WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

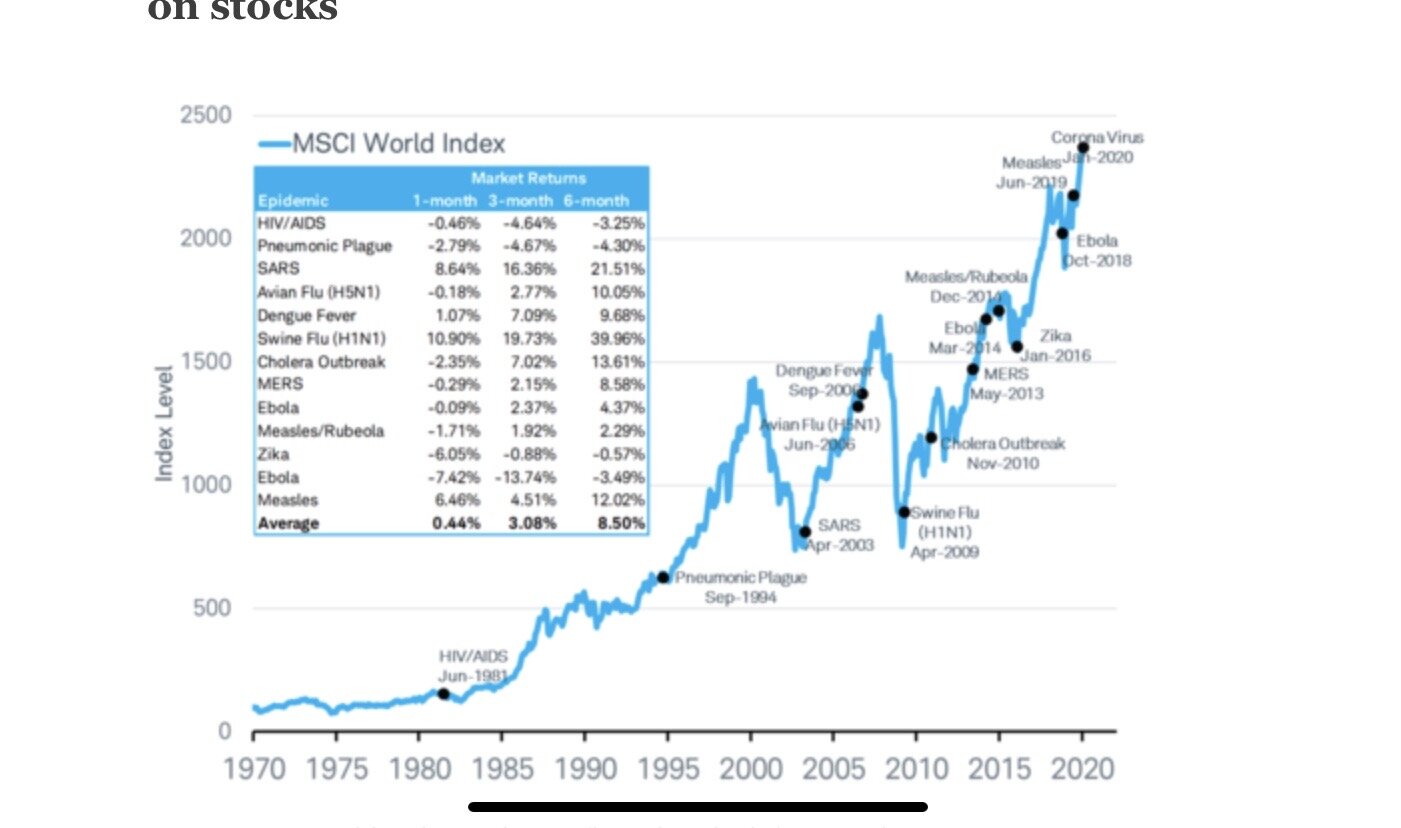

Note: Life isn’t easy at the moment for any of us. We have financial concerns, as well as very real health concerns. While this post will focus on the “investing” side of things, please don’t think for a minute that I’m blind to the seemingly more pressing concerns surrounding our health and the health of […]

March 9, 2020

read more

A fundamental part of being an investor is having a strategy for handling challenging times. It takes someone with a rationale mind, a steady hand, and an ample supply of knowledge and grit to be an investor in times of uncertainty. And once again, we find ourselves in such a time. It is never easy and it’s […]

February 26, 2020

read more

“When the facts change, I change my mind “ This well-known quote from John Maynard Keynes is a seemingly sound piece of advice. However, when it comes to your investing journey, you have to be careful about changing your mind too quickly. When major events occur and media headlines express panic and uncertainty, our instincts […]

