WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

If you listen or read investment-related news, you are likely to encounter the term “factor” or “factor based investing” as this concept has taken off in recent years. A client recently asked for our take on this concept. Great question! Definitions Think of factors as traits or characteristics of the underlying company. Factors are not […]

August 25, 2022

read more

Some problems are definitely better than others. A recent client question about possible ways to circumvent a material gain in a taxable account is certainly a nice problem to have – but one that still deserves some discussion. Investment Taxation Basics Let’s start with an overview of taxation of investments. If you are buying and […]

August 18, 2022

read more

As we approached the end of June 2022, markets seemed to be in a free fall. There was no shortage of things to worry about as an investor – inflation, rate increases, global unrest, midterm elections, covid variants, and perhaps front and center: Recession fears. With reports of a slowing economy and the persistent belief […]

August 18, 2022

read more

If you are at or nearing Medicare age, you are well aware of its underlying complexities. We frequently work with clients as they navigate this program – but always recommend the inclusion of a Medicare insurance advisor/broker as well, given the intricacies and considerable nuances. One such nuance that a client just ran across this […]

August 11, 2022

read more

It was only a few years ago that inflation reports would go virtually unnoticed. Nowadays, they receive “breaking news” headlines, live news coverage, and follow-up press conferences at the White House. July’s inflation report (published August 10, 2022) was yet another hotly awaited release. The key question at hand – are things getting worse or […]

August 11, 2022

read more

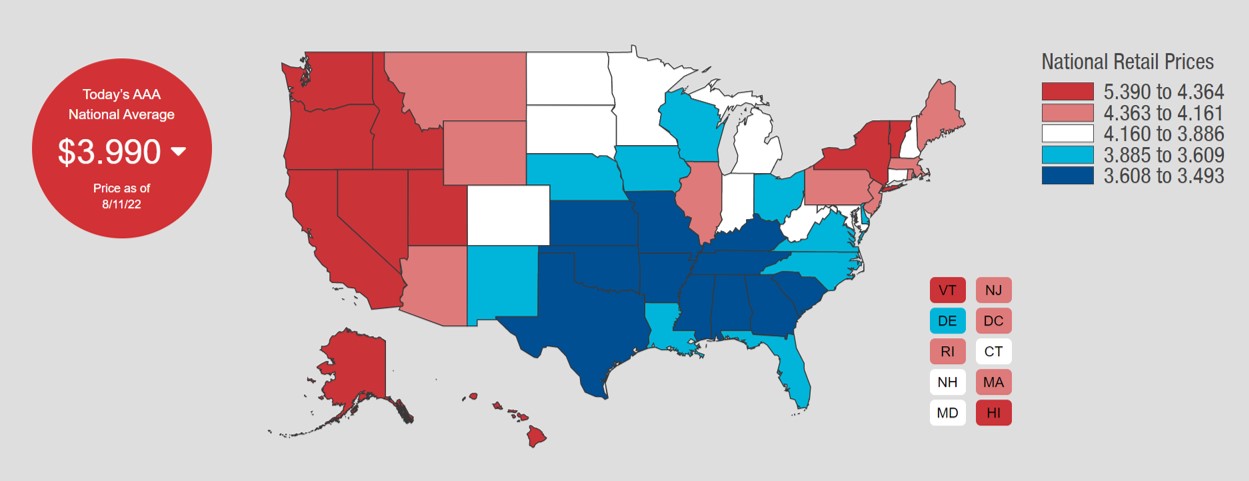

July 2022’s CPI print brought some relief, showing a 0% increase since June. A big reason of that change was the decline in gas prices month over month. The data published on August 11th, 2022 by AAA helped to reiterate this development. As shown in the graphic below, the national average per gallon of regular […]

August 11, 2022

read more

August will always remind me of back to school season. Even though I am years (check that, decades!) removed from having to buy school supplies, pick out a locker, and review my class schedule, this month always puts me right back in that mode. Time to say goodbye to summer fun and get back to […]

