View from the Chair: Windermere’s Market Perspectives (April 2018)

April 4, 2018

What is something worth? That’s a simple question without a simple answer. You could argue that something is worth the value stated on the price tag, or the price the purchaser is willing to pay and a seller is willing to accept, or even the quantitative price plus an implied value for the associated qualitative benefits.

Assigning worth (also known as valuation) is not as easy as it seems – especially when it comes to investments. Let’s walk thru a few examples together.

We’ll start with an easy one – cash. Our bank accounts are worth the balance in the account. Simple, right? Not so fast. What about inflation? Do we need to consider the fact that our dollars may not be able to buy as much when we actually go to spend them?

How about exchange-traded investments, like stocks, mutual funds, and bonds. Thanks to real-time market news & quotes, after-hours trading, and overseas markets, you can literally value these investments every second of every day by obtaining the current quote for each security. This is indeed the price a buyer will pay you (a potential seller) for it at that exact instance. But does that really represent the valuation of your share of the underlying future cash flows of the business or security? If you still believe in the original investment thesis and future prospects for the underlying entity and intend to remain invested for years to come, does the price at a particular second truly determine the ultimate worth? Have you incurred a real loss if you choose to stay invested?

What about non-exchange traded investments, like your home? There’s no market quotes for this asset so valuation becomes even more difficult. Perhaps we decide it’s worth what we paid for it, or maybe we elect to apply a bit of a mark-up because our neighbor’s house just sold above asking last month. Or perhaps we decide that its real value is related to the safety and comfort it provides to our family and that since we aren’t selling, today’s valuation doesn’t matter.

You’re beginning to see the challenge in assigning worth to investments. There are many different approaches and variables to consider. But know this – if you believe the ultimate worth of your investments can be determined in a split second as you refresh your online investment account or track the stock ticker across the scrolling screen, you are mistaken.

Investing, in our opinion, is meant to be a long-term process, where worth is defined over years, not seconds and where patience and discipline are essential to the ultimate attainment of value.

So what do you do today? We fully understand today’s markets are volatile and that large swings in account values and “shock & awe” headlines in newspapers and TV shows don’t lend themselves to a long-term view of worth. Here are a few things to keep in mind during these times to help you stay the course and focus on the true meaning of value:

1.) Time and temperament are your friends: Investing is not meant to be a short-term process. Commit to at least a five-year horizon and know it won’t be a linear (despite what 2017 may have led you to believe). Commit – and then work to remain calm and focused throughout the process. Trying to time the market and frequently selling out/buying back in is proven to be a losing strategy and counterproductive. You are an investor, not a speculator. Focus on what you own and why you own it and how that’s likely to translate into value over time

