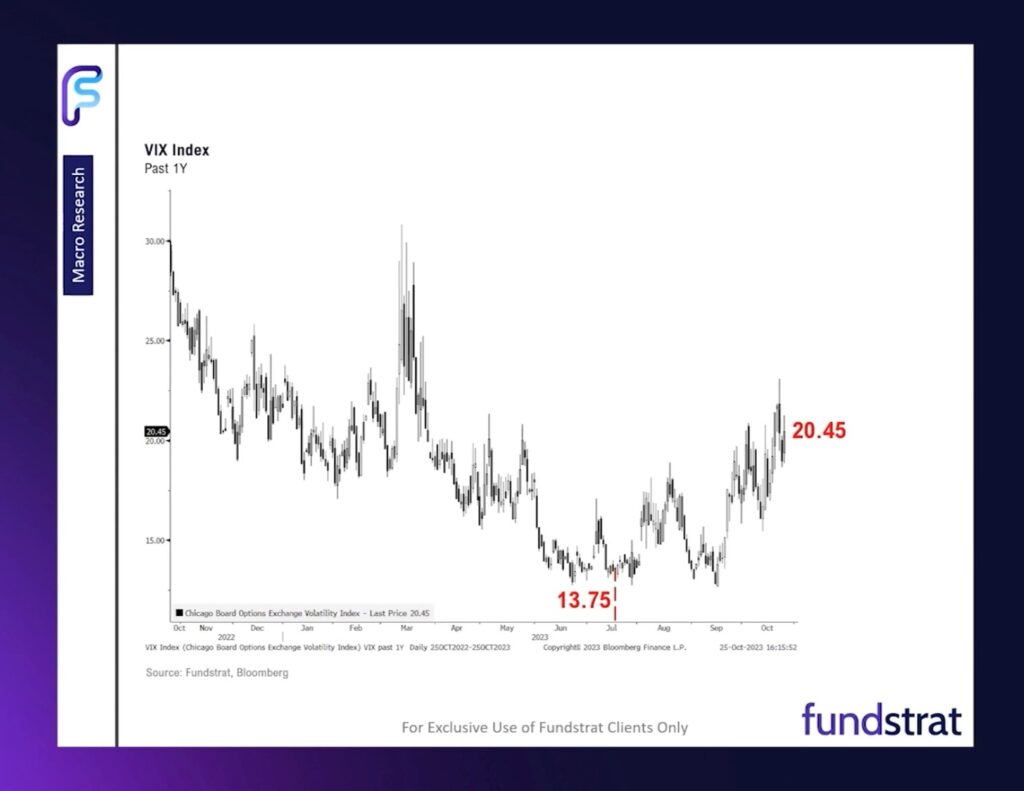

5.) VIX Increasing

The preferred measure of market volatility (the VIX) has also moved higher as of late

All of these factors have combined and contributed to recent weakness. Bonds and stocks alike have declined and investors are increasingly worried as sentiment is on the decline.

What to do now?

It’s very tempting to align yourself with the negative news and stay firmly planted on this side of the wall of worry. You certainly wouldn’t be alone in that. However, you need to keep in mind a fact about markets that has been shown to be true for decades – markets bottom on bad news. That is to say, one day (likely soon), markets will start to recover even though this backdrop of “bad news” will likely still be present. Some of the decline is technical, some of it is sentiment – none of it is enjoyable. But simply put, it will turn. It’s just a matter of time.

What will cause things to turn? We have written in recent weeks how, in our view, the dominant force at play is interest rates – so we are keeping a close eye on that metric. Rates have retreated off their highs in recent days but upcoming economic data will be essential to seeing that decline continue. In our view, many of these other “worry items” – whether it be volatility or concerns over a hard landing – will respond favorably to a downward move in rates. Global conflicts remain a key concern but historically, markets have navigated these rather well, and oftentimes result in a “safety trade” to US fixed income, which will also drive down rates.

The wall of worry is in front of us, like it has been many times before. Until we’re able to climb it yet again and come out the other side, we’d remind you of our frequent advice. Breathe in (as worrying about things seldom fix them) and zoom out (your longer term returns are still very supportive).

This wall of worry, like all of those constructed in the past, can be surmounted. Keep your ladders handy.

Onward we go,

Leave a note