WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

It’s not every day that a meeting of the US Federal Reserve Bank becomes a spectator sport. However, today (June 15, 2022), there was considerable buzz around this event. There was a countdown clock, endless commentary/predictions, and a televised press conference. Jay Powell (Chairman of the Federal Reserve) is now a well known celebrity (for […]

June 16, 2022

read more

If you own Amazon (or any other stock over the years that suddenly carries a lower per share price), you may have the same question I heard this week – what is a stock split and why would a company choose to do this? What is a stock split? A stock split is a decision […]

June 10, 2022

read more

If you’ve ever had a discussion with me or read anything I’ve written during a period of market volatility, you have likely heard me say that in my opinion, time IN the market beats tim-ING the market. What do I mean by that? TIME IN the market is quite simply being an engaged participant in […]

June 2, 2022

read more

If you turn on any news channel or read any news publication these days, odds are you will hear at least one or more financial term that immediately raises your blood pressure. Words such as correction, bear market, and recession are definitely front and center. A client recently asked what these terms mean – and […]

May 26, 2022

read more

I’m writing this post on May 19, 2022 as I sit in the Denver airport, on my way back home from a Schwab meeting in California. And admittedly, I’m experiencing a very strong sense of deja vu. The last time I was in the Denver airport was February 2020. I was on my way to […]

May 20, 2022

read more

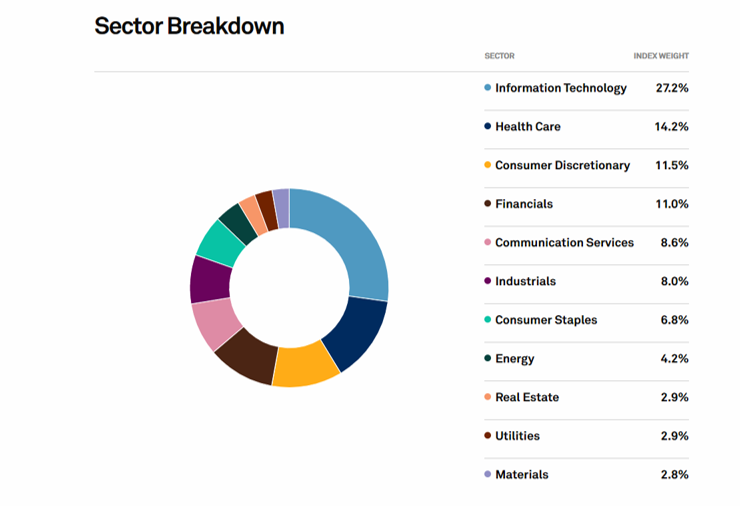

During a quarterly review meeting recently, a client asked why we include a schedule showing the sector weighting of their portfolio versus the sector weighting of the S&P 500. It was a great question and one I thought was worth diving into this week. First, a few definitions: S&P 500 index – this is a […]

May 12, 2022

read more

Calm and perspective – two things we could all use some more of these days Recently, after a wild day in the markets, I decided to pull up two pictures, just to add some perspective Return of the S&P 500 from January 1, 2022 to May 11, 2022 Return of the S&P 500 from January […]

May 12, 2022

read more

Every month, Rick Rieder – Managing Director and Head of Global Allocation Team for Blackrock – conducts a monthly call, where he shares pages of charts, data, and statistics that explain where markets have been and more importantly, where they are going. To help aid in understanding or perhaps to alleviate some of the confusion […]

May 5, 2022

read more

Markets have certainly given all of us much to think about in recent months. After an astounding recovery from COVID-driven recession to a relatively calm 2021, we have been greeted with volatility, uncertainty, and very bearish sentiment as we wrapped up the first quarter of 2022. There are always uncertainties and variables in play in […]

April 12, 2022

read more

During 2020, I wrote frequently about the investing landscape. I even drew a picture to illustrate what we were facing as we crossed the “Valley of Uncertainty” (you can read the blog posts from May, June, July, and September) So where is our investor now? I was anxious to put my artistic skills to work […]

February 3, 2021