WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

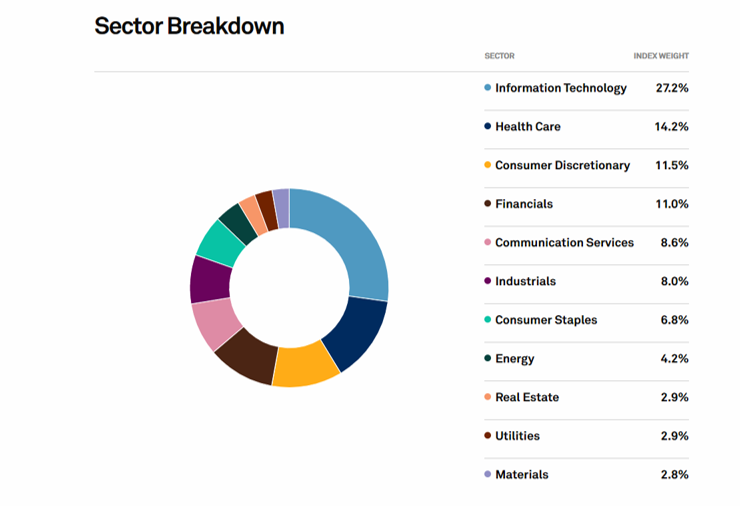

During a quarterly review meeting recently, a client asked why we include a schedule showing the sector weighting of their portfolio versus the sector weighting of the S&P 500. It was a great question and one I thought was worth diving into this week. First, a few definitions: S&P 500 index – this is a […]

May 12, 2022

read more

Calm and perspective – two things we could all use some more of these days Recently, after a wild day in the markets, I decided to pull up two pictures, just to add some perspective Return of the S&P 500 from January 1, 2022 to May 11, 2022 Return of the S&P 500 from January […]

May 12, 2022

read more

Earlier this week, I was doing my nightly Gmail inbox clean-out (yes, I strive for inbox zero and no, I can’t quite get there 😉 ). In between the ads, junk mail, and useful reminders was a hidden gem – an email newsletter from Dr. Brene Brown. If you know Brene’s work, you’ll understand that […]

May 12, 2022

read more

Note: Each week in this column, I’ll address a question discussed in recent client conversations. Who knows, it may just be on your mind as well This week, the topic is Growth versus Value. Recently, a client asked for some clarification on what those two terms actually mean and if we have a preference in […]

May 5, 2022

read more

Every month, Rick Rieder – Managing Director and Head of Global Allocation Team for Blackrock – conducts a monthly call, where he shares pages of charts, data, and statistics that explain where markets have been and more importantly, where they are going. To help aid in understanding or perhaps to alleviate some of the confusion […]

May 5, 2022

read more

Markets have certainly given all of us much to think about in recent months. After an astounding recovery from COVID-driven recession to a relatively calm 2021, we have been greeted with volatility, uncertainty, and very bearish sentiment as we wrapped up the first quarter of 2022. There are always uncertainties and variables in play in […]

