WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

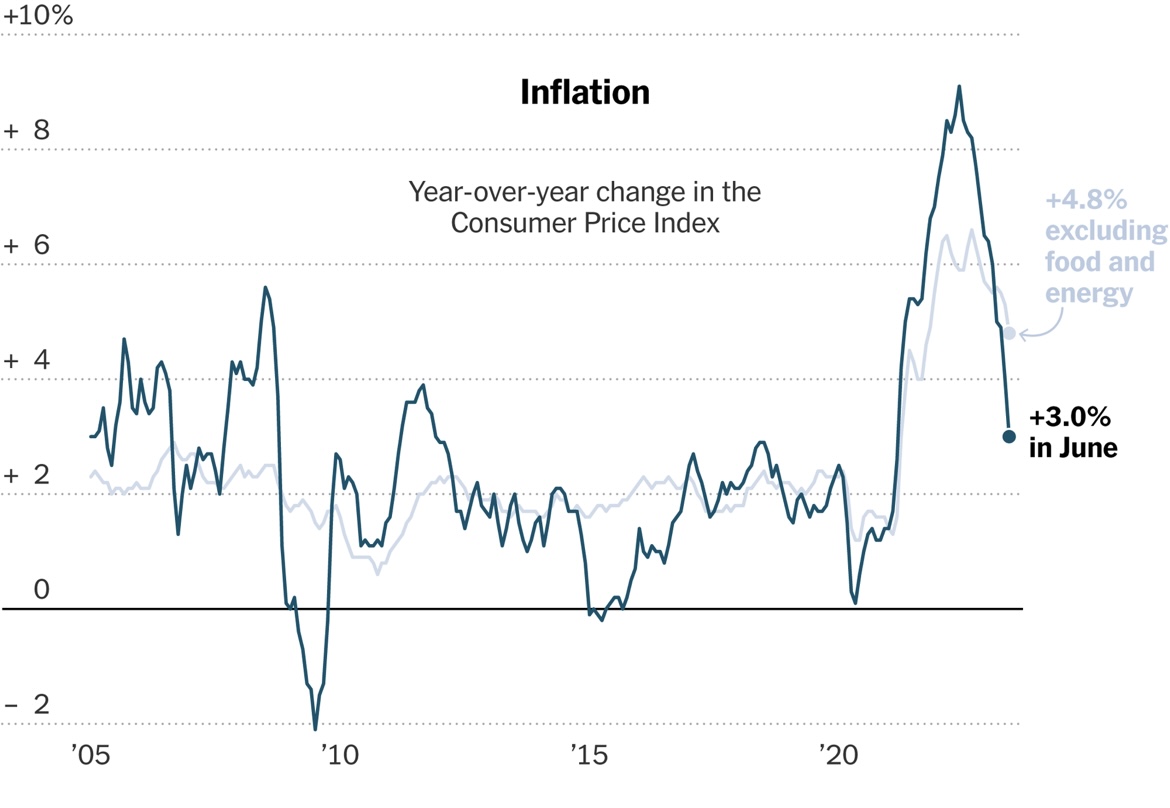

This past week, Wednesday June 12th was a big news day for markets. It doesn’t happen often that a monthly inflation report (Consumer Price Index) and a Federal Reserve Rate announcement happen on the same day, but that is in fact what occurred this week. The result? Happy markets and happy investors. Let’s start with […]

June 13, 2024

read more

While most of America was focused on setting their NCAA brackets earlier this week, market watchers were placing “bets” of their own on the Federal Reserve and the path of interest rates. As was widely expected, on Wednesday the Federal Reserve once again left rates unchanged (leaving the Federal Funds rate range at 5.25-5.5%). They […]

March 21, 2024

read more

Federal Reserve Chairman Jerome Powell testified in front of the House Financial Services Committee for two days this past week. These briefings have become “must see TV” for market watchers as the question of 2024 remains – will the Federal Reserve cut interest rates this year, and if so when and by how much? Powell […]

March 7, 2024

read more

The Federal Open Market Committee released the minutes from their latest meeting this week. As with all meetings, these recorded details of the actual conservations given market participants a bit more color regarding what the interest-rate setting body is thinking. These minutes covered the proceedings from January 30-31, 2024. There were a few interesting takeaways […]

February 22, 2024

read more

Markets were once again focused on the Federal Reserve this week as they released their September rate announcement. At that meeting, Chairman Jerome Powell stated that there would be no rate hike this month (the second such “pause” in 2023). This was a well choreographed moved and as a result, it was not a surprise […]

September 21, 2023

read more

A sure sign of the passing of time these days is the release of monthly inflation reports. August 2023’s Consumer Price Index (CPI) and Producer Price Index (PPI) were released this week and the results were..well, mixed. Let’s look at CPI first. Month over month, headline CPI rose 0.6%. The core metric (excluding volatile food […]

September 14, 2023

read more

Federal Reserve Chairman Jerome Powell spoke last week at the Jackson Hole Economic Symposium. His comments were widely anticipated and eagerly watched by market participants. His comments struck a balance between optimism and caution. On the optimistic side, he acknowledged that progress has certainly been made on inflation fight. However, he was quick to ensure […]

August 31, 2023

read more

Let’s travel back in time. Friends is the top TV show. All for You by Janet Jackson is the top song. AOL has 28 million users and AOL.com is the top website. George W Bush is president. Flip phones and Blackberries dominate the cell phone market. Gas is $1.46 per gallon. It’s early 2001. A […]

July 27, 2023

read more

After a slow holiday week, markets have resumed normal operating speed this week and thankfully, the momentum has been positive. The upward moves are largely due to signs of disinflation. The two inflation reports for June released this week did their part to reassure investors that it remains possible the US can attain a soft […]

July 13, 2023

read more

Stay the course. How many times have I given that message to clients (and myself), both in these weekly posts and in general conversation? Thousands of times I am sure! And a large majority of those have come in the past three years as all investors have been thru a lifetime’s worth of challenges. Truth […]

June 15, 2023