View from the Chair: Windermere’s Market Perspectives (January 2020)

January 18, 2020

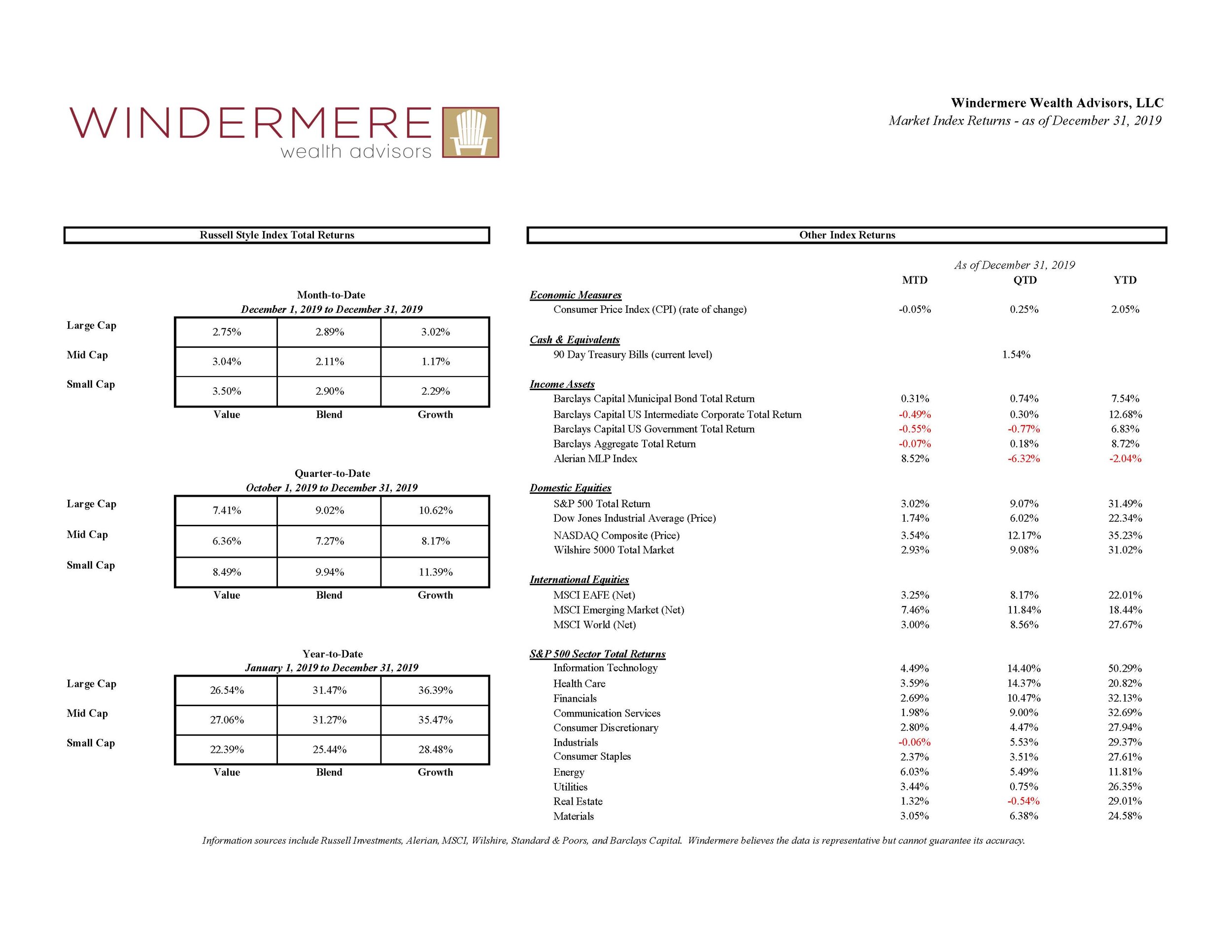

Many investors are still flying high after a very successful 2019. Returns for virtually all asset classes were above average in the year, coming off of a challenging end to 2018. Chart shows the returns by asset class for the year (click on chart to enlarge).

Below are some key items we are keeping in mind as a new investing year takes flight. (Please note: the information below represents our opinions and does not constitute investment advice specific to your situation. Contact your investment advisor to tailor a “flight plan” that is right for you).

1.) Cruising altitude

Even with the parabolic ascent in equity markets in 2019, we believe there is still room for growth in certain areas of the equity markets (see next section). With accommodative interest rates, low inflation, ongoing consumer strength, and resolution on some key trade issues, stocks remain attractive relative to other asset classes and have potential for ongoing gains. However, we expect that growth to be a bit more in line with historical norms.

2.) Sticking to our flight plan

We remain committed to the following areas of the market (and have started to see some meaningful evidence of inflection points that favor these choices)

•Value over growth – We continue to focus on companies that are trading below their intrinsic value. While growth, “high-flying” valuations, and momentum strategies have been the standouts for the past several years, we see that tide turning somewhat in recent quarters

•International over domestic – Whether it’s via a foreign company or a US business with considerable foreign revenue, we continue to seek opportunities to take advantage of higher growth rates and favorable demographic trends beyond our borders. Resolution on trade matters, relative underperformance in 2019, a stable US dollar, and possible fiscal stimulus in global economies could add further acceleration to international names

•Large over small – While recession fears have abated considerably from a year ago, we still retain our preference for companies with strong balance sheets, high free cash flow, and in some instances, healthy dividend streams. Such traits tend to be more dominant in mid to large cap businesses

3.) No Autopilot Allowed

While broad indexes and passive investments have done well (and have outperformed many active managers in recent years), we believe the present environment offers great opportunities for active identification of unique investment opportunities. Here are just a few of the reasons we are staying off of “autopilot” in 2020:

•Valuation disparities – even as equity markets reach all-time highs, there remain certain sectors and individual equities that appear “on sale” relative to the broader market valuations. Our expectation is that some of these companies that have been “left behind” will start to shine

•Forward focus – most indexes are market-cap weighted so by definition, new money goes to the names/sectors that have worked in the past – not necessarily the ones that will work best going forward. Active managers can focus forward and find the next trend – not just pile on to the last one

•Fed stepping aside – The Fed gave markets some material tailwinds with a return to accommodative policy in 2019. As they step aside in 2020 (as they have forecasted they will), there is no longer a tide helping all boats (ie: broad indexes) to rise

4.) Risk of turbulence remains

Recent events in the Middle East remind us that there are considerable risks in the world – to investing as well as on a much larger scale. Other uncertainties of the horizon this year (next stages of trade negotiations and presidential elections) will also play a role in markets. We must remain aware of these risks, take advantage of volatility, and keep our focus on the businesses we own (and why we own them)

We wish you a safe investing flight in 2020!

Invest on,

Pam

Leave a Reply

You must be logged in to post a comment.

Leave a note