WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

The Federal Reserve found itself facing a considerable dilemma this week at the Federal Open Market Committee meeting that took place Wednesday March 22, 2023. How would they balance the tension between their ongoing battle against inflation and the threats posed by the recent instability in the banking system? Up until a few weeks ago, […]

March 23, 2023

read more

We all know the fairy tale of the wandering girl who stumbles into the home of three bears and tastes the bowls of porridge trying to find one that is the perfect temperature. This “too hot, too cold, just right” parable has been told to countless children over the generations and has also served as […]

February 16, 2023

read more

I’m writing this on another grey and gloomy January day in Wisconsin. Perhaps that is why I chose this title. Or perhaps it is because today’s inflation report may finally be giving markets, investors, and this ever-optimistic financial advisor a glimmer of hope that we are approaching lighter and brighter investing days ahead. December CPI […]

January 12, 2023

read more

Years ago when Windermere was just starting out, my dad and I met with an owner of a successful investment advisory firm in Boston. He was sharing his perspective on a variety of things along with best practices for building out a large-scale advisory firm. Many of him comments and lessons have escaped my consciousness […]

November 10, 2022

read more

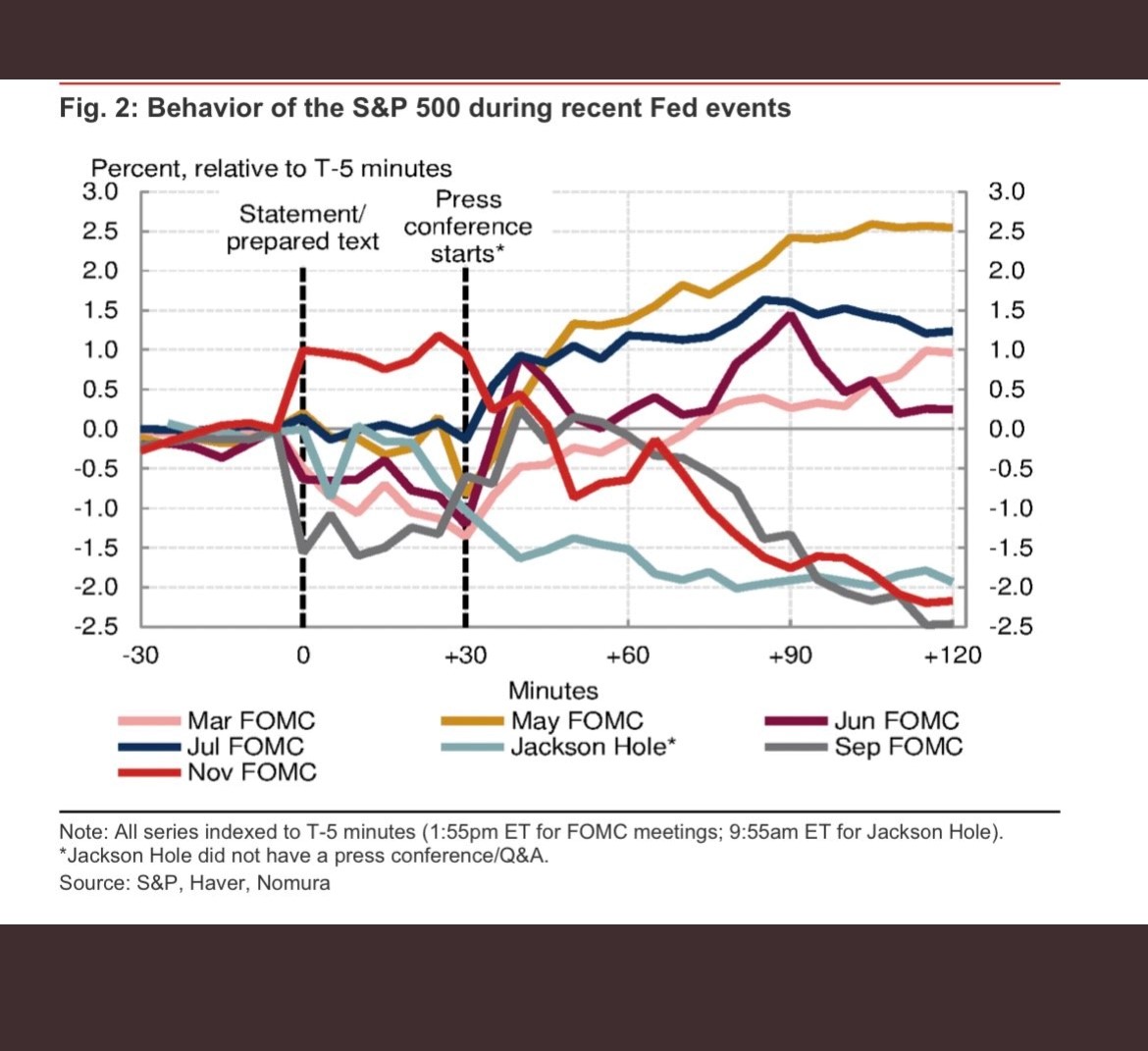

As we turned the calendar to November this week, there were a lot of things to look forward to – final two months of 2022, Thanksgiving around the corner, the few remaining nice days of fall weather (at least for us Midwesterners), and of course – the second to last meeting of 2022 for the […]

