WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

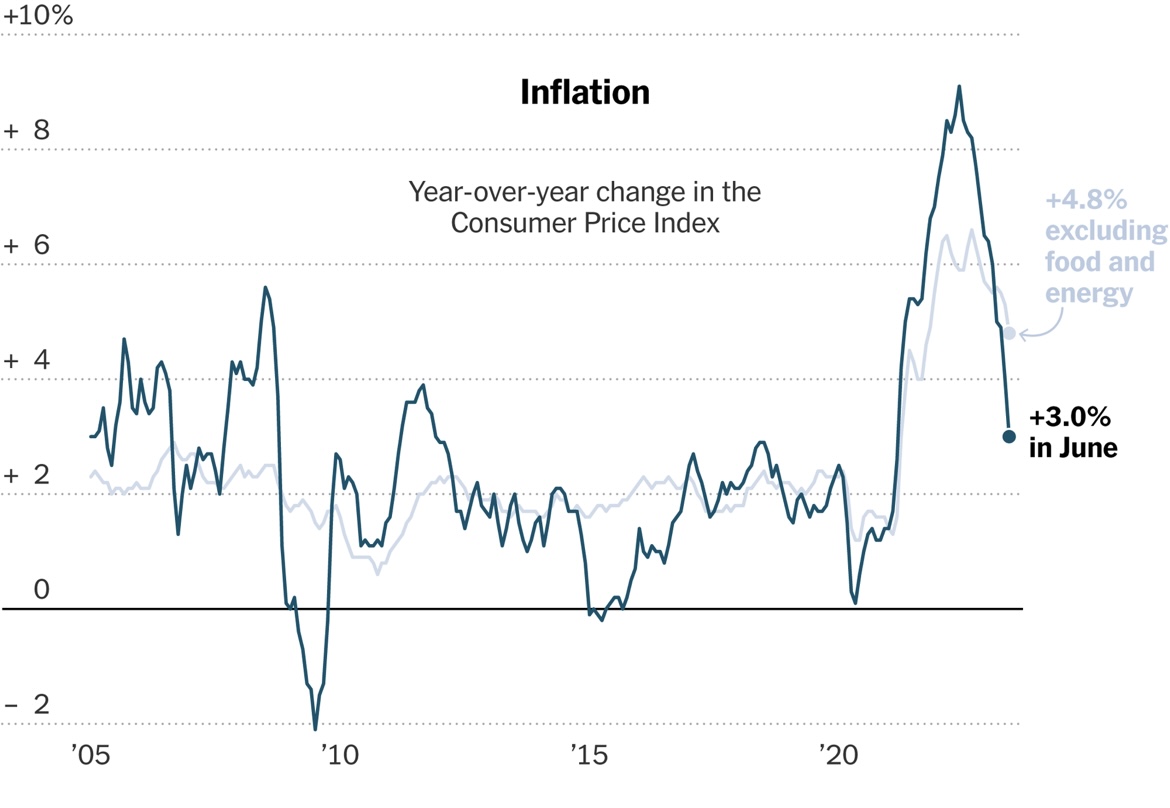

One of the most important economic releases for August came out today (Thursday August 10th) – the July CPI report – revealing the latest inflation dynamics at play in the United States. August has been a challenging month for investors, as markets have reversed their upside trendlines sharply in the first several trading days of […]

August 10, 2023

read more

While meeting with a prospective client earlier this week, he asked about a key differentiating factor in the world of financial advisors. Specifically, he asked what makes a financial advisor a fiduciary (which Windermere and its advisors are). This is an excellent concept for everyone to understand so let’s dive in What is Fiduciary Duty […]

August 10, 2023

read more

August is typically a challenging month for stocks and that is proving to be true yet again this year (at least as of August 2nd while I’m writing this note). We did get relatively tame data regarding inflation and jobs earlier in the week and another jobs report will hit the wires shortly before this […]

August 2, 2023

read more

For the past two weeks, I’ve addressed client questions related to two popular equity market indexes – the NASDAQ and the Dow Jones Industrial Average. While no none asked me specifically about the seemingly most popular equity index, I couldn’t leave this series of questions without addressing it. So let’s take a closer look at […]

August 2, 2023

read more

Last week, a client asked about the NASDAQ 100 and its rebalance. This week, I was talking to a client about the Dow Jones Industrial Average (DJIA). This long-standing market index just posted its best winning streak since the 1980s, posting 13 straight days of positive closes (it fell short of 14 straight days by […]

July 27, 2023

read more

Let’s travel back in time. Friends is the top TV show. All for You by Janet Jackson is the top song. AOL has 28 million users and AOL.com is the top website. George W Bush is president. Flip phones and Blackberries dominate the cell phone market. Gas is $1.46 per gallon. It’s early 2001. A […]

