View from the Chair: Windermere’s Market Perspectives (May 2020)

May 7, 2020

Throughout the past few months, as I think about markets and investing, I’ve had an image in my mind’s eye.

It’s that of the iconic Bixby Canyon bridge in Big Sur, California . As you wind your way down the coast of California on Highway 1, this bridge spans a staggeringly deep valley that plunges into the ocean below. It’s this strong and formidable structure, standing tall each day, even when facing Pacific winds and rains, to allow motorists and bikers to safely cross.

Here’s a picture to give you an idea of its importance and strength:

It’s in my mind on repeat as I feel that us, as investors, are all walking across that bridge – right now. Together.

We’ve been on an investing journey and for the past ten years, we have been blessed with a solid road beneath us. Sure, we’ve hit a few small road bumps and detours along the way but for the most part, we’ve traversed the path without issue. We’ve felt secure. We’ve felt supported. We could see miles of road in front us. We’ve had maps telling us it safe to proceed. We’ve been on solid footing.

And suddenly, just a few months ago, we came up against a valley. A valley unlike one we’ve ever encountered before. A valley that had seemingly endless depth and threatening drops. But there was no turning back – we had to keep traveling and we had to get across.

Luckily, we found a bridge (like the one in the picture) to get us across. And we have the ocean wind at our back and opportunities that wait for us on the other side (and even some opportunities that may help us to cross the expanse faster).

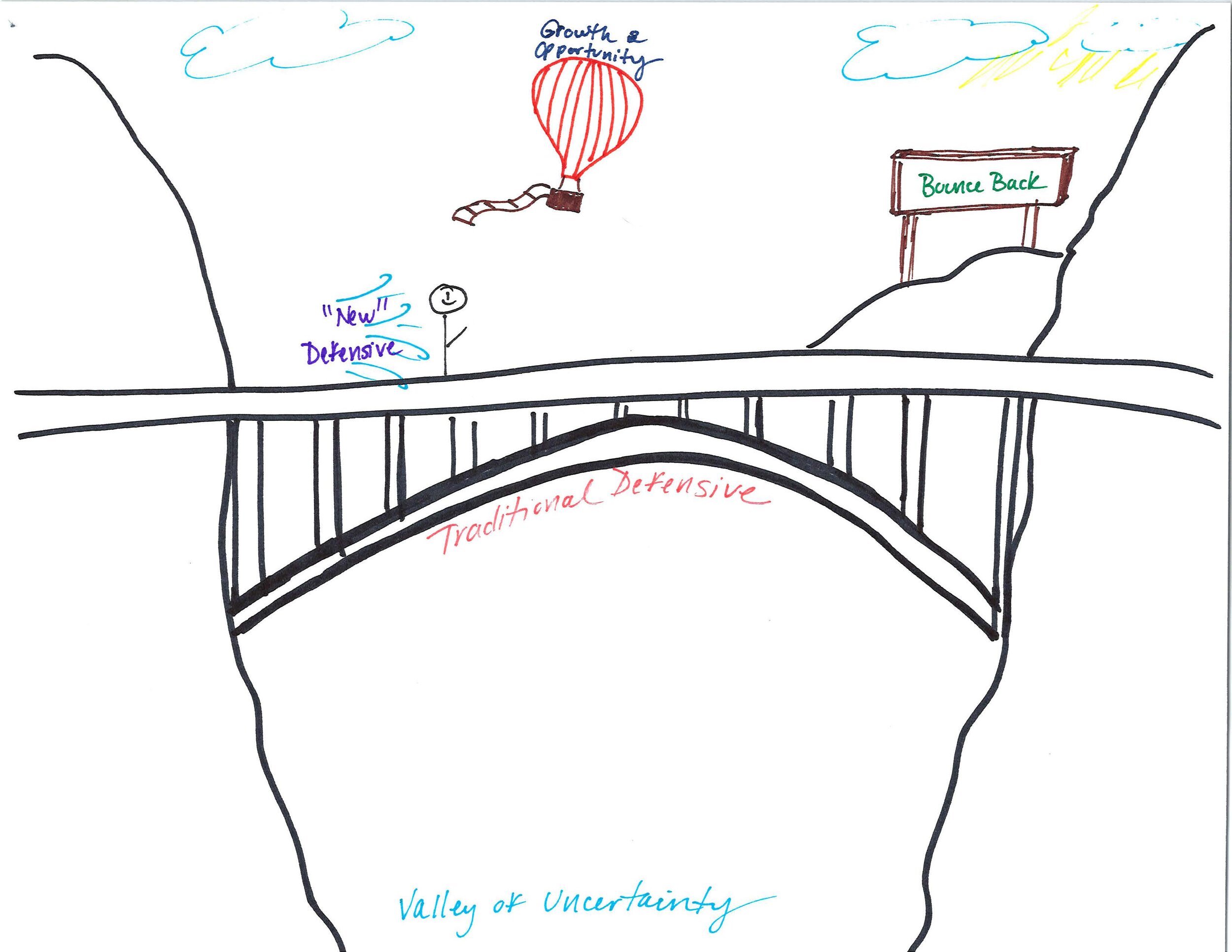

As I think about portfolios, markets, and where we go from here, I have been assigning our various asset class, sector exposures, and holdings to the elements on this scene in my mind.

Want to see what I mean? I’ve included my sketch of these concepts below. Please be kind – I’ve only just taken up drawing during quarantine and well, I clearly have a ways to go!

In case you learn better with words, here’s a quick recap of my masterpiece!

(Side Note: due to the broad distribution of this article, we will not name specific holdings. However, we are happy to walk thru your portfolio in this framework if that’s helpful)

-

The valley – the uncertainty surrounding COVID-19 and the ultimate impact it will have on our economy and all of us going forward

-

The bridge – these are your traditional defensive names, sectors, and asset classes (think of cash, fixed income, defensive sectors)

-

The wind at your back – this is a category I’m calling “new defensive.” These are companies with fortress balance sheets, strong cash flows, industry leading positions, perhaps a dividend stream. While not in sectors typically viewed as defensive (such as certain technology names), they are definitely serving in that capacity now

-

The hot air balloon – these are the growth-oriented holdings. While there is always a bit more uncertainty surrounding high-growth revenue streams and valuations in times like these, many of these continue to “take flight.” They can provide a much-needed life across the valley in certain instances

-

The other side – waiting on the other side of the valley is the Bounce Back rest area. These are the more cyclical sectors and positions that have been hardest hit by these events. However, many have the potential to outperform on the other side of the valley and may just give us a much needed recovery period

One final comment: You’ll notice Investor Man/Woman is only about 30% across the bridge. Please know that progress is not drawn to scale. I don’t know where we are in our “valley-crossing” journey. I don’t know when exactly we’ll reach the other side. But I am confident that armed with a stable bridge beneath us, a powerful wind behind us, and some potential lift above us, we will travel safely across this valley. Together.

Invest on (stay healthy – and wash your hands)

Pam

Leave a Reply

You must be logged in to post a comment.

Leave a note