August 5, 2022

read more

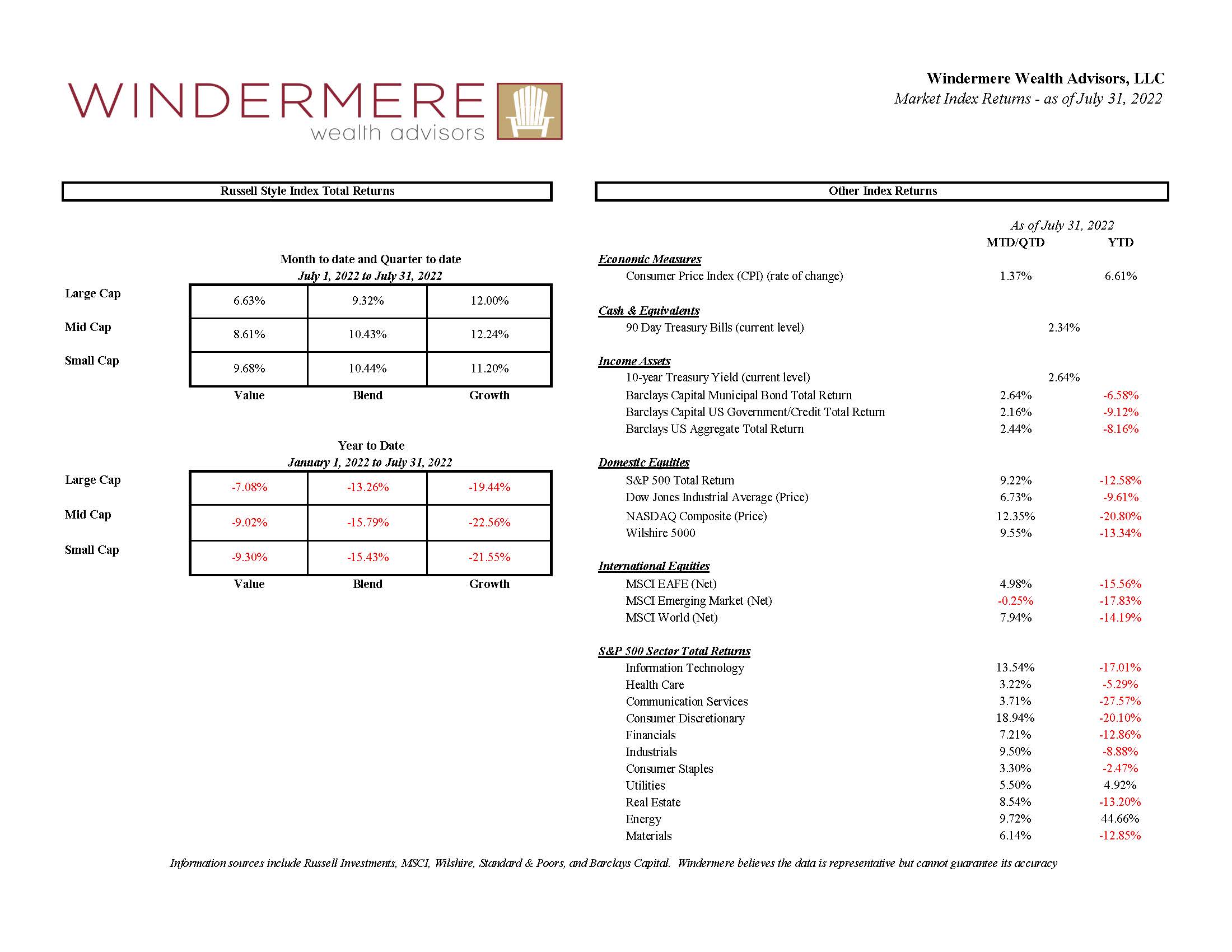

Another month has come to and end. This one was far kinder to asset class returns. See for yourself – a summary of several index returns is provided below. In two words.. Much Better!

August 5, 2022

read more

While it may seem like we just went thru a major election cycle, it is almost that time again. A client recently inquired about ways to keep track of what’s happening in our nation’s capital and the related impact on markets/portfolios. I have just the sources! In the interest of keeping things simple, I’m sharing […]

August 5, 2022

read more

One thing you have to love about the world of finance is all the acronyms! It can be hard to keep track of them all. A recent headline made me laugh when I read it – “Forget TINA, get reacquainted with CINDY.” No, the article was not talking about long lost friends. It was referring […]

July 29, 2022