WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

There is a lot of chatter about the upcoming “earnings season” which prompted a client question about what exactly that means – and why it is getting so much attention this time around. Public companies in the US (ie: the ones that trade on stock markets and are available for public investment) are required by […]

July 14, 2022

read more

It was certainly a very challenging start to the year for investors. Virtually every asset class experienced materially negative returns. If you would rather cover your eyes, I certainly understand. Just remember – markets go thru phases. We’re in the middle of a very difficult one – but like all the other phases (even the […]

July 7, 2022

read more

There is no shortage of acronyms when it comes to finances. One you may be hearing in the news lately is RMD, or Required Minimum Distribution. A client recently asked me to explain this concept in more detail. So, let’s take a look at what an RMD is, how it may apply to you (now […]

July 7, 2022

read more

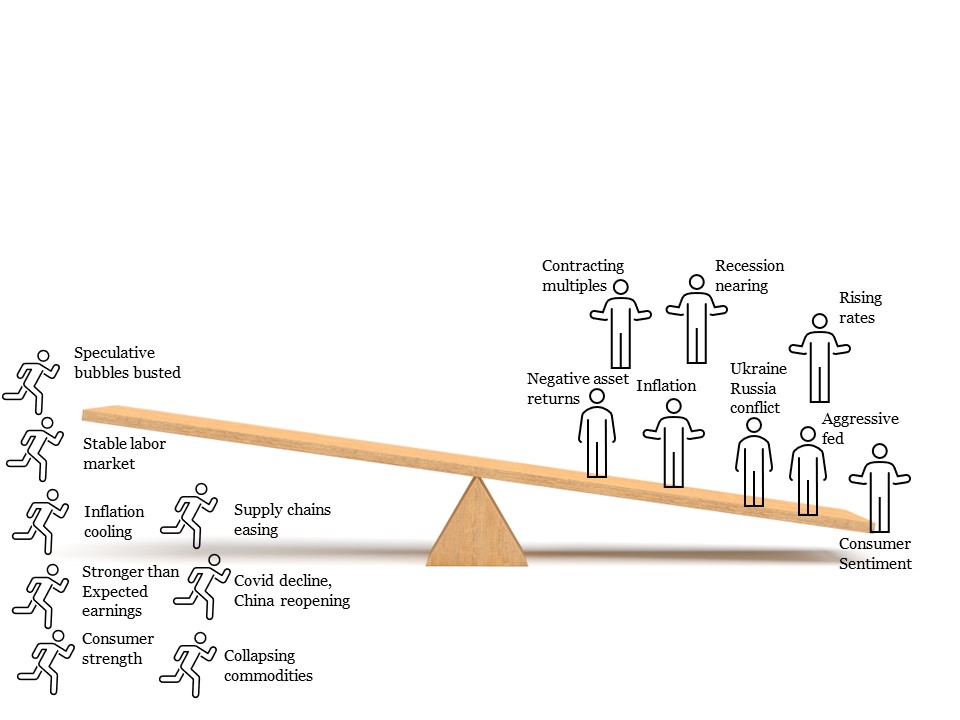

When my nephews visited last November, we visited a local playground. They are two very curious and active boys (ages 6 and 3 at the time) so naturally, we had to explore and try out every piece of equipment and toy in the park. They eagerly climbed on one side of the teeter totter together […]

July 6, 2022

read more

There is a wonderful philanthropic underpinning to America. The Annual Report on Philanthropy for the Year 2021 reports that individuals, bequests, foundations and corporations gave an estimated $484.85 billion to U.S. charities in 2021. An increasingly popular vehicle for charitable giving is a Donor Advised Fund and it is an idea we often bring to […]

June 30, 2022

read more

I’m writing this post on June 30, 2022 as stocks are set to end the first half of 2022 with the worst first-half performance since 1970. Think about that – the worst six month start to an investing year in 52 years. Geez, that’s longer than I’ve been alive! Add in high prices in many […]

June 30, 2022

read more

Let’s talk about budgeting! I started working with a young couple and we are working together to put a savings approach in place – determining how much of their net earnings each month can/should be allocated to the various savings/investment buckets (cash reserves, IRAs, employer plans, after-tax investments, education funds, etc). The place to start […]

June 24, 2022

read more

I have to admit that I unfortunately didn’t know much about this holiday. As we marked its first official occurrence as a federal holiday this past Monday, I did some reading and research to educate myself and I thought learning more about the day and the new holiday may be of interest to you as […]

June 24, 2022

read more

Just as I was putting the finishing touches on a different Pam to Paper column (I’ll come back to that one another week), I received an email from a Mutual Fund Company we work with, Calamos Investments. In addition to having a proven track record as a money manager, they also produce some very informative […]

June 24, 2022

read more

Class is in session! Twice this week, I had discussions with clients about what information should be shared with their young adult/teenage children and grandchildren as it relates to finances and investing. I always enjoy these discussions. It’s a honor to speak with young adults and add some much needed context to a topic that […]

June 16, 2022