WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

During 2020, I wrote frequently about the investing landscape. I even drew a picture to illustrate what we were facing as we crossed the “Valley of Uncertainty” (you can read the blog posts from May, June, July, and September) So where is our investor now? I was anxious to put my artistic skills to work […]

February 3, 2021

read more

One silver lining of 2020 is that we hear from clients far more than we used too! If there ever was a year we all need to talk financial matters out, 2020 was it! We are loving the frequent discussions, debates, and opportunities to work thru this challenging time together. We’ve heard some similar questions […]

December 9, 2020

read more

Throughout the past few months, as I think about markets and investing, I’ve had an image in my mind’s eye. It’s that of the iconic Bixby Canyon bridge in Big Sur, California . As you wind your way down the coast of California on Highway 1, this bridge spans a staggeringly deep valley that plunges […]

May 7, 2020

read more

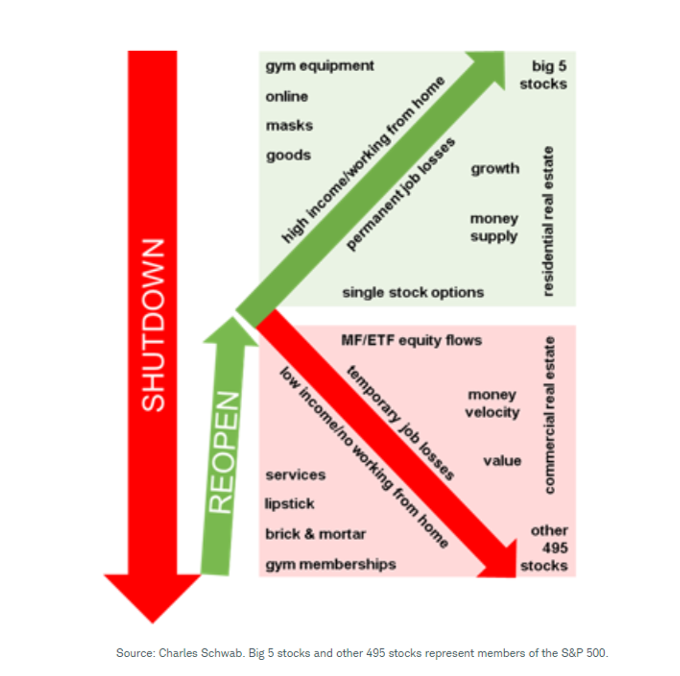

“When will this end?” “Has the market reached its bottom yet?” “Could asset prices go higher? “Could asset prices go lower?” “What else will the government do?” “How will the virus progress from here?” These are just a sampling of the questions I’ve been discussing with clients over the past months as the COVID-19 situation […]

April 28, 2020

read more

There has been no shortage of words to describe the market environment as of late: “worst one day percentage decline, largest single day move, recessionary indicator, trade war, interest rate fears” – and the list goes on and on. Going forward from here, we believe only one word matters – CHOICE Investing has always been […]

January 11, 2019

read more

I’m an avid reader of all things Seth Godin, including his daily blog posts. This recent post stuck a cord and made me think of recent market activity. *Be sure to visit the link to the post and consider subscribing!) The title of the post was “String too Short to be Saved”, telling the story […]

December 4, 2018

read more

October was certainly a trying month for investors. While we all understand that markets can move in both directions, downward moves always attract far more of our time & attention and lead to significant questions and concerns. Media outlets do their best to explain the moves, predict the future, and create as many shocking headlines […]

November 5, 2018

read more

You’ll have to forgive this Canadian for the hockey analogy but it occurred to me lately that this famous quote from the “Great One” perfectly summarizes our approach to markets: I skate to where the puck is going to be, not to where it has been ~ Wayne Gretzky It’s so tempting as investors to […]

October 8, 2018

read more

“Timing is everything” This age-old saying can be applied to so many areas of our lives – including investing. Lately, it seems like timing is on top of a lot of investors’ minds. Questions such as: Is it time to get out of the market? Is it time to go all in? Is it time […]

September 5, 2018

read more

2018 sits in stark contrast to 2017 when it comes to many things – including investing and the markets. After a steady climb in 2017, where almost nothing could stop the upward movement across virtually all asset classes, 2018 has been a much more challenging investment environment. Emerging markets have faced headwinds from a rising […]