WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

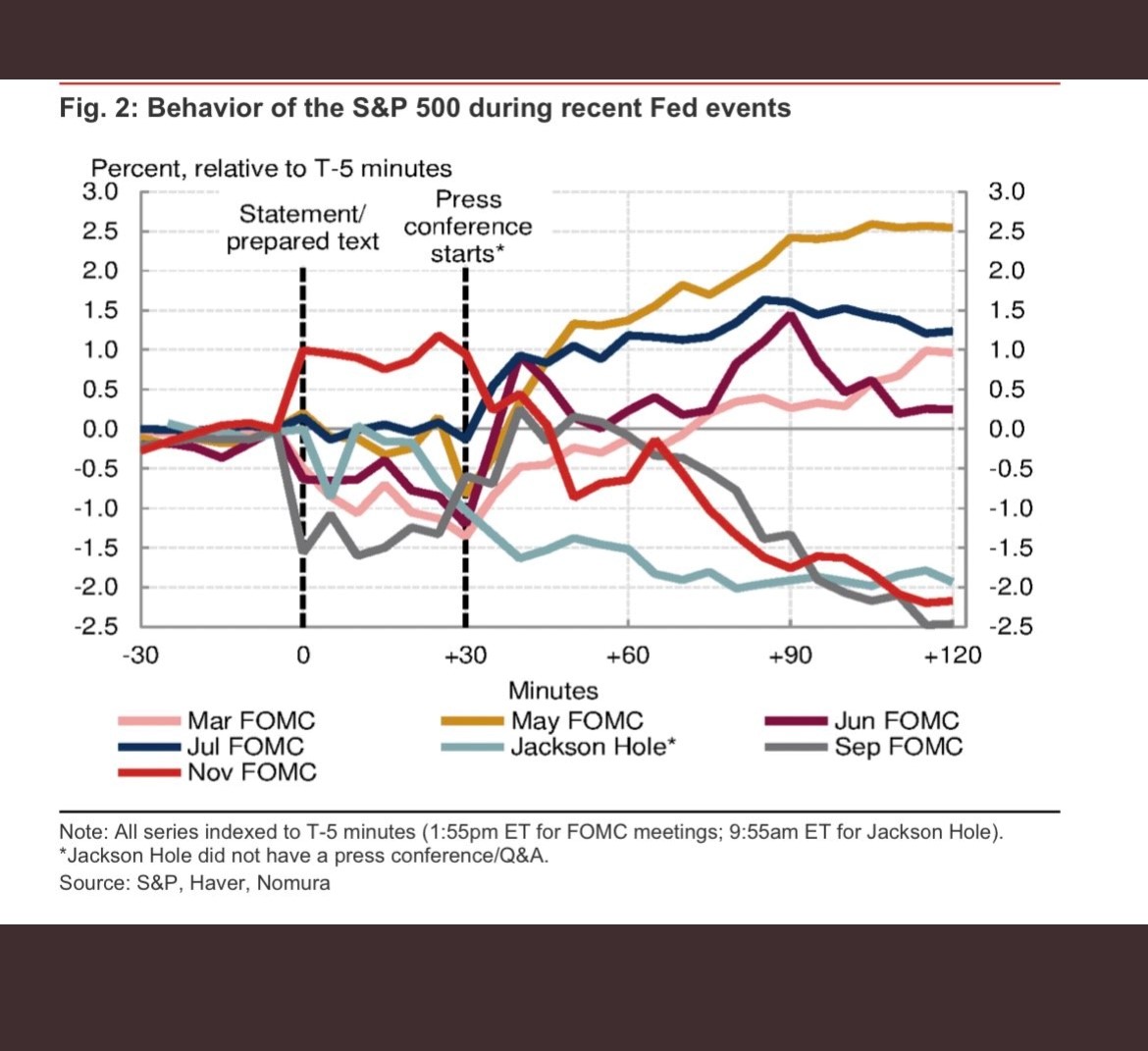

As we turned the calendar to November this week, there were a lot of things to look forward to – final two months of 2022, Thanksgiving around the corner, the few remaining nice days of fall weather (at least for us Midwesterners), and of course – the second to last meeting of 2022 for the […]

November 3, 2022

read more

I don’t know about you, but think we could all use a little break from the markets. The next few weeks will be action packed – with inflation readings and a Federal Reserve meeting and the midterm elections. So this week, I thought we’d instead do a little exercise together. One that may help you […]

October 27, 2022

read more

A client recently reached out to set a time to review her benefits during Open Enrollment. This is a great practice and one I thought would be worth sharing in this week’s column What is Open Enrollment? Every year, employees are able to review and make changes to employee benefits during a process called Open […]

October 27, 2022

read more

A client reached out this week, expressing concerns about the decline in her portfolio. As I started to provide my rationale for staying the course and how markets go thru cycles, etc. , she said “thanks, I just need the hang in there pep talk once in a while.” Don’t we all? It has been […]

October 20, 2022

read more

There was a slight bit of good news for US individuals this week as the IRS published certain key items that will apply to 2023 income taxes. A client reached out for confirmation of the changes – so let’s cover them here. Before we dive into details, it’s helpful to understand what is driving these […]

October 20, 2022

read more

Congratulations, you’ve survived another week as an investor in 2022! A week where we have seen positive and minus +2% moves in equity markets within the same day. Is anyone else just a bit tired of this?! Much of this week’s excitement centered around – you guessed it – inflation. You can read more on […]

October 13, 2022

read more

Inflation seems to come up in every client conversation these days – rightfully so! This week it was an extra hot topic with Thursday’s latest CPI release for September 2022. Let’s cover some of the highlights What do I need to know about September’s inflation report? The September Consumer Price Index (CPI – or “CP-High” […]

October 13, 2022

read more

No, this isn’t a sing-along to the classic 80’s song but rather a question that I’m sure many investors (perhaps yourself included) find themselves asking after another rough quarter. Markets had a tumultuous end to Q3, as rates rose and equities sold off (read more about that dynamic in this week’s client question). In combination […]

October 6, 2022

read more

It’s hard to escape the constant chatter about rising interest rates lately, so it was only natural for a client to ask about the interplay between interest rates and asset prices. Interest rates are an essential driver of asset prices. You don’t have to take it from me – here’s a quote from famed investor […]

October 6, 2022

read more

We took a lot of road trips when I was a child. Much to my parent’s chagrin, I would usually ask (at least a few times per trip) the age old question – “are we there yet?” I wasn’t trying to be annoying, I promise! I was simply tired of sitting still, tired of waiting […]

September 29, 2022