WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

I talked with clients this week regarding their savings plan for the year. The question of timing came up – ie: when should they deploy cash they now have on hand into their various accounts. Let’s look at the items we discussed Roth IRAs One of the accounts my clients are able to fund in […]

June 19, 2024

read more

We’ve talked about the term Safe Harbor before (in regards to estimated tax payments – you can revisit that post here). This week, a client reached out regarding another type of Safe Harbor. She said her friend had brought up the concept of Safe Harbor retirement plans and she wondered not only what they were […]

June 5, 2024

read more

A client reached out this week with the exciting news that she had been offered a new career opportunity. She asked for a call to discuss the opportunity and sent me the offer specifics to review. Since this is a situation others may find themselves in amidst this active job market, I thought it was […]

May 23, 2024

read more

This past week, I spoke with several clients in the middle of a career transitions for a variety of reasons (transitioning to a new role, opting to take some time away, and entering well-deserved retirement stage). With each of these clients, the items to consider during a career transition vary but there are some common […]

May 2, 2024

read more

At the end of 2023, I saw a mention of new regulation in a newsletter from a law firm that noted an upcoming reporting requirement for various companies (including LLCs and corporations). As a member of two LLCs, I looked into this more to see if it applied. And sure enough, there was a requirement […]

April 25, 2024

read more

In talking with a client this week, I learned that he has not completed his estate planning as I have been recommending for a while now. He recently got married and is expecting a child, so the establishment of these documents is more important than ever. He certainly appreciates and understands the importance of this […]

April 11, 2024

read more

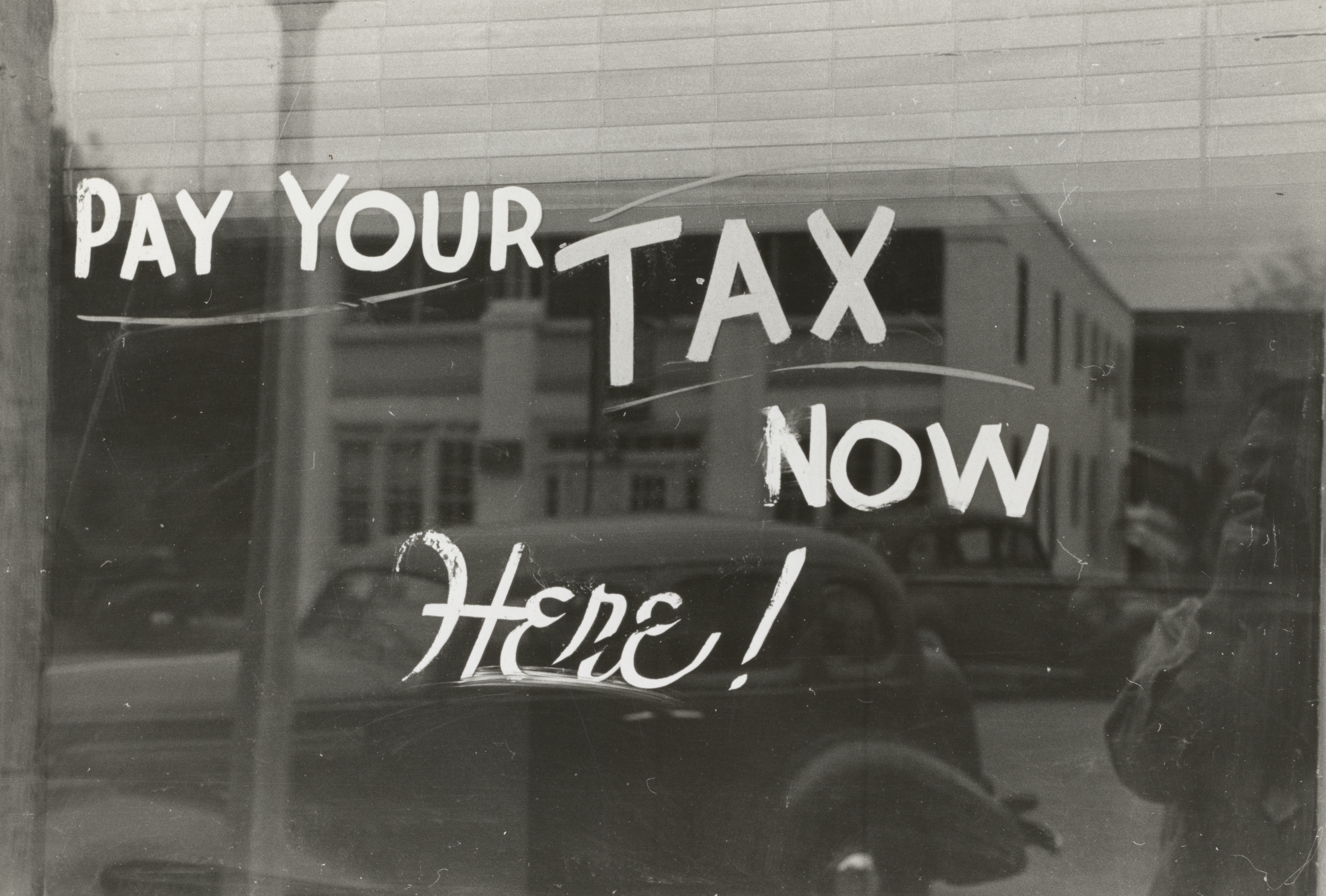

If there was ever a risk of me forgetting tax day, I have a feeling it would be mitigated by the numerous client questions I inevitably receive in the few weeks leading up to the important date! I thought I’d cover a few of them here as tax day approaches. When do you think I’ll […]

April 3, 2024

read more

In talking with a client this week, the subject of property and casualty insurance came up and I mentioned umbrella policies. She had not heard the term before. This is an important type of insurance to have in place as you age and your earnings and net worth increases. Let’s cover the highlights below but […]

March 21, 2024

read more

Don’t look now – the 2023 tax filing due date (without extension) is only a month away. As the date approaches, you may have questions on certain tax-related matters (there a lot of things to keep track of!) As a result, I thought I’d cover a question I received from a client this past week […]

March 14, 2024

read more

At least once a month, I have a client ask me about a cyber security related question (setting up two-factor authentication, best practices regarding wi-fi use, password issues, etc). It’s a great topic to discuss and sadly, it is also one that is becoming increasingly important with each passing minute. Our custodian, Charles Schwab, does […]

February 22, 2024