WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

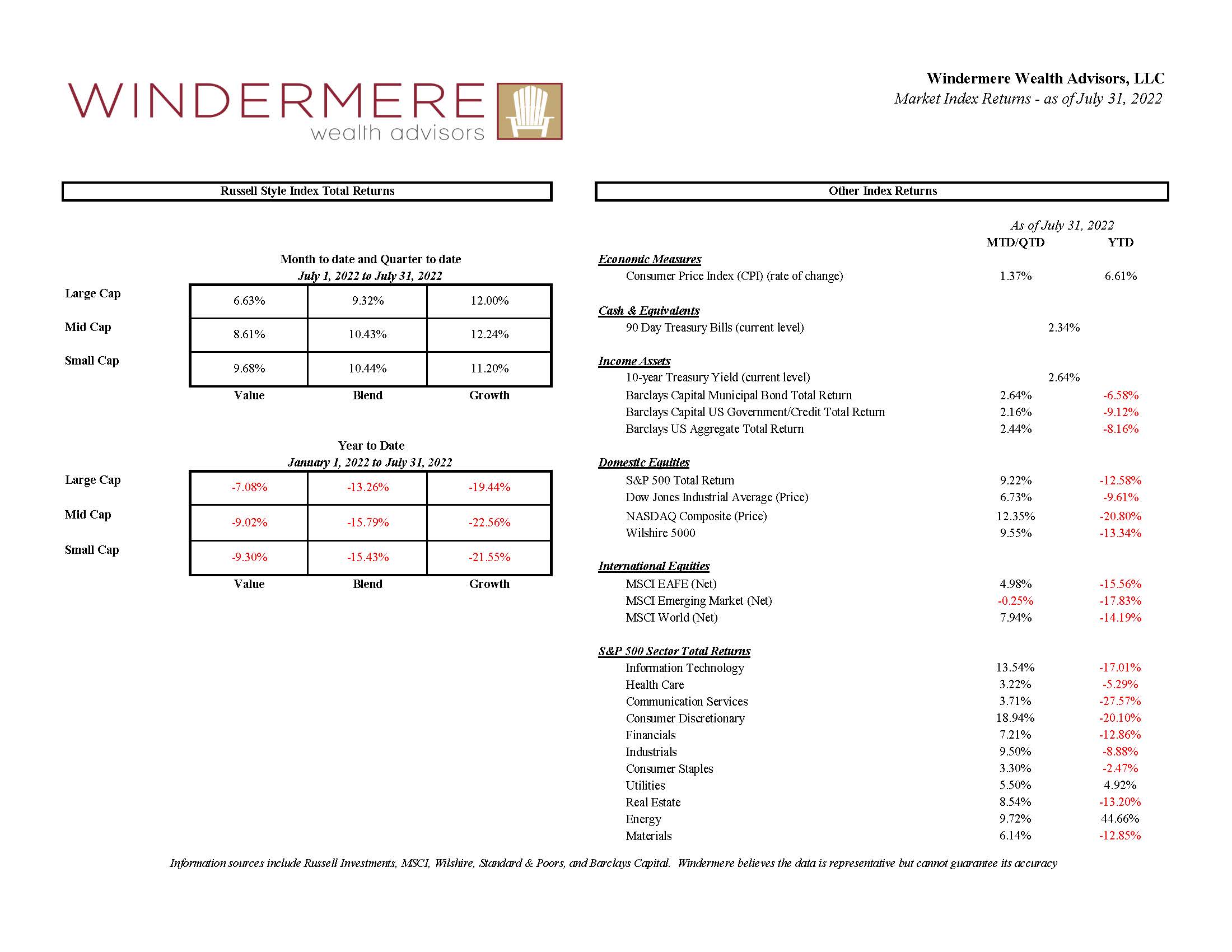

Another month has come to and end. This one was far kinder to asset class returns. See for yourself – a summary of several index returns is provided below. In two words.. Much Better!

