Westward we go

September 1, 2022

Five years ago, I was lucky enough to have a wonderful western adventure with a lifelong friend, spending time in Wyoming and Montana. During that trip, we visited Grand Teton National Park which encircles the beautiful town of Jackson, WY. The area is absolutely beautiful and if you haven’t been, maybe this will nudge you in that direction. America at its best!

Beware of the Bears

When we arrived first at the park, we stopped at the visitor center to gather some information for our planned hike. We were aware of the frequent presence of bears in the park and given that it was a quieter time of year to visit, we wouldn’t have the benefit of crowds/noise to deter them.

A park ranger kindly walked us over a the bear spray area (which was right near a statue of a bear for the proper effect) and proceeded to give us some further advice:

- Prepare – Keep your eyes open, make noise, carry bear spray

- Don’t go alone – Travel with someone else, there is strength (and noise) in numbers

- Don’t panic – if you encounter a bear, stay as calm as you can and don’t flea

- React at the right time – if bear approaches, stand firm and don’t spray until bear is within 30 feet (!)

Prepare, don’t go alone, don’t panic, and react at right time. Sound advice from a skilled park ranger. I’m happy to report we didn’t need to use any of these tips as we navigated our 10 mile journey without seeing any bears. Phew!

Jerome Powell in Jackson Hole

I couldn’t help but reflect on this advice (and my time in Jackson, WY) last week as the financial markets turned their attention to that same area for the US Federal Reserve’s annual Economic Symposium held in Jackson Hole, WY.

After a rather dovish tone of the July Fed meeting (where rates were once again increased 75 basis points) and July’s inflation reading, markets were feeling a lot better about the path forward and had posted strong returns in July and August.

However, markets did not take kindly to Federal Reserve president Jerome Powell’s press conference in Jackson Hole and have been on a decline ever since. The speech was without a doubt a forceful one – and made it clear that there is still work to be done (to lower inflation and stabilize prices).

Personally, I didn’t find anything new or alarming in his speech. I thought it was a very measured communication and was a necessary indication that the Federal Reserve is not going to allow inflation to endure.

Deep Dive into the Speech

Let’s take a closer look at the speech so you can see why I feel this way. Below are a few excerpts from the speech (shown in italics), along with my thoughts in regular text. (Note, you can read the entire speech here)

The Federal Open Market Committee’s (FOMC) overarching focus right now is to bring inflation back down to our 2 percent goal This is not new. This is part of the Federal Reserve’s dual mandate and has been repeatedly emphasized as inflation has spike

Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth This is consistent messaging. Growth needs to slow to bring inflation down – but keep in mind, that does not mean a recession is inevitable.

While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain. An excellent reminder and very valid. Periods of excess/froth/inflation may feel good for a short time (see 2021) – but that is unsustainable in the long run (see 1970s). The corrective period (see 2022) may not feel so good either but soon we emerge on the other side

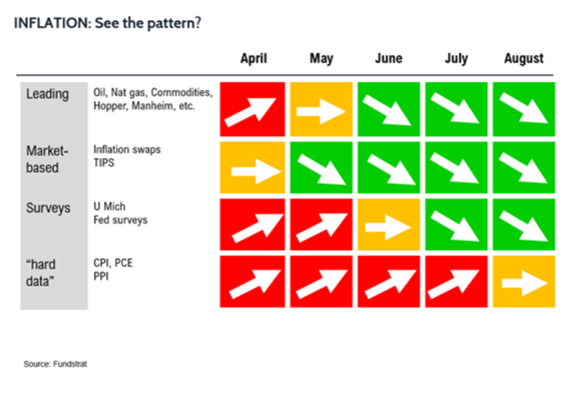

While the lower inflation readings for July are welcome, a single month’s improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down. The Federal Reserve is data dependent and they are observing countless inputs. Here is the chart we’ve shown in the past that illustrates the point of leading and lagging signs of inflation.

As you can see, the early indicators are showing great improvement. This is encouraging – and rest assured the Fed can see this too. However, Chairman Powell has to ensure he doesn’t come off message too early. They need to stress the message of getting inflation under control, in large part due to this final comment:

If the public expects that inflation will remain low and stable over time, then, absent major shocks, it likely will. Inflation is a self-fulfilling prophecy in many ways. The Federal Reserve needs the public to believe (and act as if) inflation is under control. In my view, this speech went a long way in reinforcing that idea

Revisiting the Park Ranger’s Advice

After listening to the speech – and watching the markets sharp decline on that Friday (and the days since), I couldn’t help but think what a challenging time this is for investors. Markets seemingly flip on a dime (or a short press conference) and it is easy to be left feeling fearful and confused. What can investors do now? I couldn’t help but think back to what the park ranger had told us during my time in Jackson Hole.

Prepare – build a portfolio and allocation that can compound wealth over time and endure periods of voltaility

Don’t go alone – work with an advisor you trust, who can act as a sounding board on key decisions

Don’t panic – panic (or greed) do not make very sound investment strategies. Stay calm and don’t allow the market gyrations to throw you off your plan

React at the right time – as Warren Buffett said, “be fearful when others are greedy, and greedy when others are fearful.” Perhaps a down market is a sale/good entry point in disguise

Look at that. Seems as though the strategies for dealing with an actual bear and a (nearly) bear market aren’t too dissimilar.

Onward we go,

Note: All commentary above is as of the date of this post and is for education and informational purposes only. Windermere and its principals do not intend for this to serve as investment advice and are not responsible for any actions taken based on this article. Consult your financial advisor before taking any actions as it relates to your own investment portfolio

Leave a Reply

You must be logged in to post a comment.

Leave a note