WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

To say the first (almost) six months of 2024 have been an interesting time in the markets would be an immense understatement. Virtually everything that has transpired (zero rate cuts, 15%+ return in S&P 500, 10-year interest rate well above 4%, massive concentration in returns among large cap tech stocks, etc) was NOT the consensus […]

June 19, 2024

read more

Another quarter is (almost) behind us. As every investor knows, there are always lessons to be learned from time in the market and the past ninety days of activity were on exception. Below I summarize three key learnings from Q3 2023. 1.) It’s a Long and Winding Road This quarter was a great reminder that […]

September 28, 2023

read more

I’ve been meeting with clients to review 2022 reports this week. During some of those discussions, I’ve been referencing a chart from a renowned investor that really captures the powerful shift in markets over the past year. The chart is from Howard Mark’s most recent quarterly memo. (Howard Marks is a legendary investor and his […]

January 26, 2023

read more

As I watched the recent inflation release on Tuesday (and the subsequent jarring market decline), a common phrase kept coming into my mind over and over – “change is hard.” How many times have I said or heard that saying in my lifetime? At least a few hundred – maybe more. Why do I always […]

September 14, 2022

read more

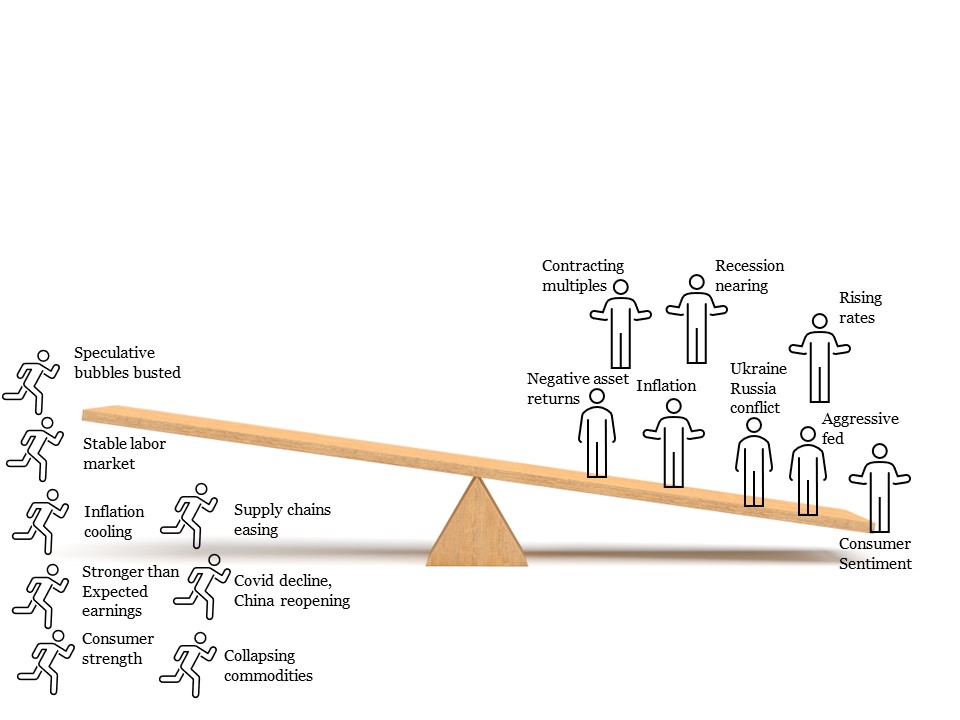

When my nephews visited last November, we visited a local playground. They are two very curious and active boys (ages 6 and 3 at the time) so naturally, we had to explore and try out every piece of equipment and toy in the park. They eagerly climbed on one side of the teeter totter together […]

July 6, 2022

read more

If you turn on any news channel or read any news publication these days, odds are you will hear at least one or more financial term that immediately raises your blood pressure. Words such as correction, bear market, and recession are definitely front and center. A client recently asked what these terms mean – and […]

May 26, 2022

read more

I’m writing this post on May 19, 2022 as I sit in the Denver airport, on my way back home from a Schwab meeting in California. And admittedly, I’m experiencing a very strong sense of deja vu. The last time I was in the Denver airport was February 2020. I was on my way to […]

May 20, 2022

read more

Earlier this week, I was doing my nightly Gmail inbox clean-out (yes, I strive for inbox zero and no, I can’t quite get there 😉 ). In between the ads, junk mail, and useful reminders was a hidden gem – an email newsletter from Dr. Brene Brown. If you know Brene’s work, you’ll understand that […]

May 12, 2022

read more

Every month, Rick Rieder – Managing Director and Head of Global Allocation Team for Blackrock – conducts a monthly call, where he shares pages of charts, data, and statistics that explain where markets have been and more importantly, where they are going. To help aid in understanding or perhaps to alleviate some of the confusion […]

May 5, 2022

read more

Markets have certainly given all of us much to think about in recent months. After an astounding recovery from COVID-driven recession to a relatively calm 2021, we have been greeted with volatility, uncertainty, and very bearish sentiment as we wrapped up the first quarter of 2022. There are always uncertainties and variables in play in […]

April 12, 2022