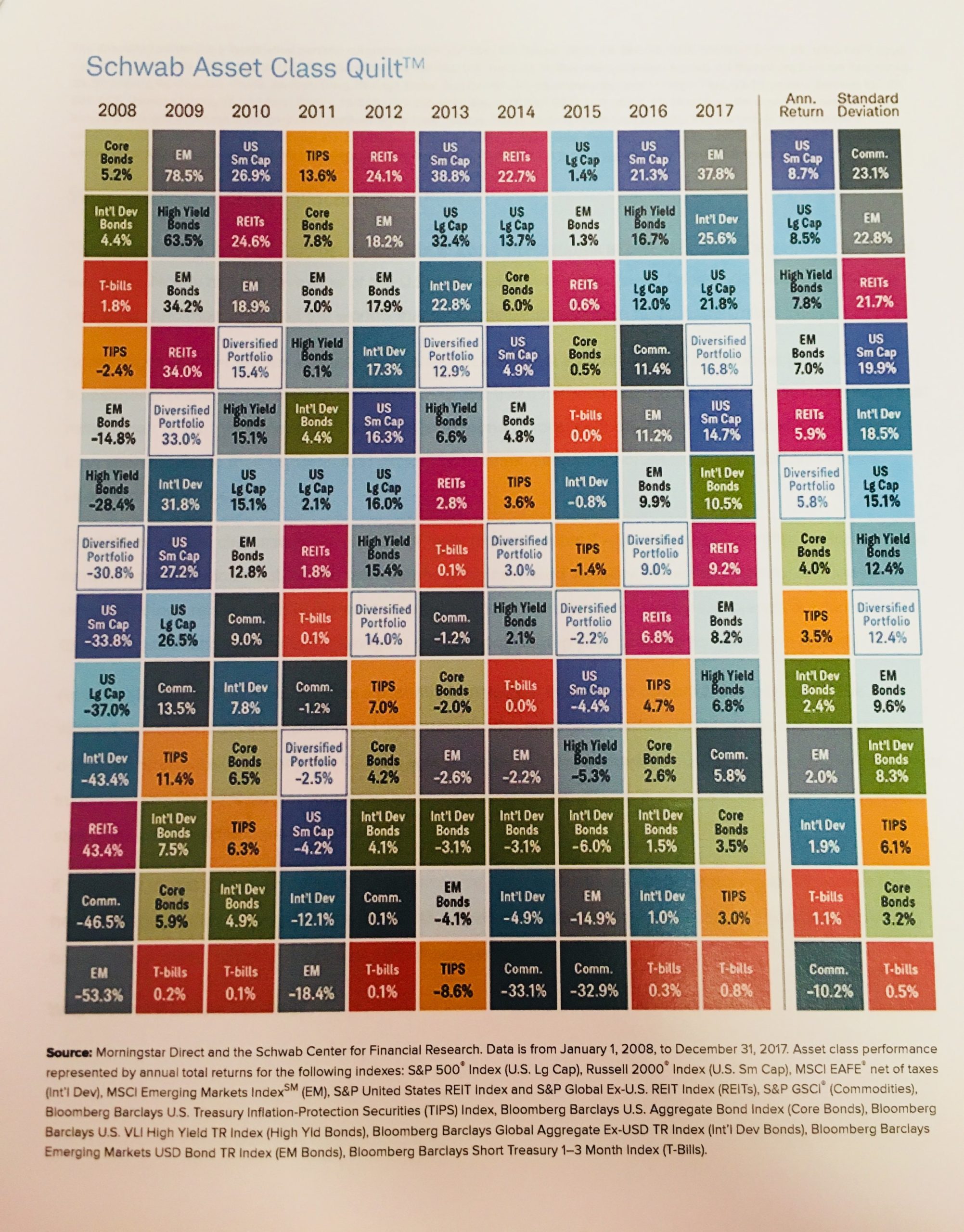

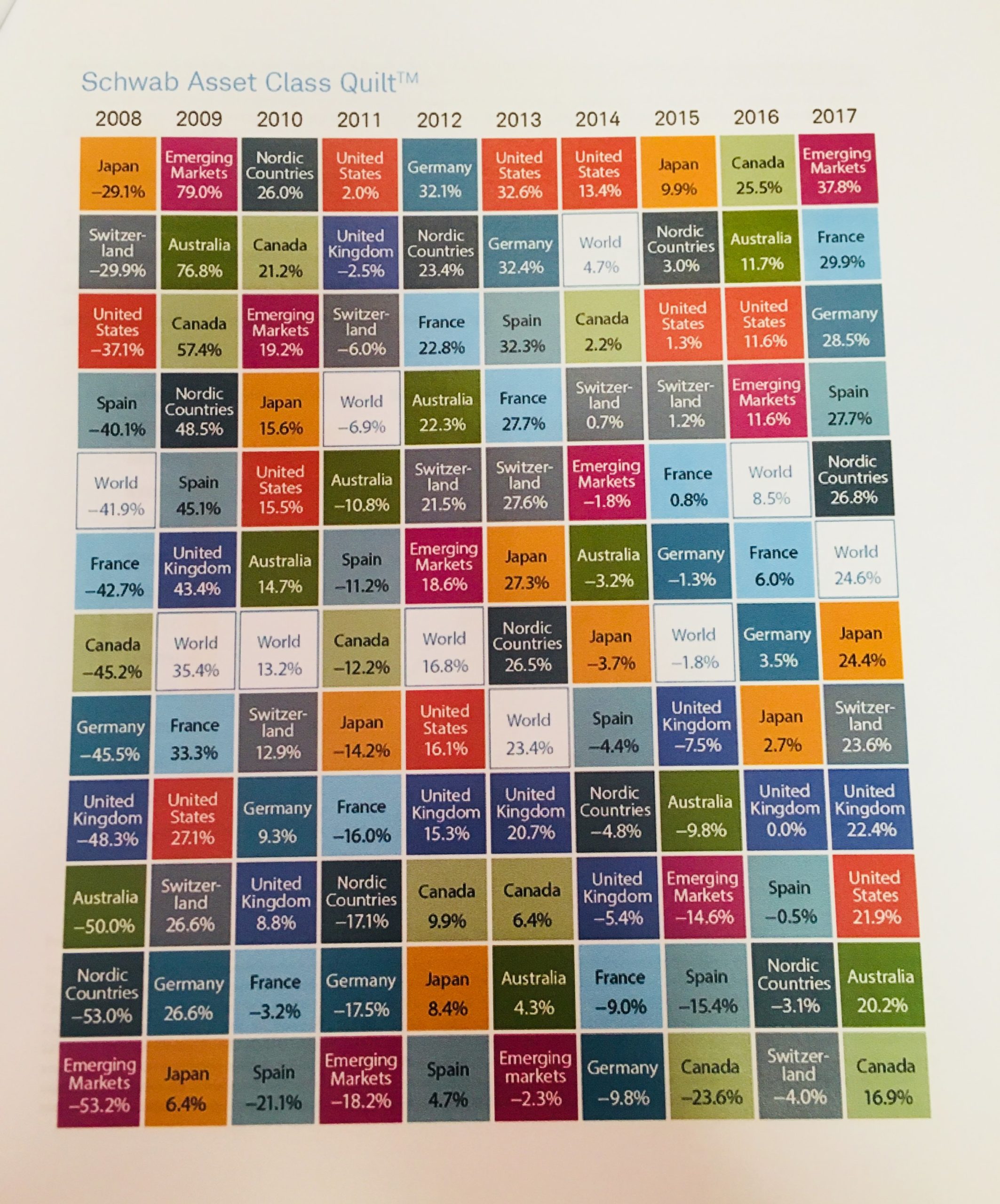

2.) Asset allocation and diversification still matter: You should be working to construct a portfolio that includes a bunch of different investments. While correlations have increased in recent years and certain stocks have outpaced the average, the below “quilts” help to illustrate how different asset classes (and different countries) perform year to year.

You can see that a winner in one year can fall to the back of the pack in the next year – and that over time, a diversified mix produces reasonable (and more consistent) returns. Having a well-diversified portfolio has historically proved its worth and we believe it will continue to do so

3.) Seek useful distraction: Instead of worrying about the latest CNBC newsflash or the daily prices on your holdings, seek a useful distraction. Remind yourself why you began investing in the first place and. Study your annualized returns since you first started investing. Recast your retirement scenarios and see if your returns allow you to reach your goals. That is time far better spent

4.) It’s all about balance: Good news isn’t as exciting to report, and as a result, it gets far less attention. Recent headlines are swamped with news of possibles tariffs and trade wars, white house administration changes, interest rate policy, and Facebook fallout. Of course, much of this is true and worthy of analysis – but some of it is hype.

It’s important to remember the “good” and balance that against the risks. Where’s the good? There’s plenty to choose from – including low unemployment, strong corporate earnings and increasing earnings estimates, improving GDP, range-bound interest rates (for now), and ongoing synchronized global growth. We are not saying that risks aren’t present – they certainly are today and always have been. However, there is a healthy balance between risk and reward that has, and always will be, a key part of determine the long term worth of investments. So go ahead and analyze risk – but be sure to analyze the good alongside it

Investing is not easy but in our opinion, it is always worth it. Stay the course and we look forward to hearing about the value you are able to accrue.

Invest on,

Pam

Leave a Reply

You must be logged in to post a comment.

Leave a note