WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

It’s been a relatively quiet week in the markets (finally!). With a return to action next week (an inflation print and a meeting of the Federal Reserve), I thought this was a great chance to write about a non-investment topic this week…habits. A few weeks back, I was reading James Clear’s weekly 3-2-1 email and […]

June 8, 2023

read more

If you’ve been reading my articles for a while, you know I’ve written about a tetter totter (or see saw if you prefer) in the past when explaining any number of market dynamics. I’ll risk repeating myself this week as it is such a good visual. It works especially well when thinking about investor sentiment. […]

June 1, 2023

read more

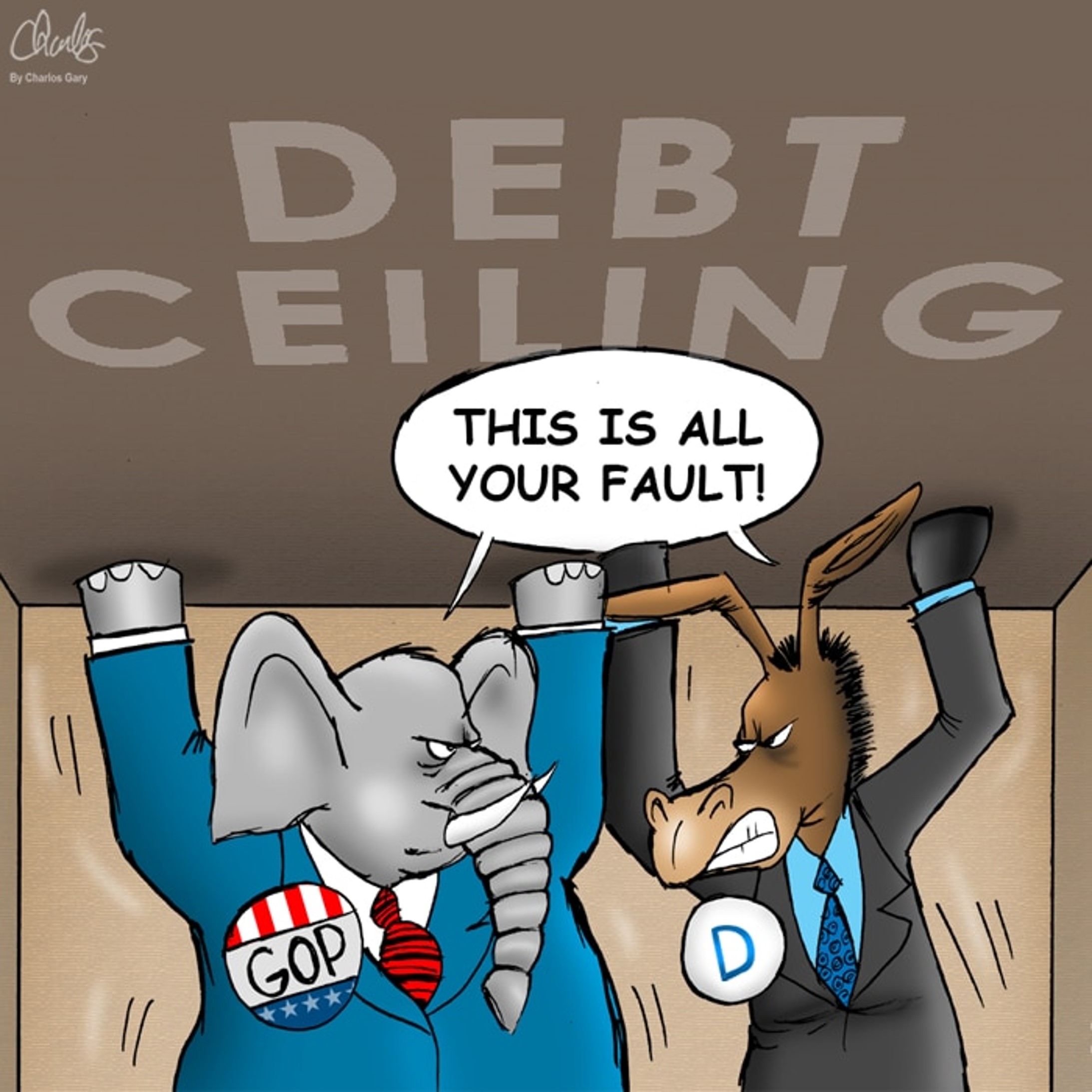

2023 is quickly becoming the year in which I discuss topics I never imagined would come up with such frequency, if at all… topics such as bank failures (see March 2023 publications) and now the potential of a US default. But in life it seems we should expect the unexpected! The United States is a […]

May 25, 2023

read more

I receive a weekly newsletter from Jesse Itzler, a serial entrepreneur and speaker who has a unique and compelling take on many topics. In a recent newsletter, he took readers thru a quick exercise to illustrate an innate human instinct. I’m about to put my own spin on this same exercise to reiterate the point […]

May 18, 2023

read more

Here we are again – another month, another set of inflation readings. April’s reports were both very encouraging. The Consumer Price Index (CPI) report for April was released this week, and it showed clear progress in the ongoing battle against inflation. CPI rose 0.4% in April and 4.9% year over year – both 0.1% lower […]

May 11, 2023

read more

Here we go again. Earlier this week, as expected, the Federal Open Market Committee (FOMC) raised the fed funds rate by 25 basis points to a range of 5.0-5.25%. This is the tenth increase in this rate cycle (that started just over a year ago) and brings rates (from zero) to levels last seen before […]

May 4, 2023

read more

Being from Milwaukee, I likely shouldn’t admit this (shhhhh, don’t tell anyone!) – but I don’t watch a lot of Bucks basketball. Nothing personal against the Bucks, but NBA just isn’t on my usual radar. However, once playoff time rolls around, I can’t help but get swept up in the action and this year was […]

April 27, 2023

read more

It’s been a relatively quiet week market wise – quarterly earnings continue and we are in between major economic releases and Fed meetings. As a result, I thought we could all use a fun “Pam to Paper” exercise on brand loyalty. Market musings will return next week! Last week, Warren Buffett gave a three-hour interview […]

April 20, 2023

read more

Two major economic reports have been released in the past week for March – labor report and inflation report (as measured by the Consumer Price Index (CPI)). Let’s review the headlines of these economic news releases and explore what these reports may mean for markets moving forward. Labor Market Report Markets may have been closed […]

April 12, 2023

read more

The health of employment in the country has always been a topic of interest. However, ever since COVID, the release of the monthly payroll report by the Bureau of Labor Statistics has become “must see TV,” second only to the release of CPI! Early on in the pandemic, it was shocking to see how quickly […]

April 6, 2023