August 5, 2022

read more

It’s easy to get stuck on the headlines these days – especially when it comes to inflation. Turn on the tv, listen to a podcast, open your email – and odds are you will see some sort of jarring financial headline concerning inflation. Even a drive past the gas station can bring the topic front […]

July 29, 2022

read more

After one of the worst start to the year for equity investments, you may find your self asking WHY? Why do I bother? Why do I subject myself to this angst, only to see my invested capital decline? Why not just put it in cash and take all my worry away? Why invest, when I […]

July 21, 2022

read more

Inflation is the top issue on investors and consumers’ minds these days. I thought it would be worth taking a closer look at the latest reading – and how future readings may play out. If you’ve read any news headline over the past 48 hours, you already know that June’s inflation reading (as measured by […]

July 14, 2022

read more

There is a lot of chatter about the upcoming “earnings season” which prompted a client question about what exactly that means – and why it is getting so much attention this time around. Public companies in the US (ie: the ones that trade on stock markets and are available for public investment) are required by […]

July 14, 2022

read more

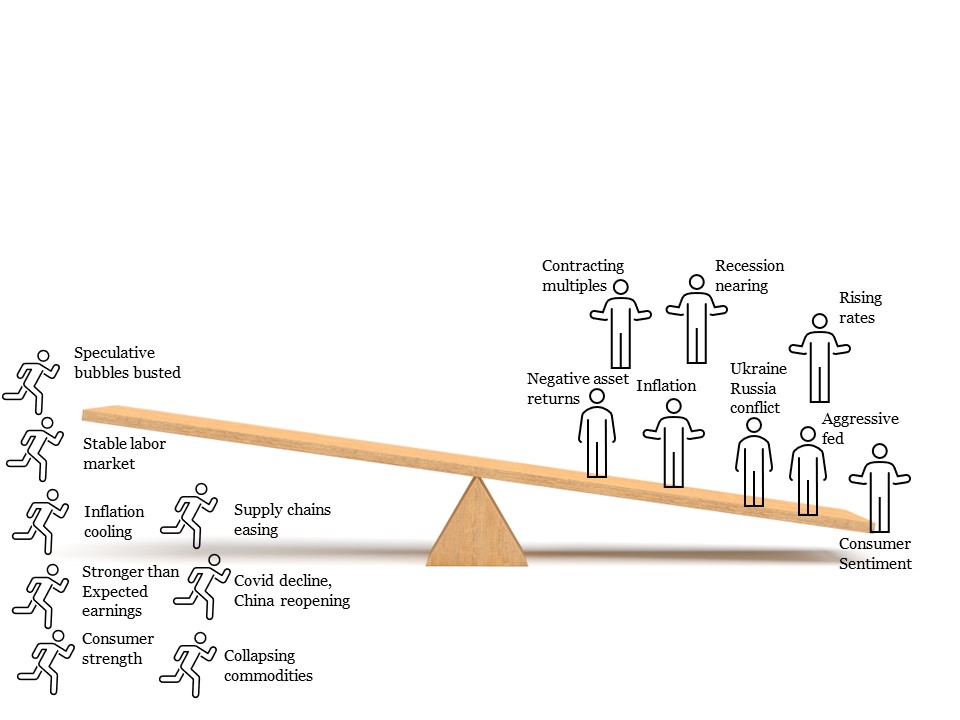

When my nephews visited last November, we visited a local playground. They are two very curious and active boys (ages 6 and 3 at the time) so naturally, we had to explore and try out every piece of equipment and toy in the park. They eagerly climbed on one side of the teeter totter together […]

July 6, 2022

read more

I’m writing this post on June 30, 2022 as stocks are set to end the first half of 2022 with the worst first-half performance since 1970. Think about that – the worst six month start to an investing year in 52 years. Geez, that’s longer than I’ve been alive! Add in high prices in many […]

June 30, 2022

read more

Just as I was putting the finishing touches on a different Pam to Paper column (I’ll come back to that one another week), I received an email from a Mutual Fund Company we work with, Calamos Investments. In addition to having a proven track record as a money manager, they also produce some very informative […]

June 24, 2022

read more

Class is in session! Twice this week, I had discussions with clients about what information should be shared with their young adult/teenage children and grandchildren as it relates to finances and investing. I always enjoy these discussions. It’s a honor to speak with young adults and add some much needed context to a topic that […]

June 16, 2022

read more

It’s not every day that a meeting of the US Federal Reserve Bank becomes a spectator sport. However, today (June 15, 2022), there was considerable buzz around this event. There was a countdown clock, endless commentary/predictions, and a televised press conference. Jay Powell (Chairman of the Federal Reserve) is now a well known celebrity (for […]

June 16, 2022