WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

It was certainly a very challenging start to the year for investors. Virtually every asset class experienced materially negative returns. If you would rather cover your eyes, I certainly understand. Just remember – markets go thru phases. We’re in the middle of a very difficult one – but like all the other phases (even the […]

July 7, 2022

read more

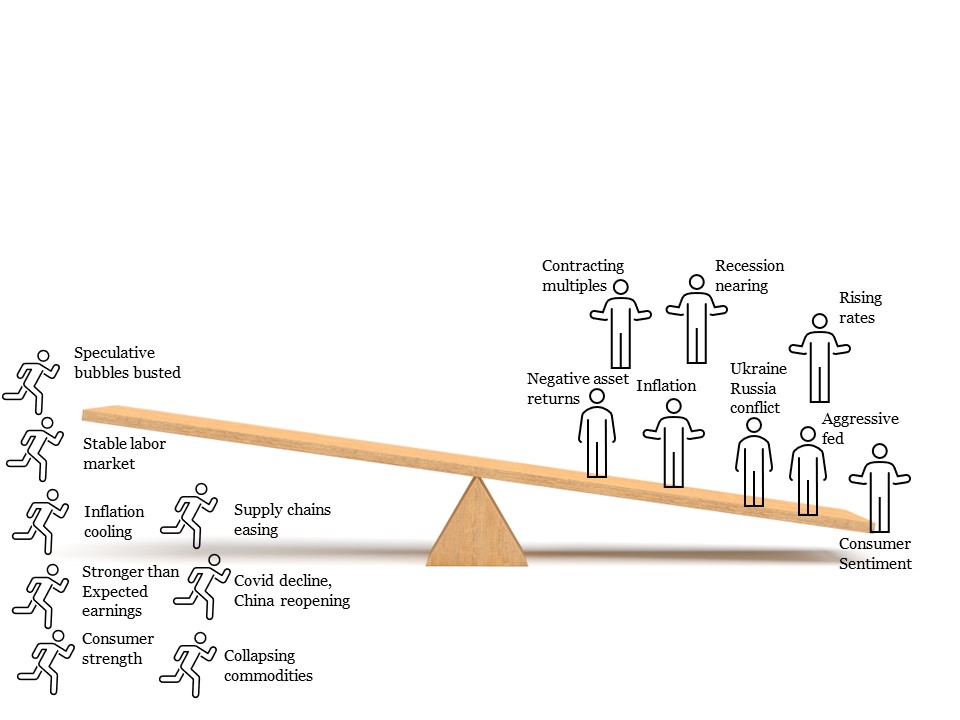

When my nephews visited last November, we visited a local playground. They are two very curious and active boys (ages 6 and 3 at the time) so naturally, we had to explore and try out every piece of equipment and toy in the park. They eagerly climbed on one side of the teeter totter together […]

July 6, 2022

read more

If you turn on any news channel or read any news publication these days, odds are you will hear at least one or more financial term that immediately raises your blood pressure. Words such as correction, bear market, and recession are definitely front and center. A client recently asked what these terms mean – and […]

