WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

A client asked for a debrief on the Federal Reserve’s actions. Here we go! What happened at the meeting? On July 27, 2022, the US Federal Reserve (the “Fed”) once again raised the Fed Funds Rate by 75 basis points. The Federal Funds Rate now ranges from 2.25-2.5%, up from near zero in March. This […]

July 29, 2022

read more

It’s easy to get stuck on the headlines these days – especially when it comes to inflation. Turn on the tv, listen to a podcast, open your email – and odds are you will see some sort of jarring financial headline concerning inflation. Even a drive past the gas station can bring the topic front […]

July 29, 2022

read more

Inflation impacts all of us – especially those on a fixed income. A client recently asked me if social security benefits would see a meaningful increase in the near future. Great question! Ever since 1975, social security benefits have been increase annually via Cost of Living Adjustments (or COLAs). Here is a chart of COLAs […]

July 21, 2022

read more

If you’ve read the wildly popular book Atomic Habits, you may already be familiar with the work of its author, James Clear. James publishes a weekly newsletter called 3-2-1, in which he shares 3 ideas, 2 quotes, and 1 question to consider. (It’s a must read for me – feel free to subscribe here and […]

July 21, 2022

read more

After one of the worst start to the year for equity investments, you may find your self asking WHY? Why do I bother? Why do I subject myself to this angst, only to see my invested capital decline? Why not just put it in cash and take all my worry away? Why invest, when I […]

July 21, 2022

read more

Inflation is the top issue on investors and consumers’ minds these days. I thought it would be worth taking a closer look at the latest reading – and how future readings may play out. If you’ve read any news headline over the past 48 hours, you already know that June’s inflation reading (as measured by […]

July 14, 2022

read more

There is a lot of chatter about the upcoming “earnings season” which prompted a client question about what exactly that means – and why it is getting so much attention this time around. Public companies in the US (ie: the ones that trade on stock markets and are available for public investment) are required by […]

July 14, 2022

read more

It was certainly a very challenging start to the year for investors. Virtually every asset class experienced materially negative returns. If you would rather cover your eyes, I certainly understand. Just remember – markets go thru phases. We’re in the middle of a very difficult one – but like all the other phases (even the […]

July 7, 2022

read more

There is no shortage of acronyms when it comes to finances. One you may be hearing in the news lately is RMD, or Required Minimum Distribution. A client recently asked me to explain this concept in more detail. So, let’s take a look at what an RMD is, how it may apply to you (now […]

July 7, 2022

read more

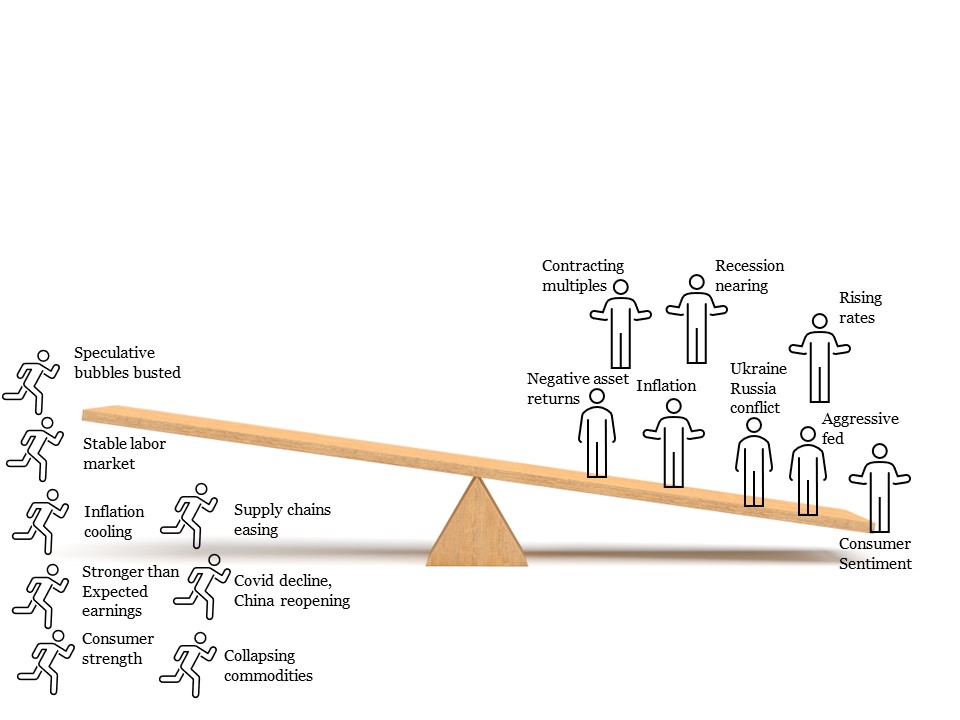

When my nephews visited last November, we visited a local playground. They are two very curious and active boys (ages 6 and 3 at the time) so naturally, we had to explore and try out every piece of equipment and toy in the park. They eagerly climbed on one side of the teeter totter together […]

July 6, 2022