November 3, 2022

read more

Inflation seems to come up in every client conversation these days – rightfully so! This week it was an extra hot topic with Thursday’s latest CPI release for September 2022. Let’s cover some of the highlights What do I need to know about September’s inflation report? The September Consumer Price Index (CPI – or “CP-High” […]

October 13, 2022

read more

On Wednesday, the US Federal Reserve issued yet another increase in the Federal Fund Rate, bringing it to 3-3.25%. (Note: you can read more detail on the meeting and the implied rate path here) I listened to the press conference from Federal Reserve Chair Jerome Powell – and one phrase kept coming into my mind […]

September 22, 2022

read more

It wasn’t all that long ago that inflation was a seemingly theoretical discussion topic. We’d bring it up to clients (usually during a financial planning future illustration) and try to find a way to explain it. “Your money will be worth less over time” or “your purchasing power will decline” were phrases we’d use. While […]

September 1, 2022

read more

It was only a few years ago that inflation reports would go virtually unnoticed. Nowadays, they receive “breaking news” headlines, live news coverage, and follow-up press conferences at the White House. July’s inflation report (published August 10, 2022) was yet another hotly awaited release. The key question at hand – are things getting worse or […]

August 11, 2022

read more

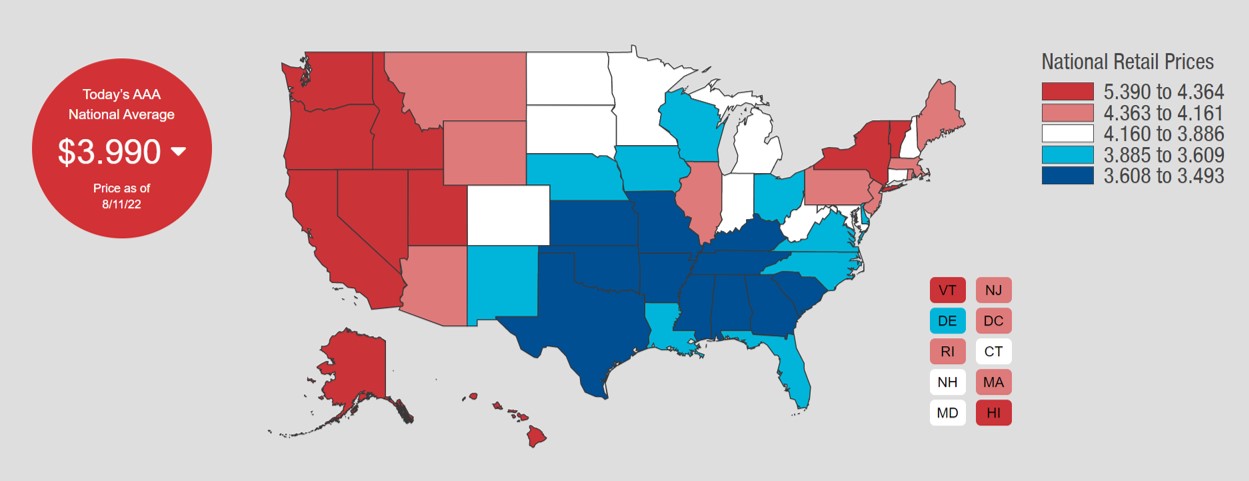

July 2022’s CPI print brought some relief, showing a 0% increase since June. A big reason of that change was the decline in gas prices month over month. The data published on August 11th, 2022 by AAA helped to reiterate this development. As shown in the graphic below, the national average per gallon of regular […]

August 11, 2022