View from the Chair: Windermere’s Market Perspectives (June 2020)

June 9, 2020

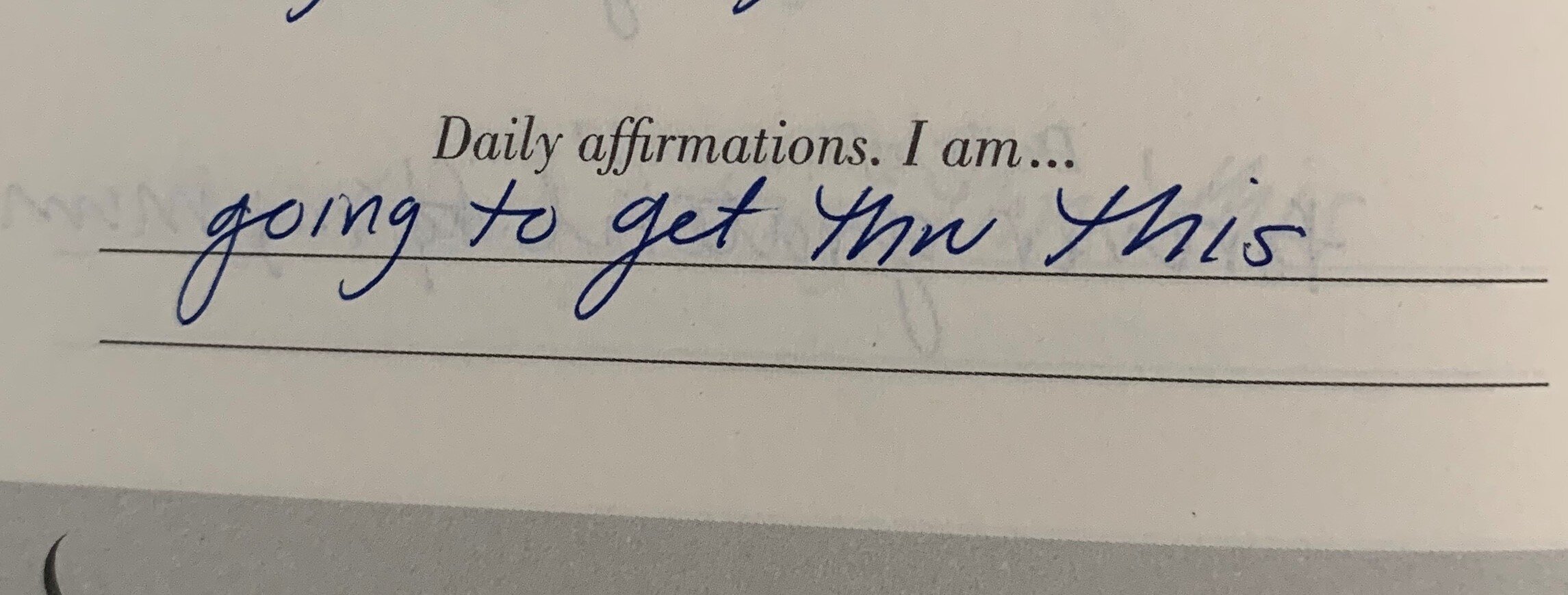

When the quarantine first began, I knew that I needed to establish some habits to keep myself grounded. One of those habits was a daily gratitude practice (I use the Five Minute Journal). The journal has many daily prompts, one of which is “Daily Affirmations: I am ____________.”

Recently, I looked back at my entry from March 23rd (the day markets hit their most recent low). On that day I wrote the following:

I can remember this time very clearly, as I’m sure many of you do. It was a heavy time – there was seemingly non-stop worry, fear, uncertainty, and suffering on so many levels. It was hard to believe in a better tomorrow when all we were facing was a challenging today – over and over again.

As I have written in the past (see last month’s blog post for full explanation and illustration), I had a constant image of crossing a valley of uncertainty, with no idea what the trip across would be like or how long it would last. And yet, I remember writing that statement to remind myself to raise my sight line and focus forward – to picture the other side of the valley, to remember that this too shall pass, to remind myself of my underlying belief in innovation, ingenuity, science, and ongoing growth, and to determine the best ways to get across to the other side. I didn’t know when, or how, but I believed we’d endure this challenging time.

As I write this on June 8, 2020, certain market indices have now turned positive for the year. Economic data has started to trend in a positive direction. Businesses are starting to reopen and recent jobs data shows creation not loss. Is it fair to say my prediction/statement has come true? Or am I still in a situation that I need to get thru? Yes – and Yes.

Make no mistake – we’ve all come through a challenging time period the past few months and that is something to be celebrated and recognized. If you’re an investor and/or client, you have been there with me on that bridge so you know it wasn’t an easy journey. Yet you kept the faith and we’ve made it this far.

However, I also know that we are still crossing that imagined bridge. Many things remain unknown, including how the virus will advance from here, how people will resume “normal” life, how spending and hiring patterns will change, how supply chains will be altered, how much fiscal stimulus will occur from here, how science will innovate, and countless others.

And while the ongoing nature of the journey may seem unique to this time period, it’s important to remember that Investing has always been, and will always be, an ongoing journey. It will always simultaneously be something we have gotten thru and something we have yet to get thru. And no matter how uncertain the future may seem, we must take that next step time and time again in to reach our destination.

Many have asked what we do now. While we have some tailwinds at our backs and have come a long way, the bridge still feels shaky and the valley appears deep. My answer – keep moving forward and focusing on the “sure steps” that we’ve practiced all along, including:

1.) Setting a target allocation in accordance with your longer-term goals (which need to be continually revisited and refined)

2.) Consistently rebalance portfolios against those targets

3.) Revisit your risk tolerances and evaluate your behavior in recent months. Your portfolio should work for you, not cause you immense stress and concern. If changes need to be made, explore ways to adapt and adjust (considering the resulting impact on your plan)

4.) Consider available investing alternatives in context of your goals (ie: while cash is “safe”,” will earning 0.10% on savings allow you to reach your goals?)

5.) Go back to basics – review your budget, seek to increase savings or improve earnings level, save at regular intervals at all different market points (via employer plan or your own automated savings)

6.) Focus on what you can control – your chosen advisor, your goals and plan, your curation of media, your thoughts, your savings level, and many more. Tune out what you cannot

7) Remember that markets are forward looking – so you should be to. Don’t focus on what has occurred but rather what the future will look like. Don’t dwell on absolute numbers rising – but rather look at the rate of change/trend lines in those items

8.) Remind yourself of things we know to be true

9.) No matter what, don’t halt your journey. After all, we didn’t come this far to only come this far

See you on the bridge – I’m right there, walking alongside you.

Invest on,

Pam

(Note: I was of course (and continue to be) worried about my own health, the health of my friends, family, and clients – and the general well-being of the world at this time. Being a small business owner of a financial advisory practice and the steward of client capital, I know my statement on March 23rd was focused on the markets and my path forward from there. As a result, these comments have focused on markets – – but that is in no way meant to diminish the very real health impacts and human toll and tragedy of COVID-19. Stay well, and thanks for reading).

Leave a Reply

You must be logged in to post a comment.

Leave a note