WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

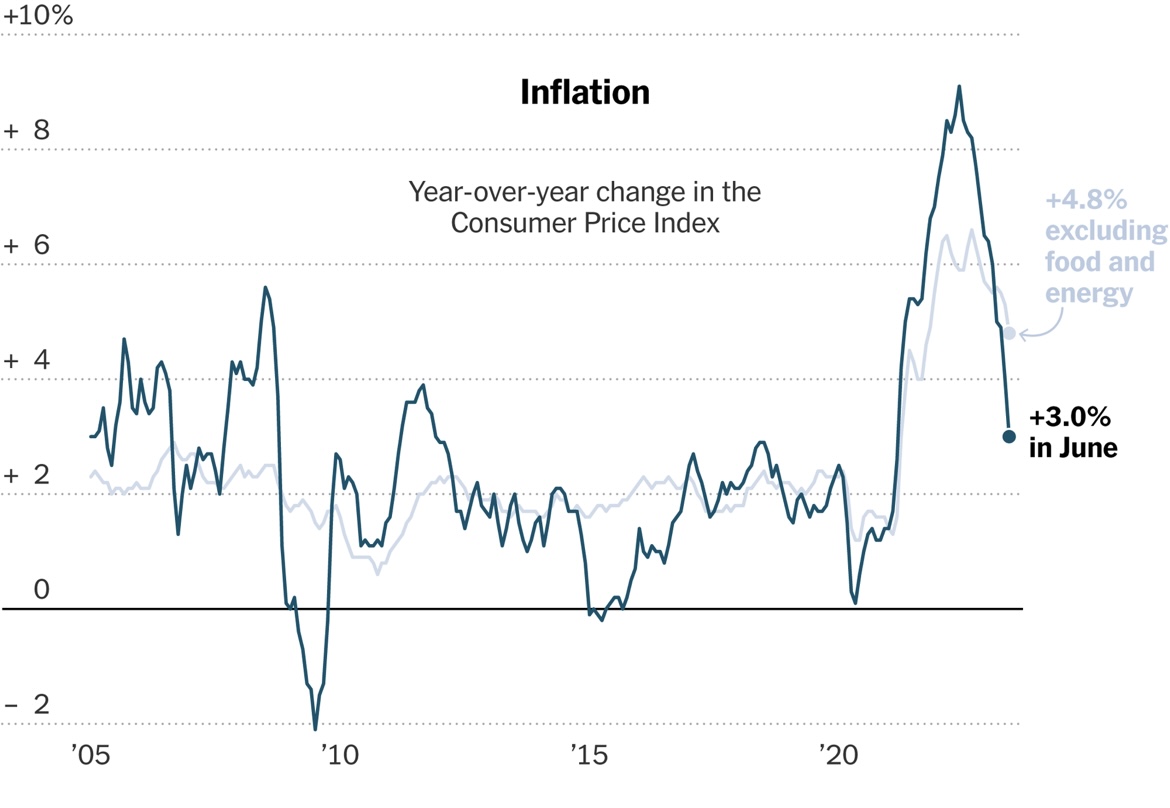

This past week, Wednesday June 12th was a big news day for markets. It doesn’t happen often that a monthly inflation report (Consumer Price Index) and a Federal Reserve Rate announcement happen on the same day, but that is in fact what occurred this week. The result? Happy markets and happy investors. Let’s start with […]

June 13, 2024

read more

This week, the Consumer Price Index (CPI) for January 2024 was released. The popular inflation report came in ahead of expectations, showing an increase in inflation during the month. CPI rose 0.39% in January, 0.09% more than expected. On a year-over-year basis, the index was up 3.1% (lower than December’s 3.4% but higher than 2.9% […]

February 15, 2024

read more

We may have started a new year, but we are still talking about inflation! On Thursday, December’s Consumer Price Index (CPI) report was released. The report showed the prices rose 3.4% year over year (compared to 3.1% in November) – however, after removing volatile food and energy, Core CPI rose 3.9% month over month (a […]

January 11, 2024

read more

The “data dependent” Federal Reserve received another two data points this week as two inflation reports for September were published. Let’s take a look at what each revealed – and what they may mean for the path forward. Producer Price Index (“PPI”) First up was PPI, which measures wholesale prices (cost producers pay for finished […]

October 12, 2023

read more

After a slow holiday week, markets have resumed normal operating speed this week and thankfully, the momentum has been positive. The upward moves are largely due to signs of disinflation. The two inflation reports for June released this week did their part to reassure investors that it remains possible the US can attain a soft […]

July 13, 2023

read more

Here we are again – another month, another set of inflation readings. April’s reports were both very encouraging. The Consumer Price Index (CPI) report for April was released this week, and it showed clear progress in the ongoing battle against inflation. CPI rose 0.4% in April and 4.9% year over year – both 0.1% lower […]

May 11, 2023

read more

We all know the fairy tale of the wandering girl who stumbles into the home of three bears and tastes the bowls of porridge trying to find one that is the perfect temperature. This “too hot, too cold, just right” parable has been told to countless children over the generations and has also served as […]

February 16, 2023

read more

I’m writing this on another grey and gloomy January day in Wisconsin. Perhaps that is why I chose this title. Or perhaps it is because today’s inflation report may finally be giving markets, investors, and this ever-optimistic financial advisor a glimmer of hope that we are approaching lighter and brighter investing days ahead. December CPI […]

January 12, 2023

read more

Years ago when Windermere was just starting out, my dad and I met with an owner of a successful investment advisory firm in Boston. He was sharing his perspective on a variety of things along with best practices for building out a large-scale advisory firm. Many of him comments and lessons have escaped my consciousness […]

November 10, 2022

read more

Inflation seems to come up in every client conversation these days – rightfully so! This week it was an extra hot topic with Thursday’s latest CPI release for September 2022. Let’s cover some of the highlights What do I need to know about September’s inflation report? The September Consumer Price Index (CPI – or “CP-High” […]

October 13, 2022