April 12, 2022

read more

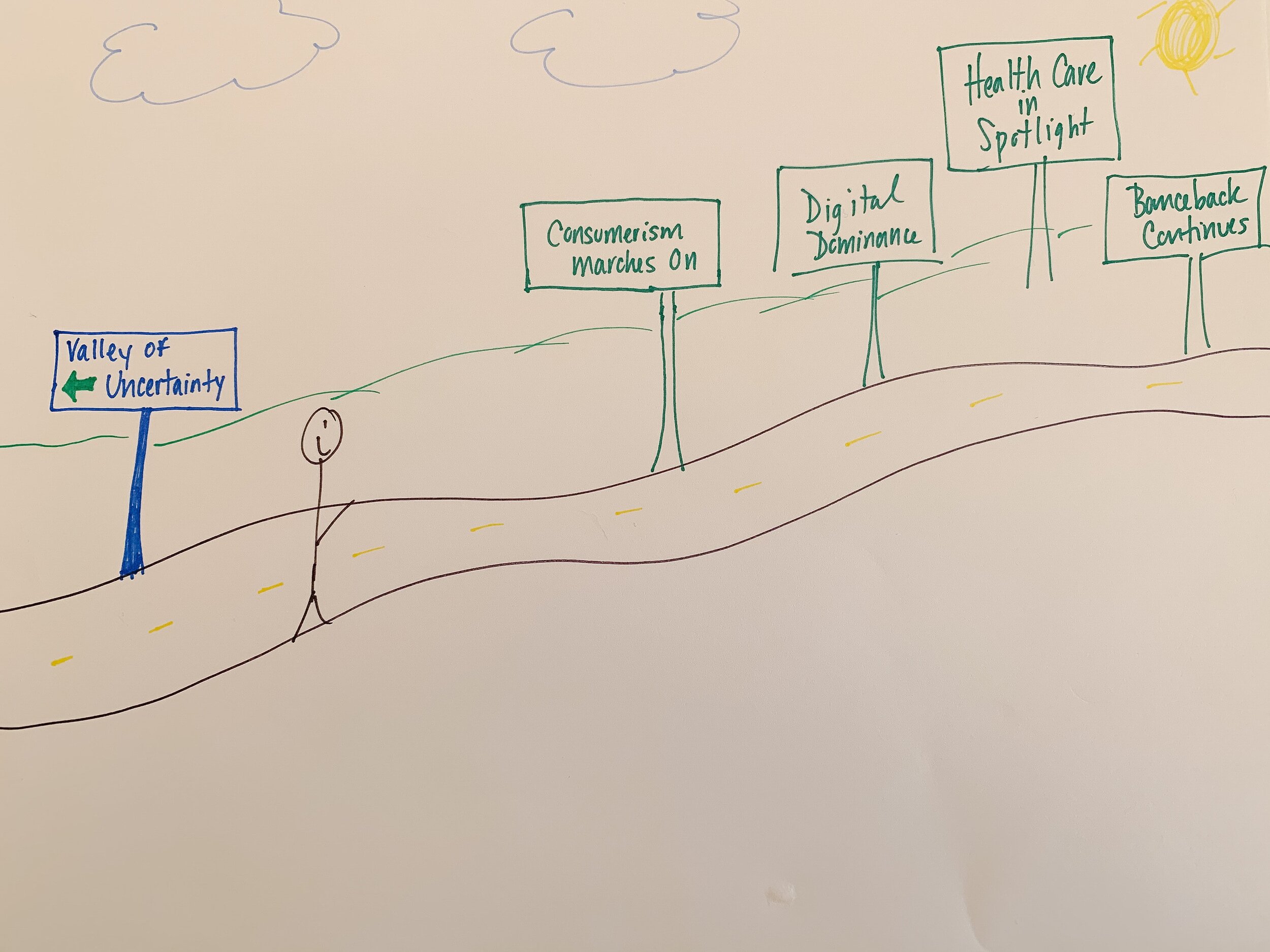

During 2020, I wrote frequently about the investing landscape. I even drew a picture to illustrate what we were facing as we crossed the “Valley of Uncertainty” (you can read the blog posts from May, June, July, and September) So where is our investor now? I was anxious to put my artistic skills to work […]

February 3, 2021

read more

Each quarter, we will share three things that we are keeping Top of Mind. After a demanding 2020, this quarter’s list includes some levity – as well as a useful tool for investors 1. Sourdough Schoolhouse – Guilty as charged – I too jumped on the sourdough bread train during the early days of quarantine. […]

February 3, 2021

read more

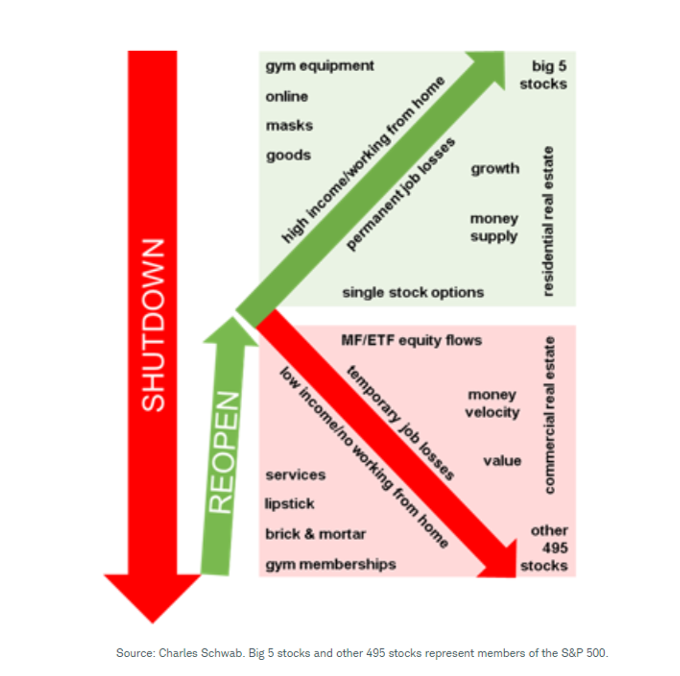

One silver lining of 2020 is that we hear from clients far more than we used too! If there ever was a year we all need to talk financial matters out, 2020 was it! We are loving the frequent discussions, debates, and opportunities to work thru this challenging time together. We’ve heard some similar questions […]

December 9, 2020

read more

Like many of you, I’ve had to come up with new ways to workout during the pandemic. I’ve switched from in-person spin classes to at-home rides using the Peloton app. For those of you not familiar, these rides are part workout/part media production, as the instructors take you thru ride prompts while also interspersing wisdom […]

November 6, 2020