WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

Each year, Charles Schwab & Co., Inc. hosts a conference for investment advisors that custody assets on its platform. Pam just returned from the 2019 conference. Here are a few themes that were woven throughout the various sessions: 1. ) Remain vigilant: with markets reaching all-time highs during the conference, it’s fair to say that […]

November 10, 2019

read more

Here we are again…after months of volatility and discussion of an impending recession, many markets have once again reached all-time highs. Such a sharp turn upward to asset prices in 2019 has many once again asking, “what now?” Here are a few things we are keeping in mind as we serve our clients in this […]

November 10, 2019

read more

2019 has not been the easiest year to be an investor. It seems we take a few steps forward, only to be forced to then take a step back. The year starts strong, only to pull back a bit in recent months. The consumer continues to show great signs of strength, only to be dampened […]

October 8, 2019

read more

Turn on the TV, pick up your phone, or read most major newspapers as of late and you are likely to walk away with a rather unsettling feeling about investing. There is a seemingly omnipresent supply of confusing terminology (ie: yield curve inversion, recession, tariffs, trade war) and an equal supply of doomsday predictions. All […]

September 5, 2019

read more

If you’re feeling a bit of motion sickness from the markets over the past eighteen months, you are not alone. Markets have been on a bit of a roller coaster – now returning to the same platform where we all got on the ride, with the market recently crossing over to all time highs. But […]

July 17, 2019

read more

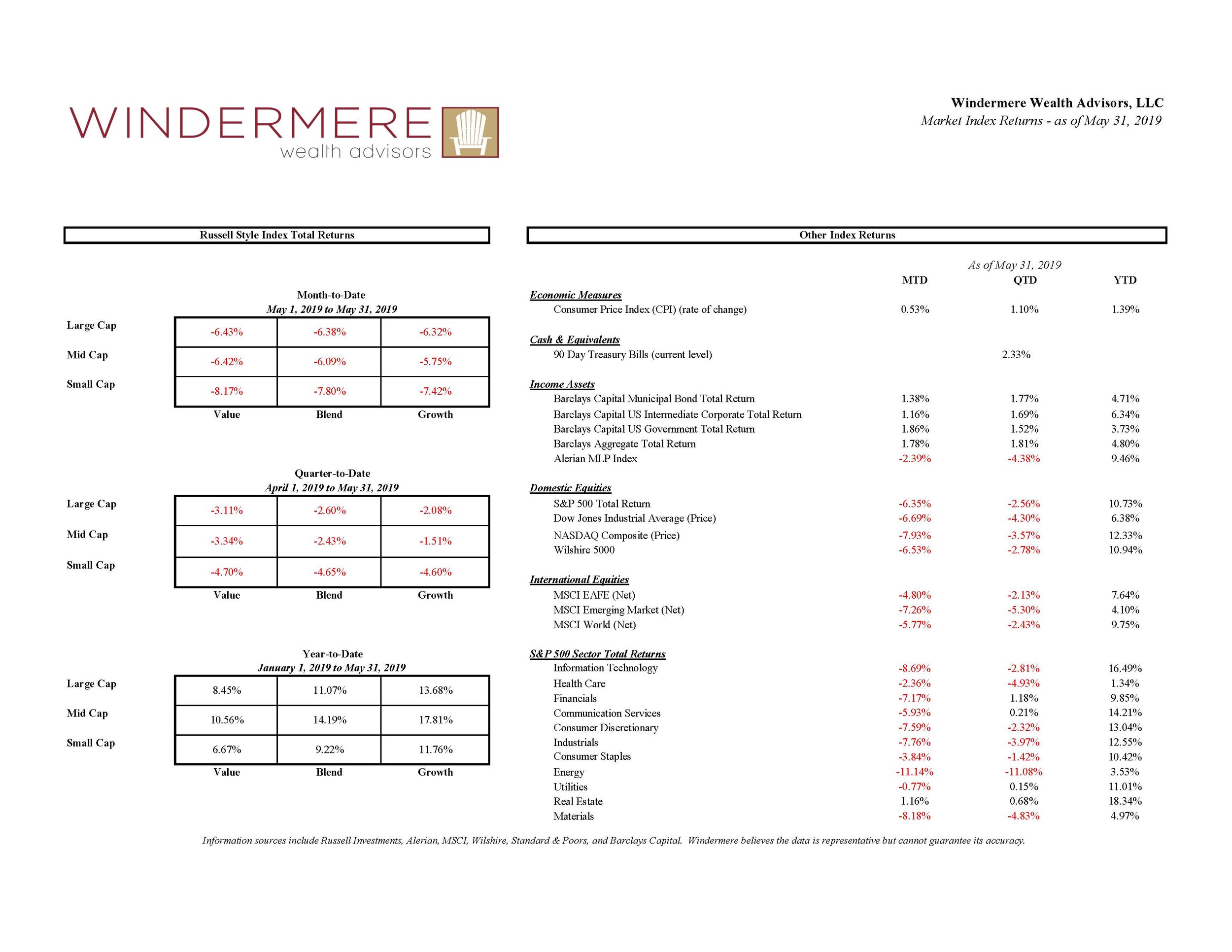

During the first four months of 2019, it seemed as if nothing could get in the way of markets. While uncertainty remained (tariffs, interest rates, economic strength, recession worries), markets ticked higher seemingly every day. In early May, that all changed. See below for market returns during May 2019 View fullsize While it’s hard to […]

June 9, 2019

read more

Normally, I use this monthly blog post to share our own views on the markets and investing. However, this month, I’m choosing to instead share some perspectives from two of the best: Warren Buffett and Charlie Munger. The first weekend in May is unlike any other weekend in Omaha as annually, 40,000+ individuals make the […]

May 7, 2019

read more

A recent blog post from Seth Godin entitled “More Right” follows: There are at least seven realistic ways to get from my home near New York to a meeting in Washington DC. None of them are wrong. Each offers its own advantage in terms of resilience, speed, cost or hassle. And so, we can’t choose […]

April 9, 2019

read more

We all like to think we are fully rational human beings, capable of staying in control of our emotions and making sound decisions in all areas of our lives – especially when it comes to investing. When markets are steady and moving in a upward trajectory, many of us are able to operate in a […]

March 5, 2019

read more

There were few investors who were sorry to see 2018 go. Market movements in October thru December brought returns for the year negative and erased most annual gains, all while worrying investors with significant daily movements and seemingly endless selling pressure. Why did these sharp downward moves occur? Markets are complex and there is no […]

February 6, 2019