July 27, 2023

read more

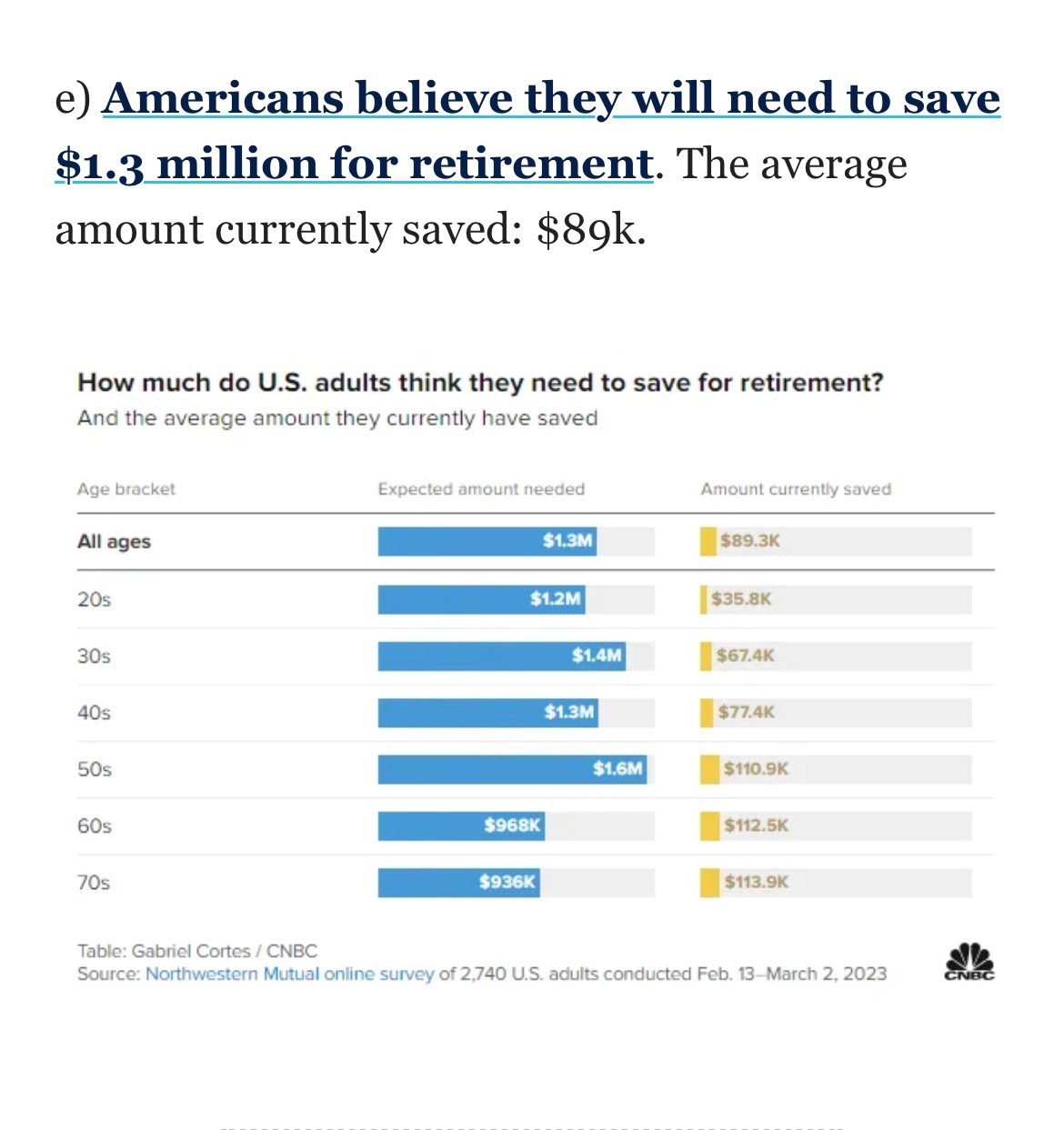

I was reviewing a weekly newsletter this week (yes, I read several others beyond the Friday Five!) when this headline caught my eye. It was sourced from this recent CNBC article on what adults in the US believe they will need to retire Notice anything alarming about this summary graphic? Pretty much everything in the […]

July 20, 2023

read more

The news media has been discussing a relatively rare occurrence this week – a special rebalance of a key market index. A client asked me why it’s happening and what it may mean for markets and individual companies. Let’s take a look What is the NASDAQ 100? The NASDAQ 100 is a common equity market […]

July 20, 2023

read more

A client reached out this week inquiring asking for help to decipher the various types of fees being charged by another financial advisor to a family member. I thought it was a great topic to cover as there can be lot of confusion (and not much clarity) on this topic. While this may be a […]

July 13, 2023

read more

After a slow holiday week, markets have resumed normal operating speed this week and thankfully, the momentum has been positive. The upward moves are largely due to signs of disinflation. The two inflation reports for June released this week did their part to reassure investors that it remains possible the US can attain a soft […]

July 13, 2023