May 26, 2022

read more

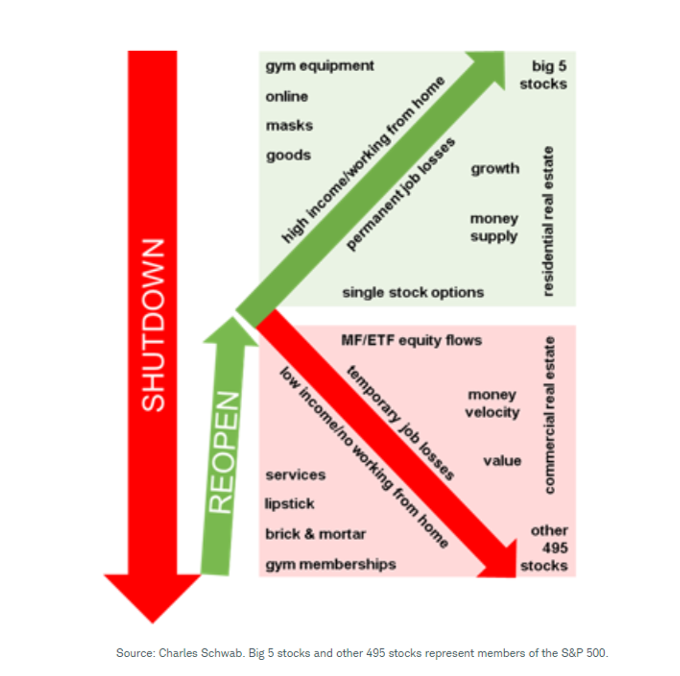

I’m writing this post on May 19, 2022 as I sit in the Denver airport, on my way back home from a Schwab meeting in California. And admittedly, I’m experiencing a very strong sense of deja vu. The last time I was in the Denver airport was February 2020. I was on my way to […]

May 20, 2022

read more

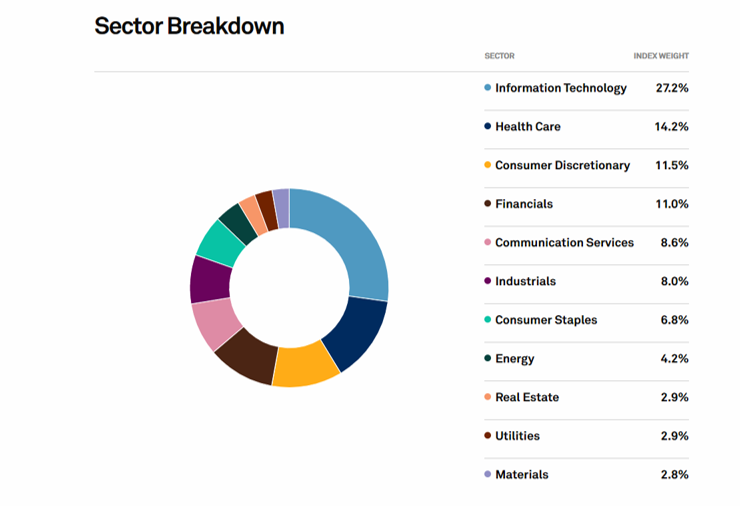

During a quarterly review meeting recently, a client asked why we include a schedule showing the sector weighting of their portfolio versus the sector weighting of the S&P 500. It was a great question and one I thought was worth diving into this week. First, a few definitions: S&P 500 index – this is a […]

May 12, 2022

read more

Note: Each week in this column, I’ll address a question discussed in recent client conversations. Who knows, it may just be on your mind as well This week, the topic is Growth versus Value. Recently, a client asked for some clarification on what those two terms actually mean and if we have a preference in […]

May 5, 2022

read more

Every month, Rick Rieder – Managing Director and Head of Global Allocation Team for Blackrock – conducts a monthly call, where he shares pages of charts, data, and statistics that explain where markets have been and more importantly, where they are going. To help aid in understanding or perhaps to alleviate some of the confusion […]

May 5, 2022

read more

One silver lining of 2020 is that we hear from clients far more than we used too! If there ever was a year we all need to talk financial matters out, 2020 was it! We are loving the frequent discussions, debates, and opportunities to work thru this challenging time together. We’ve heard some similar questions […]

December 9, 2020

read more

“When the facts change, I change my mind “ This well-known quote from John Maynard Keynes is a seemingly sound piece of advice. However, when it comes to your investing journey, you have to be careful about changing your mind too quickly. When major events occur and media headlines express panic and uncertainty, our instincts […]

