WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

Congratulations, you’ve survived another week as an investor in 2022! A week where we have seen positive and minus +2% moves in equity markets within the same day. Is anyone else just a bit tired of this?! Much of this week’s excitement centered around – you guessed it – inflation. You can read more on […]

October 13, 2022

read more

After one of the worst start to the year for equity investments, you may find your self asking WHY? Why do I bother? Why do I subject myself to this angst, only to see my invested capital decline? Why not just put it in cash and take all my worry away? Why invest, when I […]

July 21, 2022

read more

If you own Amazon (or any other stock over the years that suddenly carries a lower per share price), you may have the same question I heard this week – what is a stock split and why would a company choose to do this? What is a stock split? A stock split is a decision […]

June 10, 2022

read more

If you turn on any news channel or read any news publication these days, odds are you will hear at least one or more financial term that immediately raises your blood pressure. Words such as correction, bear market, and recession are definitely front and center. A client recently asked what these terms mean – and […]

May 26, 2022

read more

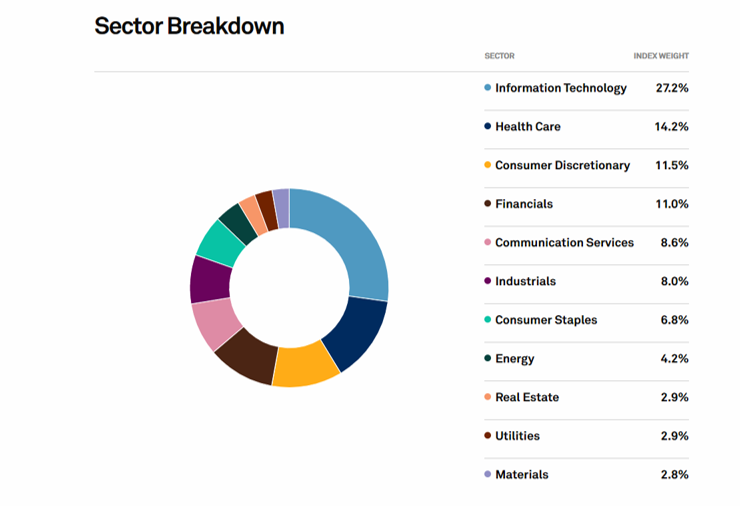

During a quarterly review meeting recently, a client asked why we include a schedule showing the sector weighting of their portfolio versus the sector weighting of the S&P 500. It was a great question and one I thought was worth diving into this week. First, a few definitions: S&P 500 index – this is a […]

May 12, 2022

read more

Note: Each week in this column, I’ll address a question discussed in recent client conversations. Who knows, it may just be on your mind as well This week, the topic is Growth versus Value. Recently, a client asked for some clarification on what those two terms actually mean and if we have a preference in […]

May 5, 2022

read more

Every month, Rick Rieder – Managing Director and Head of Global Allocation Team for Blackrock – conducts a monthly call, where he shares pages of charts, data, and statistics that explain where markets have been and more importantly, where they are going. To help aid in understanding or perhaps to alleviate some of the confusion […]

May 5, 2022

read more

Markets have certainly given all of us much to think about in recent months. After an astounding recovery from COVID-driven recession to a relatively calm 2021, we have been greeted with volatility, uncertainty, and very bearish sentiment as we wrapped up the first quarter of 2022. There are always uncertainties and variables in play in […]

April 12, 2022

read more

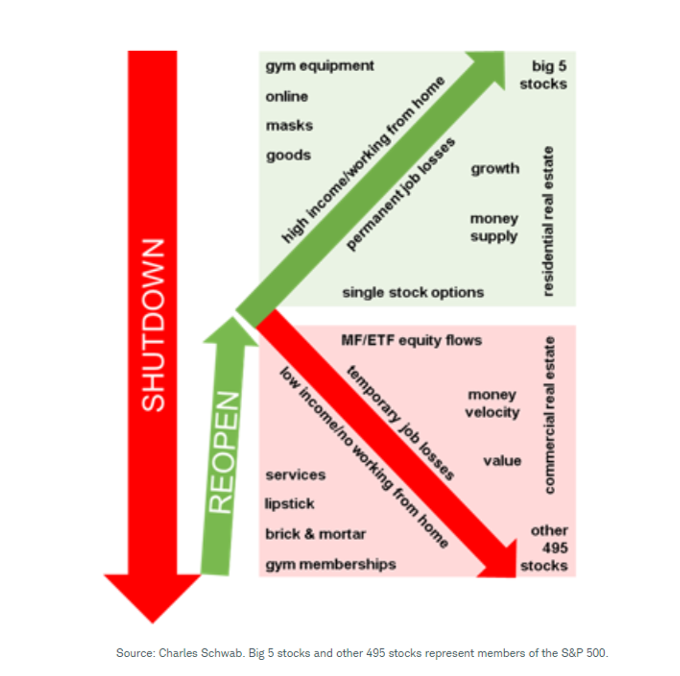

One silver lining of 2020 is that we hear from clients far more than we used too! If there ever was a year we all need to talk financial matters out, 2020 was it! We are loving the frequent discussions, debates, and opportunities to work thru this challenging time together. We’ve heard some similar questions […]

December 9, 2020

read more

If you’re feeling a bit of motion sickness from the markets over the past eighteen months, you are not alone. Markets have been on a bit of a roller coaster – now returning to the same platform where we all got on the ride, with the market recently crossing over to all time highs. But […]

July 17, 2019