WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

I’ve written quite a bit about interest rates in recent years. They have an inextricable impact on financial asset prices, so it’s always instructive to pay attention to what is happening to rates – both in the US and abroad. Interest rates have risen relatively drastically in July and August across the yield curve (ie: […]

August 17, 2023

read more

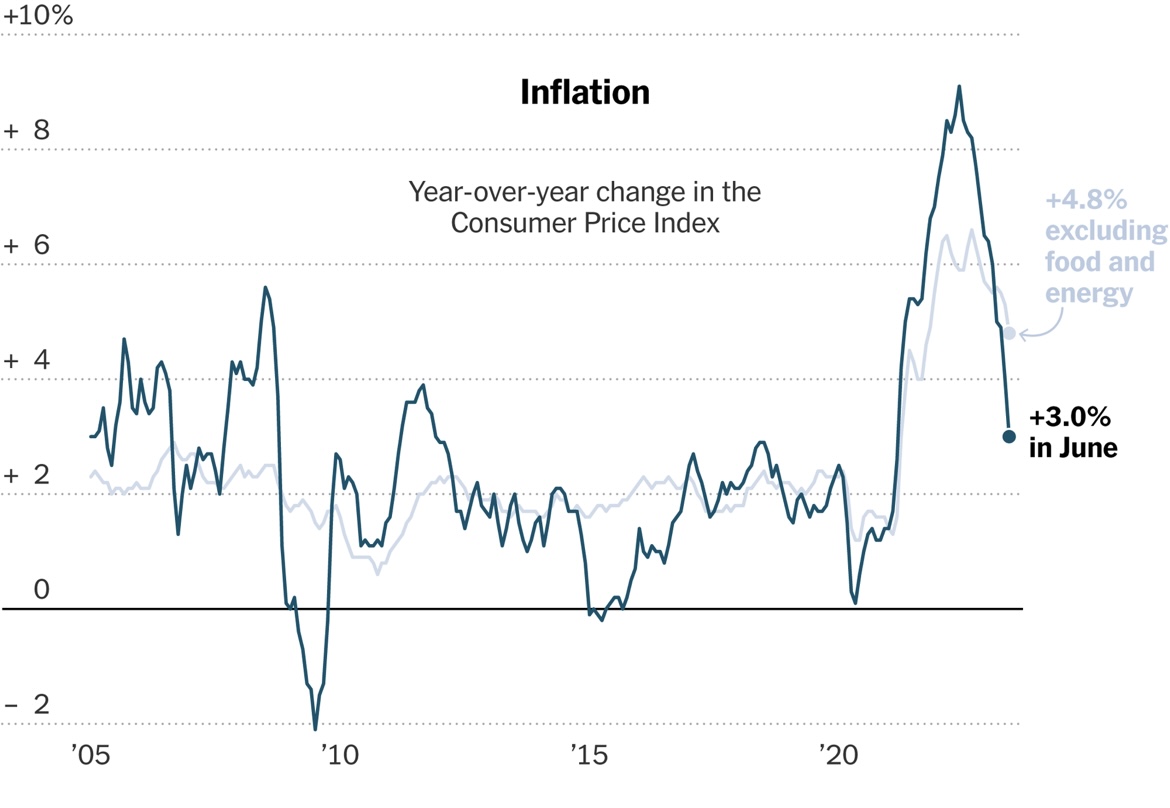

After a slow holiday week, markets have resumed normal operating speed this week and thankfully, the momentum has been positive. The upward moves are largely due to signs of disinflation. The two inflation reports for June released this week did their part to reassure investors that it remains possible the US can attain a soft […]

July 13, 2023

read more

Stay the course. How many times have I given that message to clients (and myself), both in these weekly posts and in general conversation? Thousands of times I am sure! And a large majority of those have come in the past three years as all investors have been thru a lifetime’s worth of challenges. Truth […]

June 15, 2023

read more

Here we are again – another month, another set of inflation readings. April’s reports were both very encouraging. The Consumer Price Index (CPI) report for April was released this week, and it showed clear progress in the ongoing battle against inflation. CPI rose 0.4% in April and 4.9% year over year – both 0.1% lower […]

May 11, 2023

read more

Here we go again. Earlier this week, as expected, the Federal Open Market Committee (FOMC) raised the fed funds rate by 25 basis points to a range of 5.0-5.25%. This is the tenth increase in this rate cycle (that started just over a year ago) and brings rates (from zero) to levels last seen before […]

May 4, 2023

read more

The Federal Reserve found itself facing a considerable dilemma this week at the Federal Open Market Committee meeting that took place Wednesday March 22, 2023. How would they balance the tension between their ongoing battle against inflation and the threats posed by the recent instability in the banking system? Up until a few weeks ago, […]

March 23, 2023

read more

There have been quite a few new terms floating around these days, given all the events concerning the banking industry. One of those terms is “cash sorting.” A client recently reached out to clarify what this terms means – and whether it was an activity they should undertake. Let’s take a closer look Why is […]

March 22, 2023

read more

Interest rates have never been such a hot topic of conversation! It seems you can’t turn on the news or talk to your friends lately without someone bringing up interest rates (did you see what you can earn on cash? look at how much mortgage rates have gone up! should I just buy the 2-year […]

March 2, 2023

read more

It was not all that long ago that Federal Reserve meetings would barely be covered by the media. Now they are truly the monthly headline event and Wednesday’s announcement was no exception (February 1, 2023 meeting) US Federal Reserve Chair Jay Powell took the stage and announced a widely anticipated 25 basis point rate increase, […]

February 2, 2023

read more

A client reached out this week, expressing concerns about the decline in her portfolio. As I started to provide my rationale for staying the course and how markets go thru cycles, etc. , she said “thanks, I just need the hang in there pep talk once in a while.” Don’t we all? It has been […]

October 20, 2022