WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

A client reached out this week to confirm what seemed like news that was too good to be true (especially in a year when it seems all prices are going up). Are Medicare premiums for Part B really going down in 2023? We’re happy to report the answer is yes! Read on to learn more. […]

September 29, 2022

read more

On Wednesday, the US Federal Reserve issued yet another increase in the Federal Fund Rate, bringing it to 3-3.25%. (Note: you can read more detail on the meeting and the implied rate path here) I listened to the press conference from Federal Reserve Chair Jerome Powell – and one phrase kept coming into my mind […]

September 22, 2022

read more

When in a meeting recently, I was explaining to a client a quick way to think about varying rates of return – the Rule of 72. The client wasn’t familiar with it – so I thought a few of you may also wish to learn more about this simple but effective formula. It’s called the […]

September 22, 2022

read more

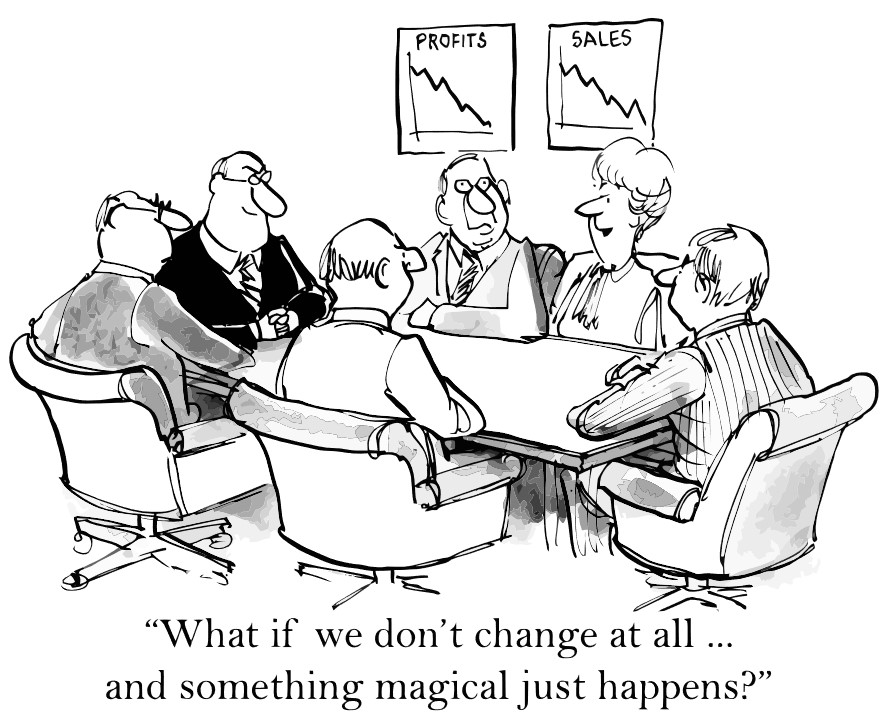

As I watched the recent inflation release on Tuesday (and the subsequent jarring market decline), a common phrase kept coming into my mind over and over – “change is hard.” How many times have I said or heard that saying in my lifetime? At least a few hundred – maybe more. Why do I always […]

September 14, 2022

read more

A silver lining of recent interest rate increases is the ability to earn some level of interest on cash balances. When reviewing the various options with a client recently, she asked what exactly a money market fund was and whether there were any risks associated with this investment vehicle. Let’s take a closer look at […]

September 14, 2022

read more

It’s officially back to school season. The streets are once again filled with school buses and my social media feeds contain pictures of smiling kids on their front porches, all ready for their first day. I always loved school. Not necessarily all of the logistics and social dynamics – but the learning element. Our school […]

September 8, 2022

read more

When discussing the upcoming annual enrollment season (the time of year when employees need to elect various health care and employee benefit elections), a client recently asked for a refresher on Health Savings Accounts (commonly known as HSAs). These are very powerful tools – both for health care costs as well as for long-term investing […]

September 8, 2022

read more

It wasn’t all that long ago that inflation was a seemingly theoretical discussion topic. We’d bring it up to clients (usually during a financial planning future illustration) and try to find a way to explain it. “Your money will be worth less over time” or “your purchasing power will decline” were phrases we’d use. While […]

September 1, 2022

read more

Five years ago, I was lucky enough to have a wonderful western adventure with a lifelong friend, spending time in Wyoming and Montana. During that trip, we visited Grand Teton National Park which encircles the beautiful town of Jackson, WY. The area is absolutely beautiful and if you haven’t been, maybe this will nudge you […]

September 1, 2022

read more

I make it a habit to follow and consume a variety of voices concerning investing and personal finance. I believe there is always something to be learned – both from those we agree with and those we may not be fully aligned with at all times. Earlier this week, I saw a post from an […]

August 25, 2022