WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

In talking with a client this week, I learned that he has not completed his estate planning as I have been recommending for a while now. He recently got married and is expecting a child, so the establishment of these documents is more important than ever. He certainly appreciates and understands the importance of this […]

April 11, 2024

read more

Welcome to April and Q2 2024. Let’s look back at the past two weeks and catch-up on things! Strong Start to the Year Let’s not dive into the second quarter without first revisiting how exceptional the past three months have been for investors. The S&P 500 (a popular index for the US equity market) rose […]

April 4, 2024

read more

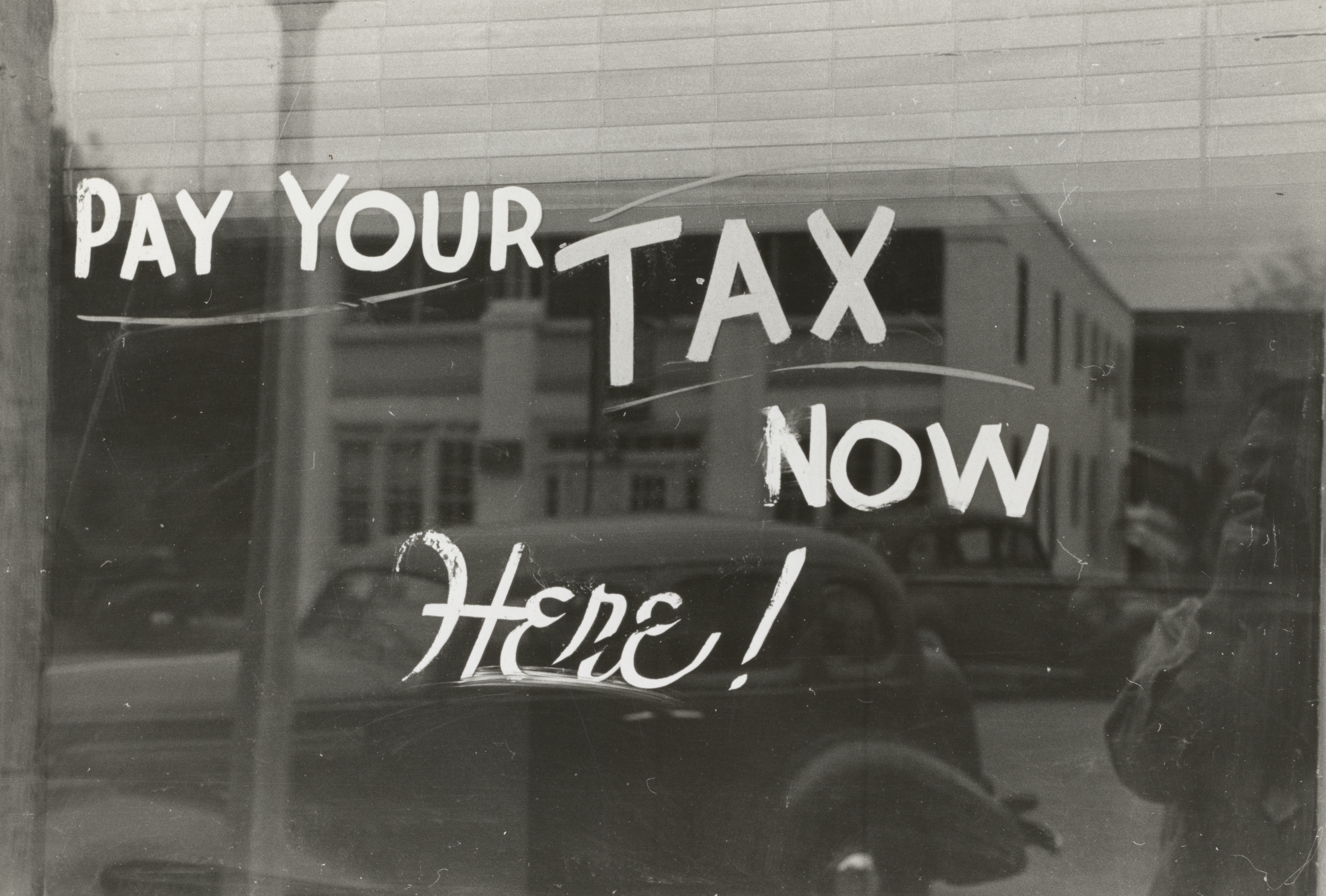

If there was ever a risk of me forgetting tax day, I have a feeling it would be mitigated by the numerous client questions I inevitably receive in the few weeks leading up to the important date! I thought I’d cover a few of them here as tax day approaches. When do you think I’ll […]

April 3, 2024

read more

While most of America was focused on setting their NCAA brackets earlier this week, market watchers were placing “bets” of their own on the Federal Reserve and the path of interest rates. As was widely expected, on Wednesday the Federal Reserve once again left rates unchanged (leaving the Federal Funds rate range at 5.25-5.5%). They […]

March 21, 2024

read more

In talking with a client this week, the subject of property and casualty insurance came up and I mentioned umbrella policies. She had not heard the term before. This is an important type of insurance to have in place as you age and your earnings and net worth increases. Let’s cover the highlights below but […]

March 21, 2024

read more

There is something about the month of March as major market events tend to occur during the third month of the year. There are three major market events that are celebrating anniversaries this month – do you know what they are? Here they are – starting with the most recent in 2023 and going all […]

March 14, 2024

read more

Don’t look now – the 2023 tax filing due date (without extension) is only a month away. As the date approaches, you may have questions on certain tax-related matters (there a lot of things to keep track of!) As a result, I thought I’d cover a question I received from a client this past week […]

March 14, 2024

read more

Federal Reserve Chairman Jerome Powell testified in front of the House Financial Services Committee for two days this past week. These briefings have become “must see TV” for market watchers as the question of 2024 remains – will the Federal Reserve cut interest rates this year, and if so when and by how much? Powell […]

March 7, 2024

read more

A year certainly goes quickly. It’s hard to believe that it was almost a year ago that Silicon Valley Bank (SVB) collapsed and sparked a “mini” banking crisis. This week, another bank was in the news with related solvency concerns – New York Community Bancorp (“NYCB”). A client asked what had occurred at this bank […]

March 7, 2024

read more

On February 29th (happy leap day!), the Federal Reserve’s preferred inflation measure – Personal Consumption Expenditures (known as Core PCE) was released for the month of January 2024. (Note: Core PCE excludes food and energy, which can be very volatile.) Core PCE increased 0.4% for the month and 2.8% year-over-year, exactly in line with expectations […]

February 29, 2024