February 6, 2020

read more

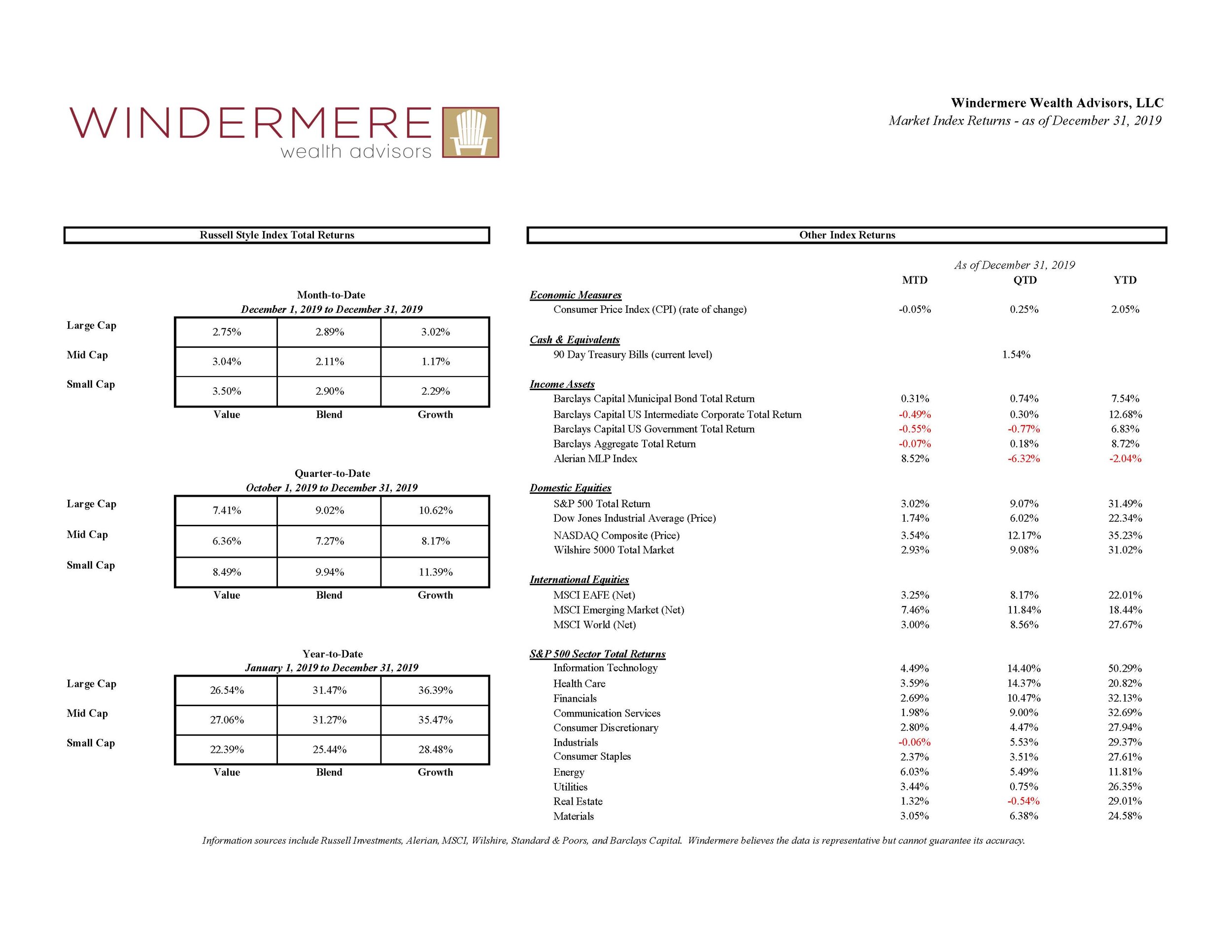

View fullsize Many investors are still flying high after a very successful 2019. Returns for virtually all asset classes were above average in the year, coming off of a challenging end to 2018. Chart shows the returns by asset class for the year (click on chart to enlarge). Below are some key items we are […]

January 18, 2020