View from the Chair: Windermere’s Market Perspectives (June 2018)

June 12, 2018

Summer has finally arrived. There is a seemingly endless list of things to do and places to be – leaving even less time than usual to focus on your money and the markets. What key items should you be paying attention to? We suggest keeping your “eye on the TIGER” – Trade, Interest rates, Growth, Earnings, and Recession.

Trade – What started as a war of words (and tweets), a “trade tiff” has escalated in recent weeks. It is becoming more likely that a trade war will ensue on some level (if it hasn’t already). This past weekend, the latest development was Trump leaving the G7 summit early and refusing to sign the joint communique. Trump’s actions were largely in response to Justin Trudeau’s (Prime Minister of Canada) comments that Canada would “not be pushed around.” Trump remarked of the G7 that the US is “being taken advantage of by virtually every one of those countries.”

Attention was quickly turned today to the summit between Trump and Kim Jong Un, a historic meeting that led to an agreement by North Korea to dismantle the country’s nuclear program. Many details remain to be clarified however, this is a very encouraging sign for global relations.

It’s clear that the the US’ role on the global stage and trade equality remains top of mind for the administration and more is certain to come.

Interest Rates – Interest rate levels serve as a key component in the pricing of financial assets, and as a result, they deserve your attention. Interest rates have risen since the beginning of the year (Rate on 10 year US Treasury sits at 2.96% on 6/11/18, up from 2.4% as of 12/31/17). The US Federal Reserve meets again this week and it is highly anticipated they will again raise rates (the 7th such hike since December 2015).

Perhaps of even more interest is the flattening of the yield curve (when short-term rates rise at a faster rate than long-term rates). The spread between 2yr and 10yr US treasuries is a much-monitored measure and that spread is declining (rests at 0.43% as of 6/12/18).

Also worth consideration are interest rates around the globe. Both Europe and Japan continue easy monetary policies (albeit at a slower rate), which will present an interesting dynamic as the United States continues to move the other direction (ie: tighter monetary policy)

Growth – 2017 was the year of “synchronized global growth.” That phrase was repeated countless times as markets reached record levels. Has that changed in 2018? No. There are 189 economies in the world, and 185 are growing (what are the four? North Korea, Venezuela, Brunei, and Equatorial Guinea). The US is no exception, with 4% GDP growth not out of the question. Economies are advancing – and for now, are growing despite the risks posed from potential trade changes and rising rates.

Earnings – We are coming out of a record setting earnings season in Q1 2018. Year over year earnings growth for the S&P 500 was 26.6%. Much of that gain was driven by the tax law changes; however the fact remains that earnings are accelerating at incredible rates. It is expected that we have seen the peak in earnings growth rates – but not yet a peak in absolute earnings levels. With growing economies and improved cash flow for consumers (due to the tax cut and declining unemployment), companies across virtually every sector are seeing improvements in their earnings and that trend is expected to continue.

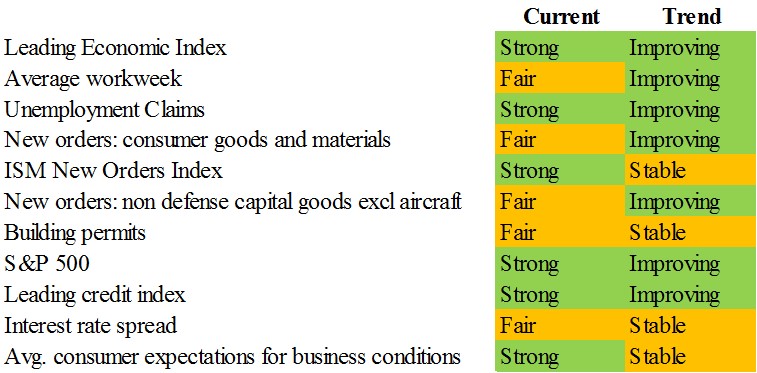

Recession – As primarily equity investors, this is a major area of focus. We are continually evaluating whether a recession appears imminent as that would present a material headwind for many companies in which we are invested and the markets in general. How can we predict a recession? We can’t – but we can observe economic data that has tended to be a very strong predictor of recessions in the past. The data we use most frequently is the Index of Leading Economic Indicators. It’s a collection of ten data points utilized to predict downturns in the economy. We look both at the overall trend line, but also at each of the component parts and their trends. We are focused on whether the data is getting better/worse, not so much whether its absolute value is good/bad. Below is a summary of the latest reading of the data and as you can see, we are still in a “better” period

Enjoy your summer and be sure to keep your eye on the TIGER.

Invest on,

Pam

Leave a Reply

You must be logged in to post a comment.

Leave a note