WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

It’s severe weather season in Wisconsin. Earlier this week, we had a major thunderstorm roll through in the late afternoon. The storm clouds encompassed the sky, blocked out all the light, caused quite a bit of worry, and left some damage in their wake (fortunately, most areas weren’t as hard hit as had been anticipated). […]

June 16, 2022

read more

If you own Amazon (or any other stock over the years that suddenly carries a lower per share price), you may have the same question I heard this week – what is a stock split and why would a company choose to do this? What is a stock split? A stock split is a decision […]

June 10, 2022

read more

Prior to forming Windermere in 2010, I worked in public accounting. For those not familiar with the industry/career track, it is a very challenging environment. It is a professional services industry, so the client’s timelines and demands rule the day. There is a known pathway to each promotion so performance on every job/task matters. Virtually […]

June 10, 2022

read more

If you’ve ever had a discussion with me or read anything I’ve written during a period of market volatility, you have likely heard me say that in my opinion, time IN the market beats tim-ING the market. What do I mean by that? TIME IN the market is quite simply being an engaged participant in […]

June 2, 2022

read more

If you turn on any news channel or read any news publication these days, odds are you will hear at least one or more financial term that immediately raises your blood pressure. Words such as correction, bear market, and recession are definitely front and center. A client recently asked what these terms mean – and […]

May 26, 2022

read more

I’m writing this post on May 19, 2022 as I sit in the Denver airport, on my way back home from a Schwab meeting in California. And admittedly, I’m experiencing a very strong sense of deja vu. The last time I was in the Denver airport was February 2020. I was on my way to […]

May 20, 2022

read more

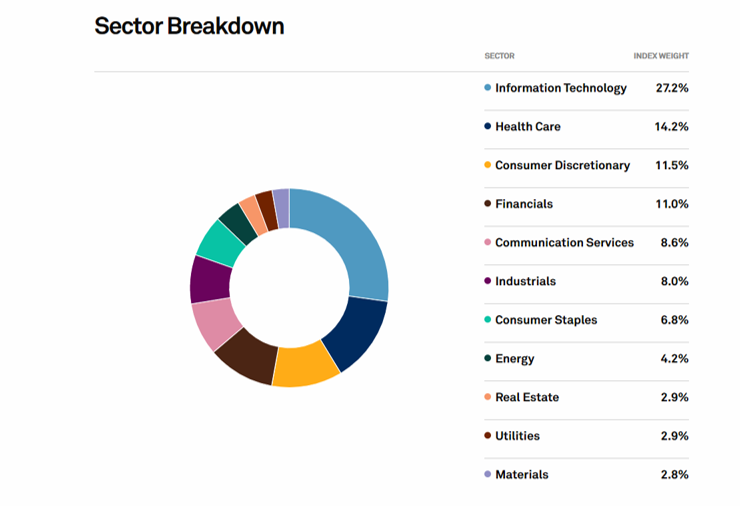

During a quarterly review meeting recently, a client asked why we include a schedule showing the sector weighting of their portfolio versus the sector weighting of the S&P 500. It was a great question and one I thought was worth diving into this week. First, a few definitions: S&P 500 index – this is a […]

May 12, 2022

read more

Calm and perspective – two things we could all use some more of these days Recently, after a wild day in the markets, I decided to pull up two pictures, just to add some perspective Return of the S&P 500 from January 1, 2022 to May 11, 2022 Return of the S&P 500 from January […]

May 12, 2022

read more

Earlier this week, I was doing my nightly Gmail inbox clean-out (yes, I strive for inbox zero and no, I can’t quite get there 😉 ). In between the ads, junk mail, and useful reminders was a hidden gem – an email newsletter from Dr. Brene Brown. If you know Brene’s work, you’ll understand that […]

May 12, 2022

read more

Note: Each week in this column, I’ll address a question discussed in recent client conversations. Who knows, it may just be on your mind as well This week, the topic is Growth versus Value. Recently, a client asked for some clarification on what those two terms actually mean and if we have a preference in […]

May 5, 2022