WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

Activist investors have been in the business news in recent months, as they have staked claims in household names such as Disney and Salesforce. A client recently asked what exactly makes an investor an activist investor and what I thought about their role and resulting impact on the companies they target. Let’s dive in! What […]

February 9, 2023

read more

A research service I subscribe to recently shared an article about decision making. If you are an investor like me than you know all too well the level of decisions you are required to make to stay sane (and invested!). A fresh perspective on decision making is always welcomed. The article discussed a recent book […]

February 9, 2023

read more

It was not all that long ago that Federal Reserve meetings would barely be covered by the media. Now they are truly the monthly headline event and Wednesday’s announcement was no exception (February 1, 2023 meeting) US Federal Reserve Chair Jay Powell took the stage and announced a widely anticipated 25 basis point rate increase, […]

February 2, 2023

read more

I’ve talked with a few clients in recent weeks about various aspects of 529 plans. These can serve as powerful savings vehicles for an important expense, so I thought a refresher may be helpfu. What is a 529 plan? A 529 plan is a state-sponsored program that allows parents, relatives and friends to invest in […]

February 2, 2023

read more

I’ve been meeting with clients to review 2022 reports this week. During some of those discussions, I’ve been referencing a chart from a renowned investor that really captures the powerful shift in markets over the past year. The chart is from Howard Mark’s most recent quarterly memo. (Howard Marks is a legendary investor and his […]

January 26, 2023

read more

When working on financial plan illustrations for clients, I request quite a bit of information. If they are not yet claiming social security, I will include a Social Security Statement in that request list. Often times, I’m asked what that is and how they can retrieve it, so let’s cover that question today. What is […]

January 26, 2023

read more

I’m in the midst of year-end reporting right now, and needless to say, reports from 2022 will not make the best seller list! It was a challenging year across virtually all asset classes. Even supposed “safe” assets such as bonds declined double-digits. After a down year, it is easy to get concerned about the investment […]

January 19, 2023

read more

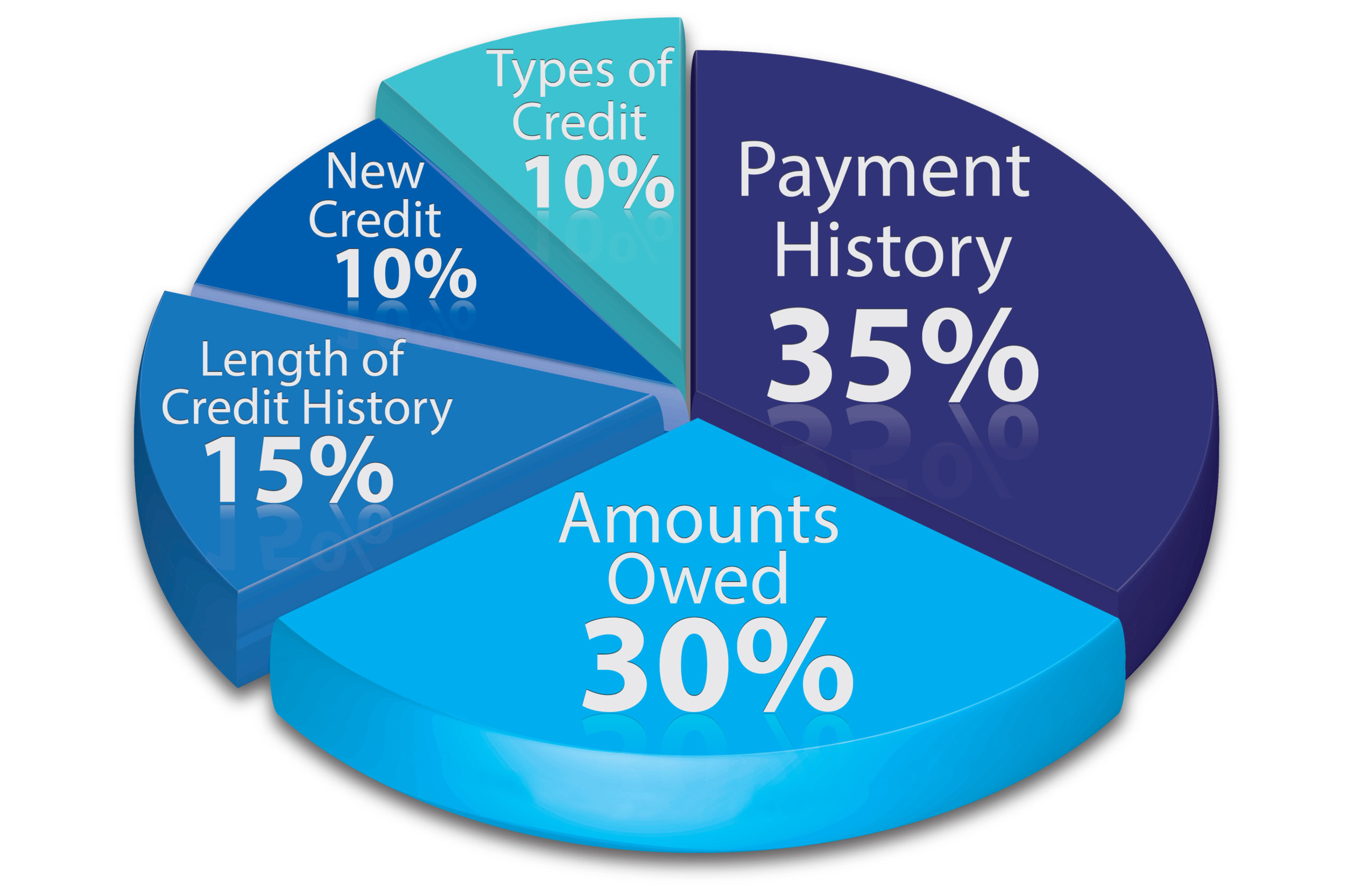

Last week, I featured a question from a client about accessing and reviewing your credit report. I thought a helpful follow-up to that could be reviewing credit scores. Here we go! What’s the purpose of a credit score? When a borrower loans you money, their main concern is whether or not you will ultimately pay […]

January 19, 2023

read more

A client received a strange letter in the mail this past week. It was from a bank (with which they have no relationship) stating that her husband’s auto loan had been approved. She wisely did not want to contact the number listed on the letter. She reached out to the bank directly (via the number […]

January 12, 2023

read more

I’m writing this on another grey and gloomy January day in Wisconsin. Perhaps that is why I chose this title. Or perhaps it is because today’s inflation report may finally be giving markets, investors, and this ever-optimistic financial advisor a glimmer of hope that we are approaching lighter and brighter investing days ahead. December CPI […]

January 12, 2023