View from the Chair: Windermere’s Market Perspectives (May 2018)

May 7, 2018

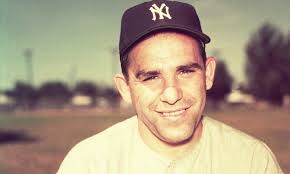

“It’s deja-vu all over again” Some of you may recognize this as a quote from the one and only Yogi Berra. Others of you may feel it should be the title slide for this year’s market. You’re both right!

Watch the business news on any given day and you will likely be left with the feeling of “haven’t I been here before?” The headlines, the commentary, the market levels, the prices of your stocks – all of it likely looks very familiar as the market takes two steps forward, one step back time and time again.

What’s an investor to think about & do with all of this volatility and repetition? We have a few suggestions, framed by a few more famous “Yogi-isms”

“The future ain’t what it used to be”

The world around us, and the predictions of what it will become, are changing every day. It’s true- markets aren’t acting like they did a year ago. But is the market’s view of the future the same as it was a year ago? Of course not. And luckily, much of what the markets did predict last year have in fact come to fruition. So, what future does the market see right now? From where we sit, we predict ongoing earnings acceleration, strong economic growth, continued innovation, and modest levels of interest rates and inflation. The future “ain’t what it used to be” but maybe it’ll be even better

“If the world were perfect, it wouldn’t be”

It’s human nature to react. We are hard-wired for emotion. Whether it be politics, world events, trade fears, interest rate movements, or price changes – we react and feel as though we are living in unusual times. Simply put – the world has never been “perfect” and never will be. However, this imperfect world has led to incredible economic growth and prosperity for investors for decades. We have no reason to believe that trend won’t continue

“You can observe a lot just by watching”

We know what we own, and we know why we own it. We understand the businesses, the sources of their earnings, the sectors they are operating in, and the surrounding economic forces. Knowing that – the daily news cycle, a tweet from our president, or a one-day trading reaction to an earnings report is unlikely to change our thesis. It’s all very interesting to watch – but unlikely to change our approach

“If you don’t know where you are going, you’ll end up someplace else”

Investing is an intentional act that should always be guided by your goals and objectives. Set a plan, know where you are trying to get to, and stay the course. If you lose sight of those goals and instead focus on the daily movements and gyrations, you may very well never reach your destination

“You don’t have to swing hard to hit a home run. If you got the timing, it’ll go”

You don’t need to swing for the fences in investing. Develop a plan, do your homework, put the time in the market vs. trying to time the market (ie: jump in and out), invest consistently and at various market entry points, and stay committed to your target allocation – and it’ll go

“It ain’t over till it’s over”

This is not meant to be a one-year adventure. It’s a life long journey and it’s not over yet. Stay the course, stay focused, and stay engaged. We never promised it would be easy but we can promise it will be worth it

Thanks Yogi for the wisdom and thanks to all of you for reading.

Invest on,

Pam

Leave a Reply

You must be logged in to post a comment.

Leave a note