WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

When you think of this time of year and harvesting, your mind may go to crops and farming. But don’t forget about harvesting investment losses as well. This topic came up with a client recently who asked for a reminder on why it can be a useful strategy, especially in a down year such as […]

November 3, 2022

read more

A client recently reached out to set a time to review her benefits during Open Enrollment. This is a great practice and one I thought would be worth sharing in this week’s column What is Open Enrollment? Every year, employees are able to review and make changes to employee benefits during a process called Open […]

October 27, 2022

read more

There was a slight bit of good news for US individuals this week as the IRS published certain key items that will apply to 2023 income taxes. A client reached out for confirmation of the changes – so let’s cover them here. Before we dive into details, it’s helpful to understand what is driving these […]

October 20, 2022

read more

A client reached out this week to confirm what seemed like news that was too good to be true (especially in a year when it seems all prices are going up). Are Medicare premiums for Part B really going down in 2023? We’re happy to report the answer is yes! Read on to learn more. […]

September 29, 2022

read more

When discussing the upcoming annual enrollment season (the time of year when employees need to elect various health care and employee benefit elections), a client recently asked for a refresher on Health Savings Accounts (commonly known as HSAs). These are very powerful tools – both for health care costs as well as for long-term investing […]

September 8, 2022

read more

Some problems are definitely better than others. A recent client question about possible ways to circumvent a material gain in a taxable account is certainly a nice problem to have – but one that still deserves some discussion. Investment Taxation Basics Let’s start with an overview of taxation of investments. If you are buying and […]

August 18, 2022

read more

If you are at or nearing Medicare age, you are well aware of its underlying complexities. We frequently work with clients as they navigate this program – but always recommend the inclusion of a Medicare insurance advisor/broker as well, given the intricacies and considerable nuances. One such nuance that a client just ran across this […]

August 11, 2022

read more

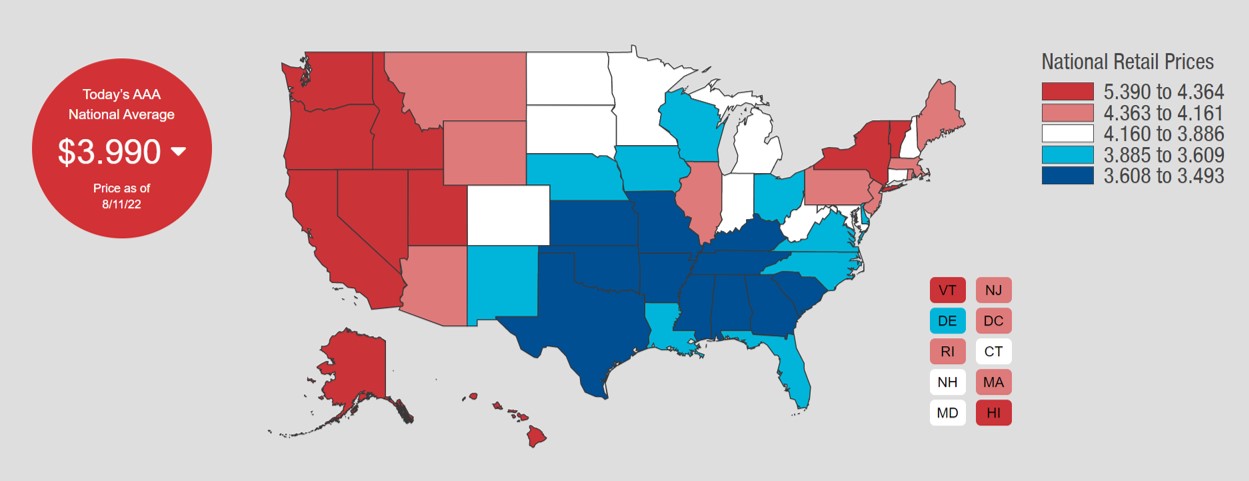

July 2022’s CPI print brought some relief, showing a 0% increase since June. A big reason of that change was the decline in gas prices month over month. The data published on August 11th, 2022 by AAA helped to reiterate this development. As shown in the graphic below, the national average per gallon of regular […]

August 11, 2022

read more

Inflation impacts all of us – especially those on a fixed income. A client recently asked me if social security benefits would see a meaningful increase in the near future. Great question! Ever since 1975, social security benefits have been increase annually via Cost of Living Adjustments (or COLAs). Here is a chart of COLAs […]

July 21, 2022

read more

There is no shortage of acronyms when it comes to finances. One you may be hearing in the news lately is RMD, or Required Minimum Distribution. A client recently asked me to explain this concept in more detail. So, let’s take a look at what an RMD is, how it may apply to you (now […]

July 7, 2022