February 6, 2020

read more

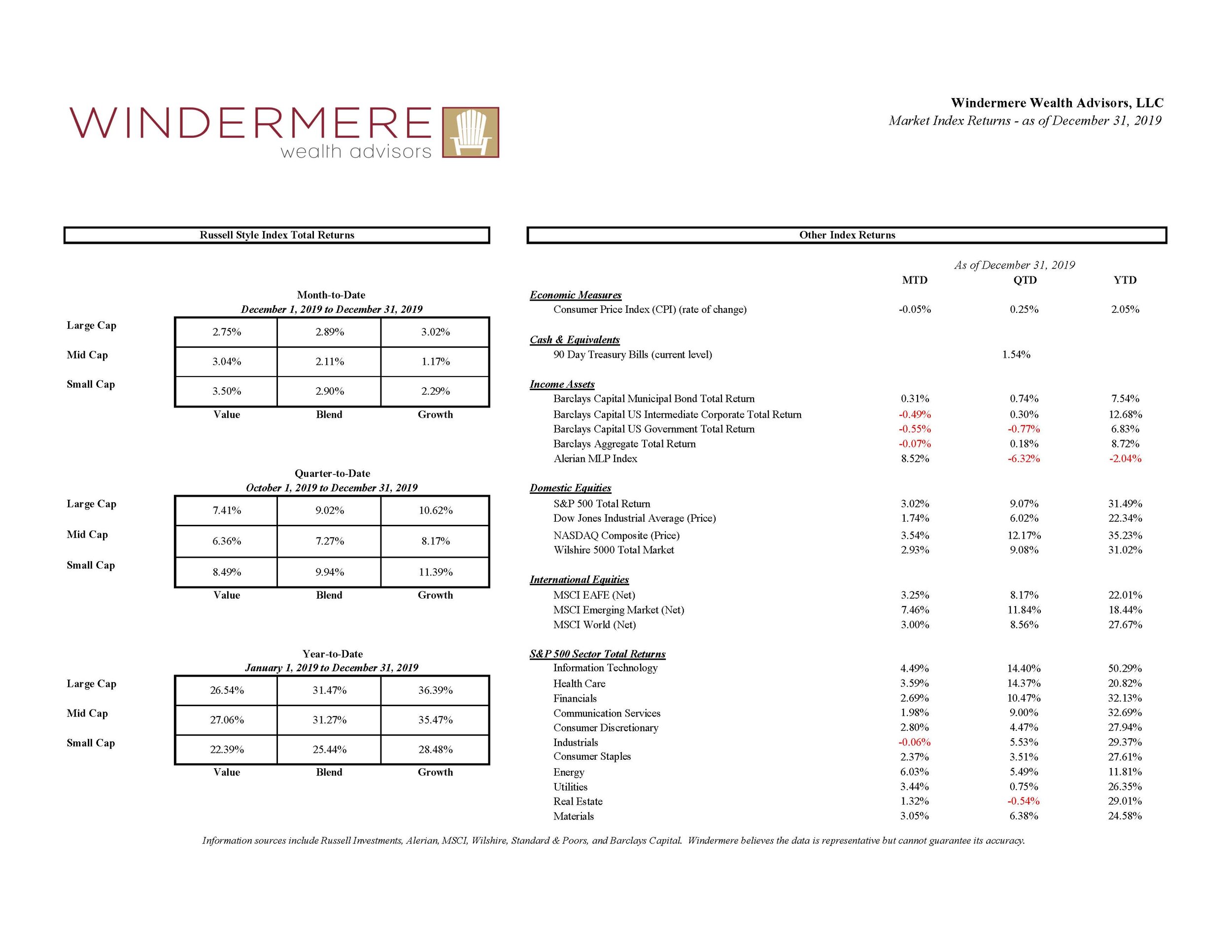

View fullsize Many investors are still flying high after a very successful 2019. Returns for virtually all asset classes were above average in the year, coming off of a challenging end to 2018. Chart shows the returns by asset class for the year (click on chart to enlarge). Below are some key items we are […]

January 18, 2020

read more

Rebalancing. One of many investing buzzwords that deserves a closer look. Let’s start with your target allocation. When you started investing, a target allocation was set for you and your specific situation, based upon a variety of factors including risk tolerance, liquidity needs, timeline, long-term goals, and many others. Your target allocation specified how much […]

December 6, 2019

read more

Here we are again…after months of volatility and discussion of an impending recession, many markets have once again reached all-time highs. Such a sharp turn upward to asset prices in 2019 has many once again asking, “what now?” Here are a few things we are keeping in mind as we serve our clients in this […]

November 10, 2019

read more

2019 has not been the easiest year to be an investor. It seems we take a few steps forward, only to be forced to then take a step back. The year starts strong, only to pull back a bit in recent months. The consumer continues to show great signs of strength, only to be dampened […]

October 8, 2019

read more

Turn on the TV, pick up your phone, or read most major newspapers as of late and you are likely to walk away with a rather unsettling feeling about investing. There is a seemingly omnipresent supply of confusing terminology (ie: yield curve inversion, recession, tariffs, trade war) and an equal supply of doomsday predictions. All […]

September 5, 2019

read more

August 15, 2019 If you were anywhere near financial news yesterday, you likely heard the term yield curve inversion more than a few times and observed a sharp equity sell-off. We thought it was worth explaining what that term actually means – and why it may matter for investors What are bonds again? The global […]

August 15, 2019

read more

What is happening? August is traditionally a slow month – as we ease from summer fun back into the routineness of fall. Not this year, at least as it relates to the markets. In case you’ve tuned out business news for the past week, here is what you’ve missed: *What goes up is coming back […]