WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

A silver lining of recent interest rate increases is the ability to earn some level of interest on cash balances. When reviewing the various options with a client recently, she asked what exactly a money market fund was and whether there were any risks associated with this investment vehicle. Let’s take a closer look at […]

September 14, 2022

read more

It wasn’t all that long ago that inflation was a seemingly theoretical discussion topic. We’d bring it up to clients (usually during a financial planning future illustration) and try to find a way to explain it. “Your money will be worth less over time” or “your purchasing power will decline” were phrases we’d use. While […]

September 1, 2022

read more

If you listen or read investment-related news, you are likely to encounter the term “factor” or “factor based investing” as this concept has taken off in recent years. A client recently asked for our take on this concept. Great question! Definitions Think of factors as traits or characteristics of the underlying company. Factors are not […]

August 25, 2022

read more

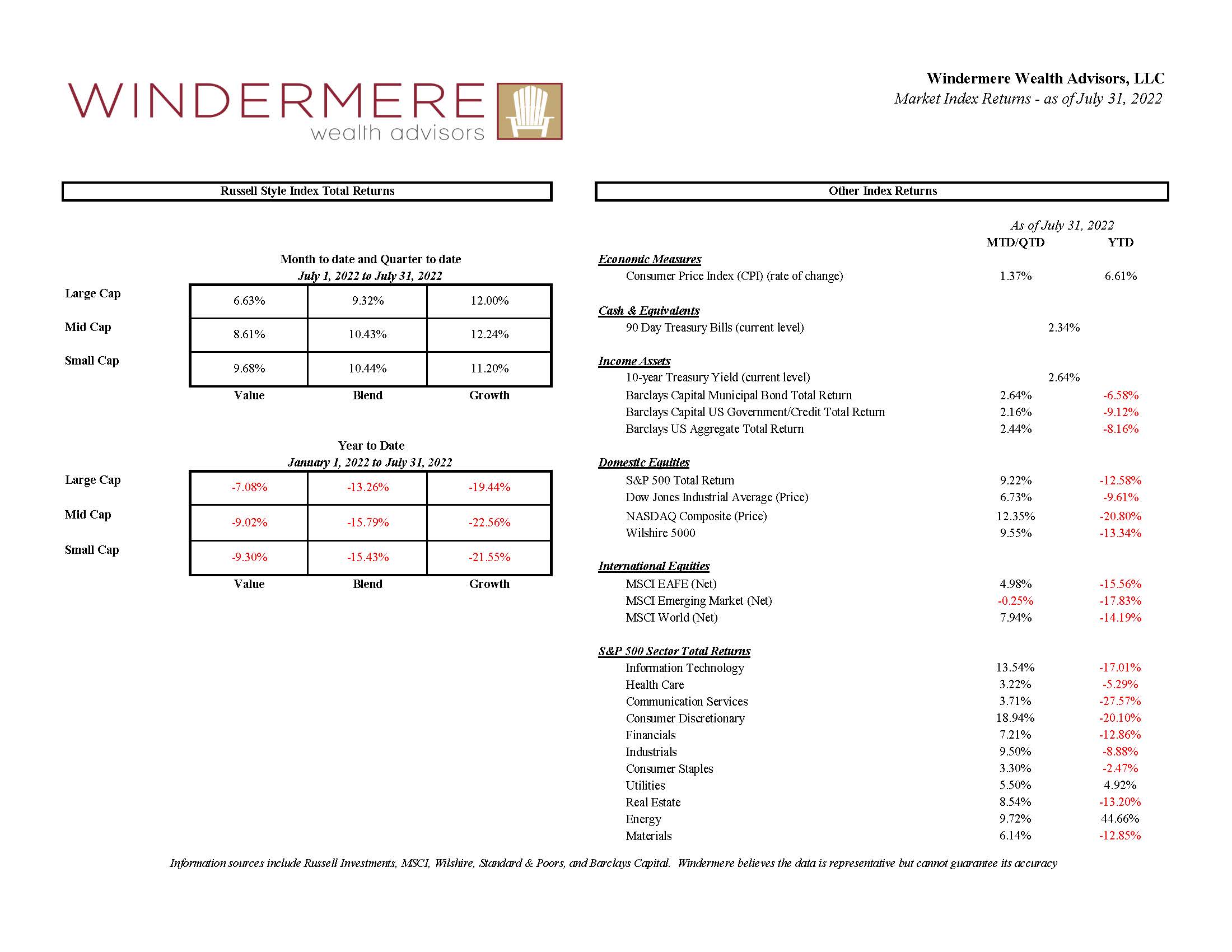

Another month has come to and end. This one was far kinder to asset class returns. See for yourself – a summary of several index returns is provided below. In two words.. Much Better!

August 5, 2022

read more

While it may seem like we just went thru a major election cycle, it is almost that time again. A client recently inquired about ways to keep track of what’s happening in our nation’s capital and the related impact on markets/portfolios. I have just the sources! In the interest of keeping things simple, I’m sharing […]

August 5, 2022

read more

A client asked for a debrief on the Federal Reserve’s actions. Here we go! What happened at the meeting? On July 27, 2022, the US Federal Reserve (the “Fed”) once again raised the Fed Funds Rate by 75 basis points. The Federal Funds Rate now ranges from 2.25-2.5%, up from near zero in March. This […]

July 29, 2022

read more

It’s easy to get stuck on the headlines these days – especially when it comes to inflation. Turn on the tv, listen to a podcast, open your email – and odds are you will see some sort of jarring financial headline concerning inflation. Even a drive past the gas station can bring the topic front […]

July 29, 2022

read more

After one of the worst start to the year for equity investments, you may find your self asking WHY? Why do I bother? Why do I subject myself to this angst, only to see my invested capital decline? Why not just put it in cash and take all my worry away? Why invest, when I […]

July 21, 2022

read more

There is a lot of chatter about the upcoming “earnings season” which prompted a client question about what exactly that means – and why it is getting so much attention this time around. Public companies in the US (ie: the ones that trade on stock markets and are available for public investment) are required by […]

July 14, 2022

read more

It was certainly a very challenging start to the year for investors. Virtually every asset class experienced materially negative returns. If you would rather cover your eyes, I certainly understand. Just remember – markets go thru phases. We’re in the middle of a very difficult one – but like all the other phases (even the […]

July 7, 2022